What are cover orders and how can one use them?

Cover Orders (COs) can be described as a mechanism that limits your loss, and in turn, reducing the risk. In other words, cover order can be a market or a limit order that is placed along with a stop loss order. When a stop loss order is placed, you will know in advance the maximum loss that you have to incur if the trade doesn’t work for you, or if the price of your holding moves adversely.

The objective of a cover order is to decrease the risk for the trader.

When the cover order is a market or limit order that’s placed with a mandatory stop loss order within a stipulated range, the stop loss order can’t be canceled.

How To Place A Cover Order:

-

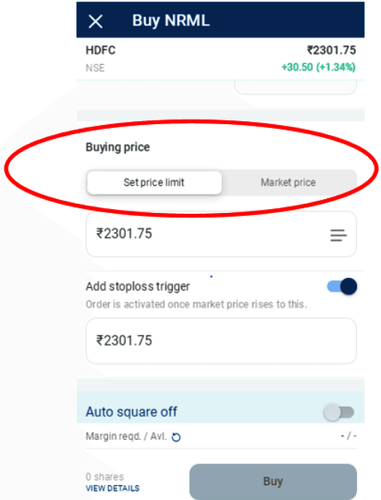

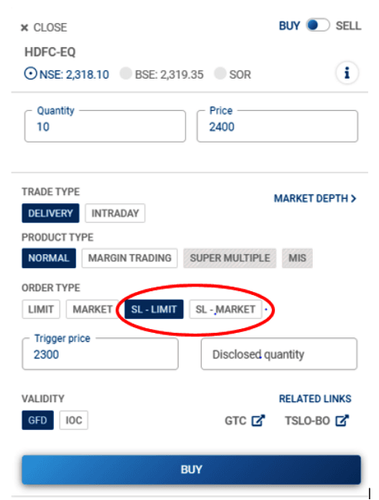

To place a cover order, you can select either SL-Market or SL-Limit and enter the Stop Loss trigger price.

-

SL-Market Order → First leg is a Market order while the second leg is a Stop Loss order. Read More

-

SL-Limit Order → First leg is a limit order while the second leg is a Stop Loss order. Read More

-

You should also know that when placing a buy CO, your limit price has to be greater than your stop loss trigger price.

-

In contrast, when you place a sell CO, your limit price has to be lower than your stop loss trigger price.

-

It is applicable for both Delivery as well as Intraday.

What is a Buyback/Takeover/Delisting?

My order is getting rejected with the following error – ‘Order price is outside the trade execution range. Try placing the order again

My order is getting rejected with the following error – ‘The order was rejected to avoid self trade. Try placing the order again’.

Why was the stop loss executed even though the price did not breach the trigger?