Margin Trading Facility (MTF)

Buy Now. Pay Later. Enhance your buying power with our Margin Trading Facility.

What is Margin Trading Facility (MTF)?

Have you ever wanted to buy more stocks than you could afford? Margin Trading Facility or MTF (e-margin) could be the solution. It lets you buy stocks by paying only a part of the total price. The remaining amount is borrowed from the broker, who charges a nominal interest on it.

This means you can trade with margin and purchase more shares than you would be able to otherwise. In other words, MTF allows you to use trading margins to increase your buying power. Sounds interesting, right?

Calculate the interest & margin requirements for margin trading:

Quantity

Features of Margin Trading Facility

How does Margin Trading Facility work?

Margin Trading Facility (MTF) provides you with additional leverage for trading, allowing you to buy up to 4x more shares than your available funds. By placing a small margin in cash or stocks as collateral in your Demat account, Kotak Securities funds the rest. With Pay Later (MTF), you only pay a fraction of the total trade value upfront, and Kotak Securities will cover the remaining. This facility helps you maximize your buying power and can also be used when you're short on funds. Simply put, buy shares now and pay later!

Let us understand this through an example.

Scenario:

- You have ₹20,000 and want to buy 1000 shares priced at ₹100 each.

- Total cost = ₹1,00,000 (₹100/share * 1000 shares).

Using Margin Trading Facility (MTF) with 4x Leverage:

- You only pay ₹20,000.

- Kotak Securities covers the remaining ₹60,000.

If the stock price rises to ₹110:

- Value of 1000 shares = ₹1,10,000 (₹110/share * 1000 shares).

- Profit = ₹10,000 (₹110,000 - ₹100,000) on your initial ₹20,000 investment, minus interest and brokerage costs.

If the stock price falls to ₹90:

- Value of 1000 shares = ₹90,000 (₹90/share * 1000 shares).

- Loss = ₹10,000 (₹100,000 - ₹90,000), plus interest on the borrowed amount.

You may also face margin shortfall requirements due to the drop in share value.

Advantages of Margin Trading Facility With Kotak Securities

Eligibility Criteria and Documents Required

MTF can be accessed with any of our brokerage plans, giving you the ability to boost your buying power. However, the Trade Free Pro Plan offers a lower interest rate. The good news is, you can start using MTF without any additional documentation! Simply accept the disclaimer, and you're ready to go.

How to Activate MTF:

Online Steps:

- Visit the stock order page of your preferred stock, or

- Go to Account Details, navigate to Products, click on Pay Later (Margin Trading Facility), and then click Activate. Once activated, you can begin placing your orders using MTF!

Offline Steps:

To activate MTF offline:

- Send an email to service.securities@kotak.com accepting the MTF terms and conditions. Be sure to mention your client code.

- To download the activation form, visit kotaksecurities.com, then, go to Support, click on Forms Download, search for Margin Trading Facility, and download the form.

- You can also use this direct link to download the form: MTF Activation PDF.

Once you send the email, our team will activate MTF for your account and confirm the same over mail. You can then begin placing your orders using MTF!

Tips for Margin Trading

When it comes to margin trading, having a strategy in place is crucial. Here are some tips to help you trade more wisely and minimise risks:

- Set a stop-loss: Have you ever thought about what loss you are willing to tolerate? Setting a stop-loss lets you decide in advance. If the price falls below a certain point, the stop-loss automatically sells your shares, preventing further loss and protecting your investments.

- Stay informed: Are you keeping up with market trends? Staying informed about news, trends, and upcoming events can help you make smarter decisions. A well-informed trader is less likely to face unexpected losses.

- Diversify: Have you considered spreading your risk? Diversifying your investments across multiple stocks or sectors reduces the impact if one stock performs poorly. It is all about balancing your risk.

- Have an exit plan: Do you know when to exit a trade? Whether it is cutting your losses or locking in profits, having an exit plan is essential. Equally essential is sticking to it and avoiding emotional decisions that could lead to poor outcomes.

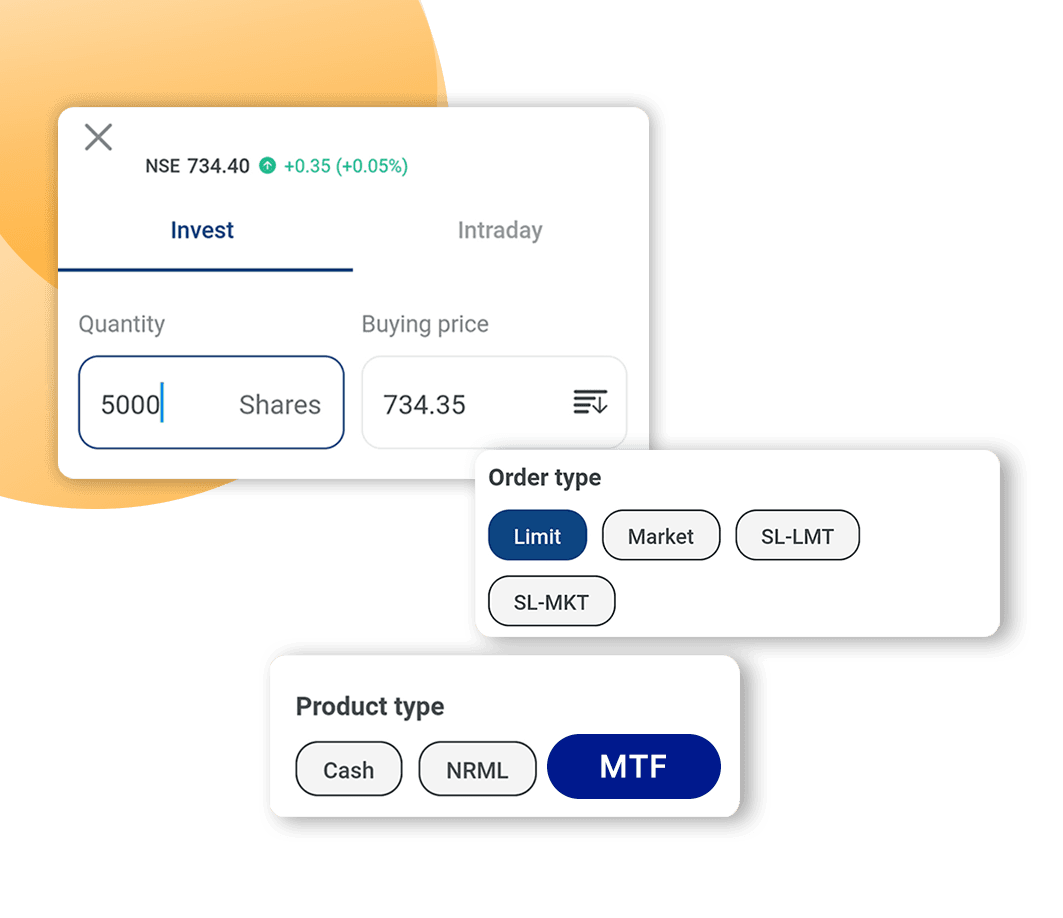

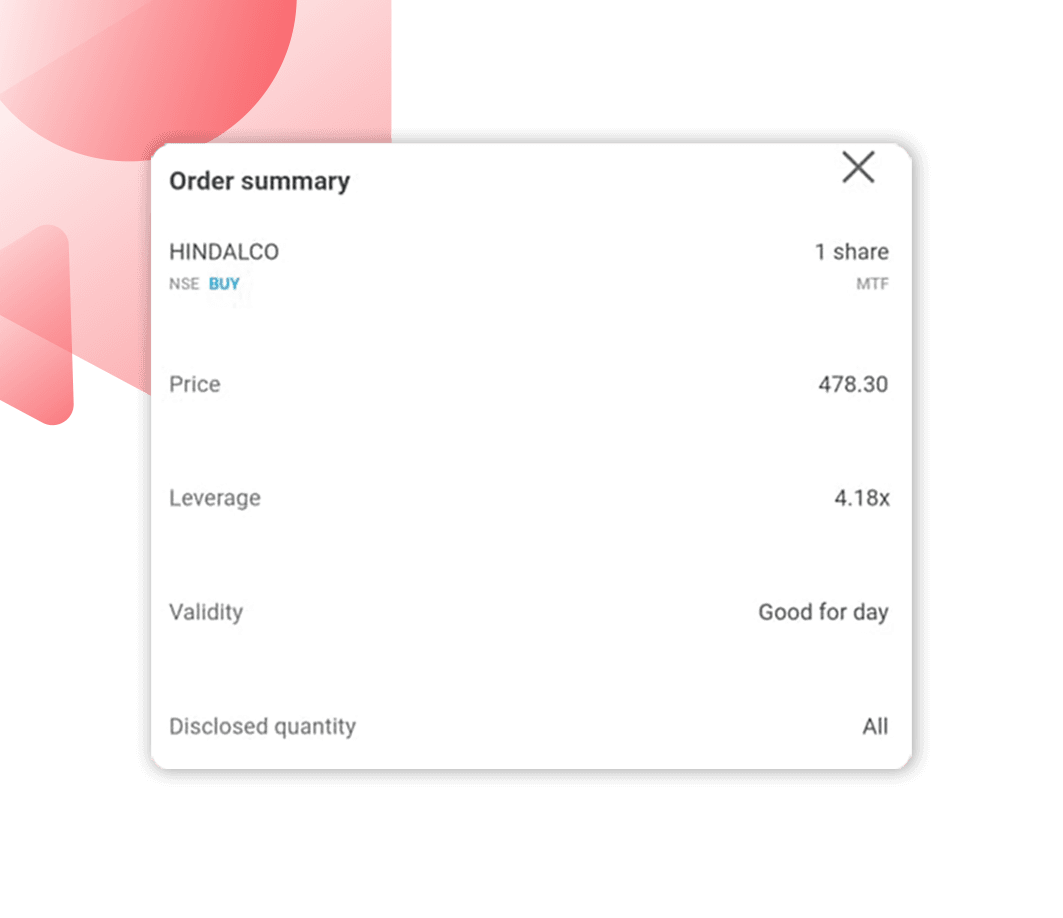

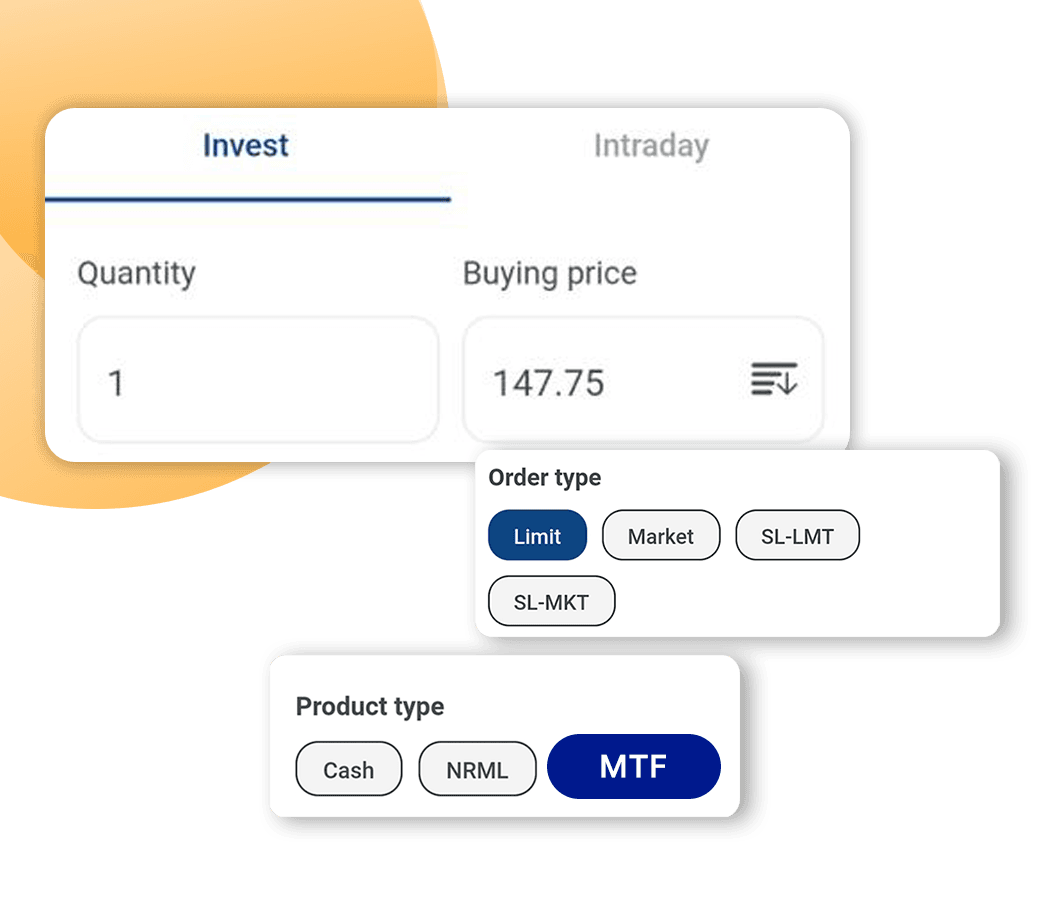

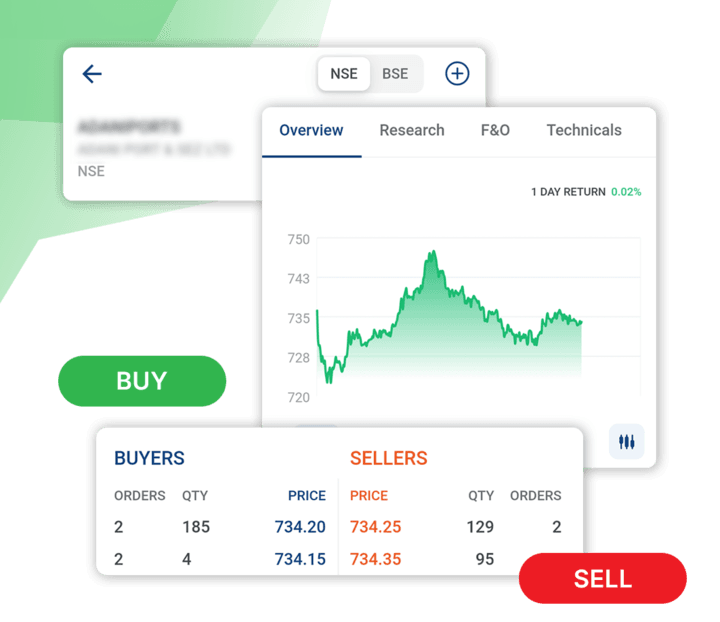

How to place MTF Trade

Enter quantity and Select “MTF” under the product type.

Once done, you will be able to place an order using MTF.

Cross-check the order details and proceed to buy.

Your order will be placed under MTF.

We believe in quality first and a technology-led approach that makes us a reputable choice for investment advisors across the industry.

*Margin available up to 4x on 1000+stocks

Frequently Asked Questions (FAQs) for Margin Trading Facility

What is Margin Trading Facility (MTF)?

Margin Trading Facility (MTF) is an exchange-approved product wherein individuals can purchase stocks by paying only the initial margin, with the remaining amount being funded by Kotak Securities Ltd. One can either keep the position open as long as they want or can take delivery of the stock.

What is Margin Trading in the stock market, and how does it work?

If you are wondering what is margin trading in the stock market, let us help you out. It is a strategy that lets you borrow funds from your broker to buy more securities than your available cash would allow. This means that you trade on the margin using borrowed money to increase your buying power. MTF, in turn, allows you to invest more and increase your profits. However, here is the catch — margin trading is not without risks. If your investments do not perform as expected, the borrowed money still needs to be repaid, which could lead to significant losses.

What is margin trading in the share market, and how is trade margin calculated?

Wanting to know what margin trading is in the share market? Margin trading is a strategy that lets you buy shares using borrowed funds from your broker. In margin trading, the broker sets a margin requirement, which is a percentage of the total value of the shares you want to buy.

Let’s take a look at an example to understand better. If the broker requires a 25% margin, you will need to contribute 25% of the share’s value. Let’s say you want to buy shares worth ₹1 lakh. You would need ₹25,000 upfront, and the broker would lend you the remaining ₹75,000.

This trade margin allows you to invest more than you would with just your available cash, thus enhancing your buying capacity. But before jumping in, it is crucial to remember that margin trading involves risk.

What are the interest rates for the Kotak Securities Margin Trading Facility (MTF)?

Kotak Securities offers lower MTF rates of 9.69% per annum or 0.027% per day, which are applied from T+1 day onwards on the Trade Free Pro Plan. These charges vary based on your selected brokerage plan.

What are the requirements of Margin Trading with Kotak Securities?

To trade with margin at Kotak Securities, you need to accept the MTF disclaimer after reviewing it. Additionally, you must maintain the required margin balance and pledge eligible securities as collateral. The security purchased under Margin Trading Facility (MTF) needs to be pledged. Alternatively, you can also pledge other eligible securities to avail margin and then trade with margin under MTF. Kotak Securities will then set margin maintenance levels, which must be adhered to in order to continue margin trading. It is a must to also comply with regulatory guidelines to ensure smooth trading with margin.

What are the risks of trading on the margin for beginners?

Trading on the margin does involve significant risks, especially for beginners. While on the one hand, it boosts your buying power; on the other hand, it also means you are borrowing money that needs to be repaid, despite your trades not performing well.

Losses can quickly surpass your initial investment. Beginners should approach margin trading cautiously and assess their risk tolerance before leveraging funds in the stock or share market.

How long can an MTF position be held?

The holding period on MTF with Kotak Securities is unlimited. This means that you can hold a stock for an unlimited number of days in MTF with Kotak Securities. Do note that interest charges will apply for the duration of the position, basis your pricing plan.

Is MTF trading profitable?

Margin trading facility, can be powerful if you aim to maximize the potential of your business. This feature makes it possible to place more bets on the market than your account balance usually is able to allow, which can result in a higher profit margin by increasing purchasing power.

Is MTF trading legal in India?

The creation of a MTF position against shares as collateral is now open to investors. SEBI and Exchanges keep a close eye on the securities that qualify for the MTF, and they periodically prescribe the margin that must be placed on such securities (either in cash or as shares of collateral).

How long can I keep my position open?

With Kotak Securities Ltd, once you have pledged your MTF stocks, you can maintain your position for as long as you wish, or you may choose to convert the position to cash.

What kind of collateral for MTF is required?

To create an MTF position, you can utilise cash, existing stocks, and ETFs held in your Demat account as collateral, post-pledging.

What is Pledging of shares under MTF?

With the introduction of the pledge model in September 2020, it has become mandatory to pledge stocks purchased under the Margin Trading Facility.To hold your MTF position for as long as you want, user are required to pledge the stocks purchased under MTF on T Day on the link received from NSDL.

Are there any charges for pledging and unpledging?

Yes, there is a charge of Rs.20 + GST per ISIN for both pledging and unpledging.

What if I fail to pledge my stocks bought under MTF?

In the event that you fail to pledge the stocks purchased under MTF, your position will be liquidated.

How does Leverage work and what considerations should I be aware of?

Benefit: Leverage enables you to amplify returns on a smaller investment, as seen when paying only 20% upfront for a 10% return on the stock price, resulting in a 50% return, pre-cost.

Risk: However, it's crucial to note that leveraging also adds losses on a smaller investment. For example, paying only 20% upfront for a 10% loss on the stock price means you lose 50% of your capital, pre-cost. Understanding the risks associated with Leverage is vital for informed decision-making.

How does the unlimited holding period feature benefit me, and what risks should I be aware of?

Benefit: Unlimited holding period allows you to hold a trade indefinitely if you believe it offers a better chance of making a profit.

Risk: Nevertheless, holding a trade for an extended period increases your interest costs, raising the breakeven for your trade. Additionally, if the trade moves against you, you may need to provide higher margins or face liquidation.