What is a Buyback/Takeover/Delisting?

Buyback-It’s a corporate action in which a company buys back its shares from the existing shareholders, usually at a price higher than market price. You are eligible for a buyback if you hold stocks on the cut-off date in your account.

Takeover- It’s a corporate action where a company or group of companies offers to buy or acquire shares of another company in order to gain enough control in that company. You are eligible for a Takeover if you have shares between the Offer Start and Offer End Date.

Delisting- When a company chooses not to offer its shares to the public anymore for trading purposes. It wants to stay private. You are eligible for a Delisting if you have shares between the Offer Start and Offer End Date.

How to Apply For Buyback/Takeover/Delisting?

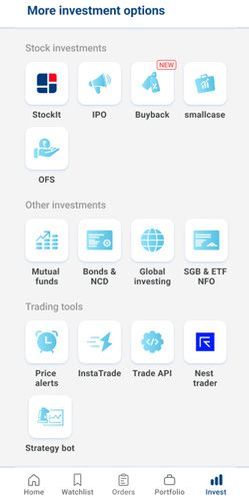

Step 1: Navigate to Invest > Buyback

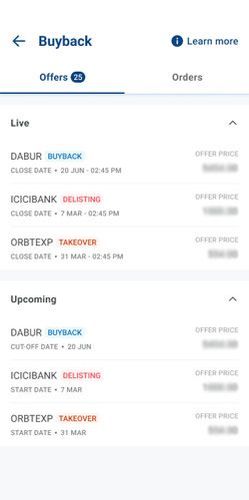

Step 2: Click on any scrip in the Live section

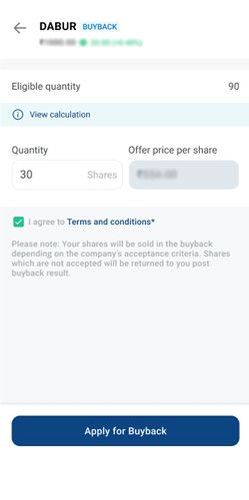

Step 3: Enter the Number of quantity you want to place in bid

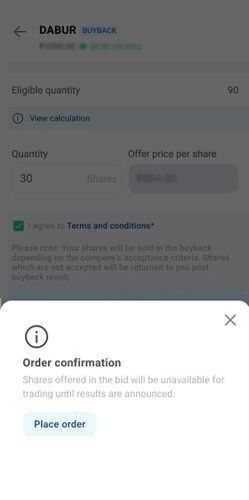

Step 4: Click on “Place Order” on Order Confirmation

Step 5: On Orders Tab, you will be able to see all your existing/past Orders

Frequently Asked Questions

Where would funds from Buyback/Takeover/Delisting get credited?

Funds from Buyback/Takeover/Delisting will get credited to your demat linked bank account on Kotak Neo.

Can I cancel my order once it is placed?

You can cancel your order till T-1 day(T day being the Offer End Date) Order cancellation is only allowed for Buyback and Delisting. Sometimes exchange may not release your order till the offer window closes and it will be returned to you once the offer closes.

What does InProcess and Accepted means on the Order page?

InProcess signifies that orders are yet to be confirmed by exchange

Accepted means orders are successfully placed at exchange

Please note: Accepted doesn’t mean bids are successful , it only signifies that bid are placed successfully for buyback consideration

Why was my Buyback bid not successful?

Your buyback request may or may not be successful. This depends on the company’s criteria and is only disclosed after the offer window discloses.

There are 3 possible outcomes for a buyback:

i. All the shares tendered are accepted

ii. Some of the shares tendered are accepted

iii. The entire order is rejected.

If your order is rejected, your holding will be returned to your demat account.

What is a Cut-off date in a Buyback?

The Cut-off date, which is set by a company's board of directors, is the date on which the company compiles a list of shareholders of the stock. Shareholders holding the shares in their demat accounts on the cut-off date are eligible for Buyback.

Can I bid Pledged/Pay Later shares in Buyback/Takeover/Delisting?

No, you cannot place Pledged/Pay later shares for Buyback/Takeover/Delisting. You can contact the customer care to unpledge/convert your shares to CNC to place them in bid.

My order is getting rejected with the following error – ‘Order price is outside the trade execution range. Try placing the order again

My order is getting rejected with the following error – ‘The order was rejected to avoid self trade. Try placing the order again’.

Why was the stop loss executed even though the price did not breach the trigger?

My order is getting rejected with the following error – ‘Stoploss price is outside the allowed range of XXX’.