Difference Between Spot Price and Future Price

Futures are derivative products whose value depends largely on the price of the underlying stocks or indices. However, the pricing is not that direct. There remains a difference between the prices of the underlying asset in the cash segment and in the derivatives segment. This difference can be understood through two simple pricing models for futures contracts. These will allow you to estimate how the price of a stock futures or index futures contract might behave. These are:

- The Cost of Carry Model

- The Expectancy Model

However, remember that these models merely give you platform on which to base your understanding of futures prices. That said, being aware of these theories gives you a feel of what you can expect from the futures price of a stock or an index.

What Is The Cost Of Carry Model?

The Cost of Carry Model assumes that markets tend to be perfectly efficient. This means there are no differences in the cash and futures price. This, thereby, eliminates any opportunity for arbitrage – the phenomenon where traders take advantage of price differences in two or more markets.

When there is no opportunity for arbitrage, investors are indifferent to the spot and futures market prices while they trade in the underlying asset. This is because their final earnings are eventually the same.

The model also assumes, for simplicity sake, that the contract is held till maturity, so that a fair price can be arrived at.

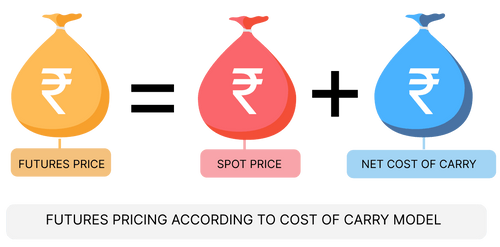

In short, the price of a futures contract (FP) will be equal to the spot price (SP) plus the net cost incurred in carrying the asset till the maturity date of the futures contract.

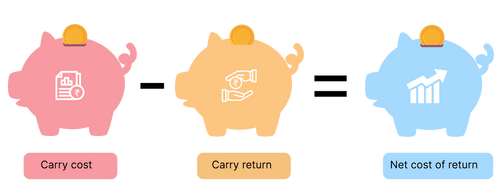

FP = SP + (Carry Cost – Carry Return)

Here Carry Cost refers to the cost of holding the asset till the futures contract matures. This could include storage cost, interest paid to acquire and hold the asset, financing costs etc. Carry Return refers to any income derived from the asset while holding it like dividends, bonuses etc. While calculating the futures price of an index, the Carry Return refers to the average returns given by the index during the holding period in the cash market. A net of these two is called the net cost of carry.

The bottom line of this pricing model is that keeping a position open in the cash market can have benefits or costs. The price of a futures contract basically reflects these costs or benefits to charge or reward you accordingly.

What Is The Expectancy Model Of Futures Pricing?

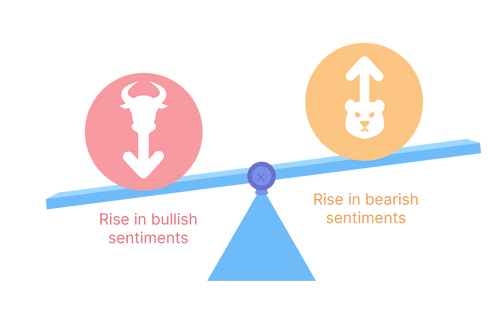

The Expectancy Model of futures pricing states that the futures price of an asset is basically what the spot price of the asset is expected to be in the future. This means, if the overall market sentiment leans towards a higher price for an asset in the future, the futures price of the asset will be positive. In the exact same way, a rise in bearish sentiments in the market would lead to a fall in the futures price of the asset. Unlike the Cost of Carry model, this model believes that there is no relationship between the present spot price of the asset and its futures price. What matters is only what the future spot price of the asset is expected to be. This is also why many stock market participants look to the trends in futures prices to anticipate the price fluctuation in the cash segment.

What Is Basis?

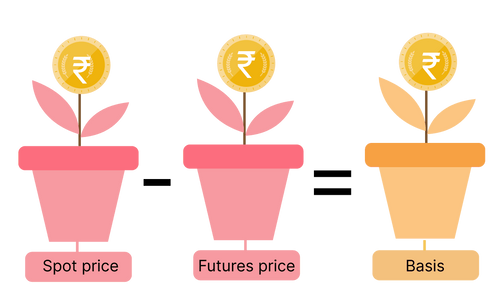

At a practical level, you will observe that there is usually a difference between the futures price and the spot price. This difference is called the basis.

If the futures price of an asset is trading higher than its spot price, then the basis for the asset is negative. This means, the markets are expected to rise in the future.

On the other hand, if the spot price of the asset is higher than its futures price, the basis for the asset is positive. This is indicative of a bear run on the market in the future.

FAQs on Difference Between Spot & Futures Pricing

Do options contracts have spot prices and futures prices?

Yes, options contracts have spot and future prices. The spot price is the existing market price. Whereas the future price is the predetermined price for the delivery of underlying assets.

What is a contango in futures trading?

Contango refers to a condition when the futures price of commodities is higher than the spot price. Contango generally happens when the price of an asset is expected to rise over time.

Where should I trade commodities, the spot market or the futures market?

You may trade in the spot market if you want immediate delivery of assets. However, if you want to get the underlying asset after some time, you can trade in the futures market. You can also sell the futures contract without taking the delivery of assets.