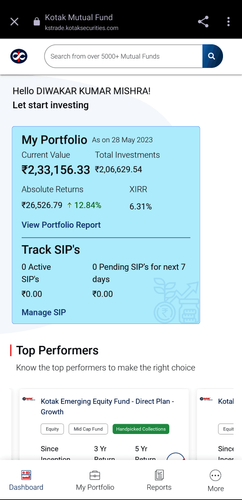

How to Invest in Mutual funds through Kotak Securities?/ What is the new flow for Investing in Mutual Funds?

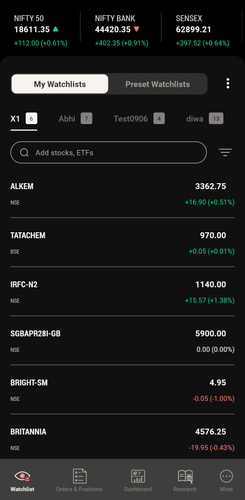

Login to the Neo App / Web, and the remainder of the process is the same; however, one must navigate to the Mutual Fund Platform via the Neo App, and then follow the same approach as mentioned before.

The steps are mentioned below -

-

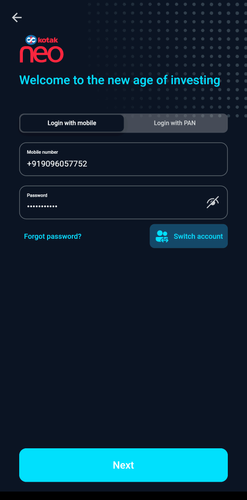

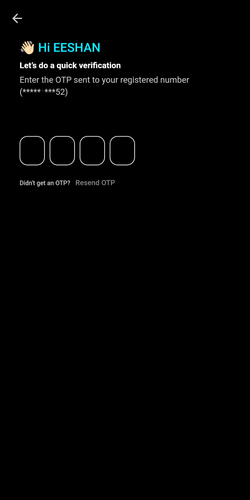

Login to Mutual Fund using NEO App

-

Enter registered Phone number, password

- Enter OTP sent to registered number

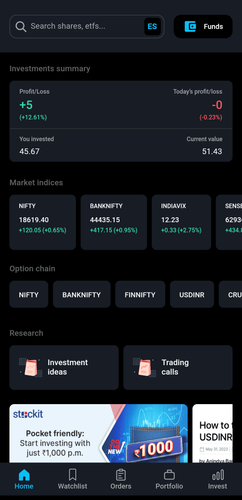

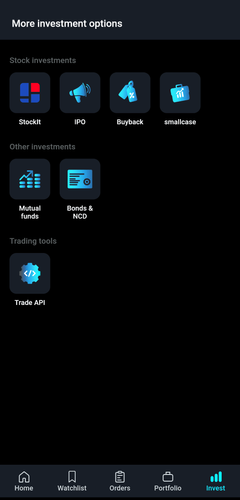

- After logging in, click on Invest from the bottom bar

- Under Other Investments, select Mutual Funds

-

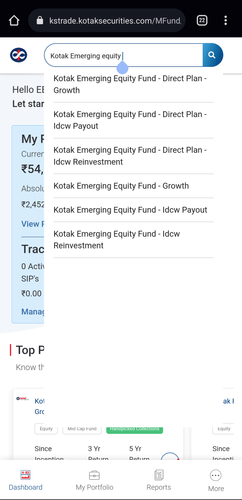

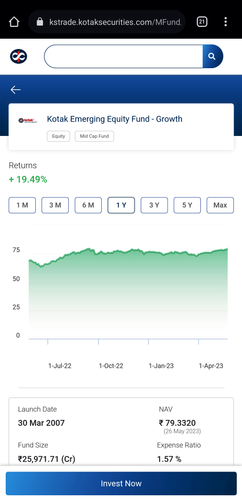

Search for the scheme you want to invest in and click on it to open scheme details

-

On scheme details page, click on Invest Now

-

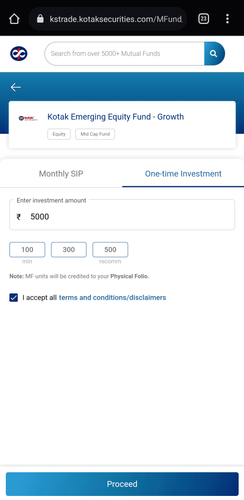

Select One-time investment and enter investment amount

-

Accept T&C and click on Proceed

-

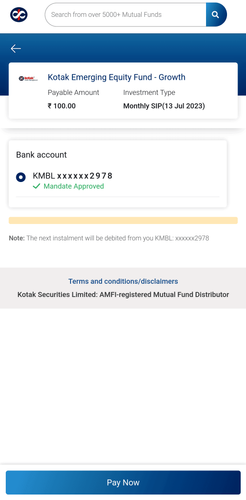

On bank details page, click on Pay Now

-

You will be taken to your Bank’s e-banking page. Enter your bank details and complete the payment

-

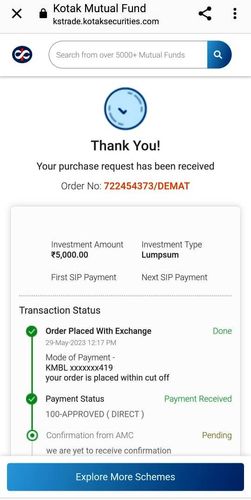

Your order will be placed successfully post successful authentication.

-

Login to Mutual Fund using NEO website https://ntrade.kotaksecurities.com/

-

Enter registered Phone number, password

-

Enter OTP sent to registered number

-

After logging in, click on Invest

-

Under Other Investments, select Mutual Funds

-

Search for the scheme you want to invest in and click on it to open scheme details

-

On scheme details page, click on Invest Now

-

Select One-time investment and enter investment amount

-

Accept T&C and click on Proceed

-

On bank details page, click on Pay Now

-

You will be taken to your Bank’s e-banking page.

-

Enter your bank details and complete the payment

-

Your order will be placed successfully post successful authentication.

-

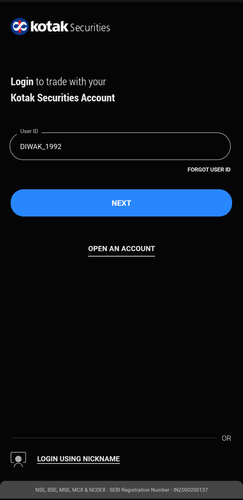

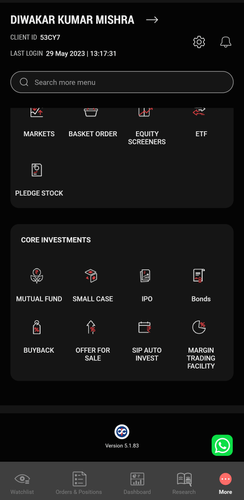

Login into Mutual Funds using Kotak Stock Trading app

-

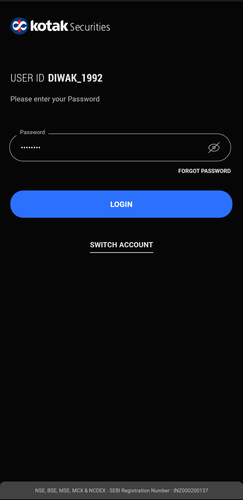

Enter User ID and password

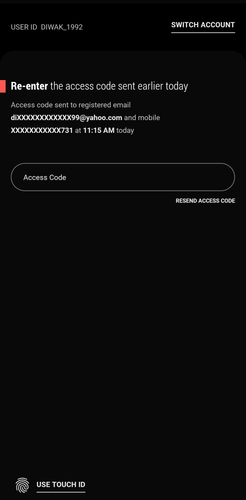

- Enter access code to login

- After logging in, click on More from the bottom bar

- Scroll down to view Core Investments

- Select Mutual funds

- Search for the scheme you want to invest in and click on it to open scheme details

- On scheme details page, click on Invest Now

- Select One-time investment and enter investment amount

-

Accept T&C and click on Proceed

-

On bank details page, click on Pay Now

12 You will be taken to your Bank’s e-banking page. Enter your bank details and complete the payment

- Your order will be placed successfully post successful authentication.

Due to regulatory changes, the following new flow will take effect on April 1, 2022. Check out the digital investment flow by clicking the link below.

Flow for fresh Mutual Funf Investments

-

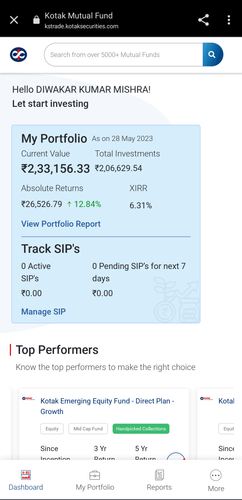

Login to Mutual Funds using Kotak Securities website: https://www.kotaksecurities.com/

-

Enter User ID and password

-

Enter access code to login

-

After logging in, click on More

-

Scroll down to view Core Investments

-

Select Mutual fund

-

Search for the scheme you want to invest in and click on it to open scheme details

-

On scheme details page, click on Invest Now

-

Select One-time investment and enter investment amount

-

Accept T&C and click on Proceed

-

On bank details page, click on Pay Now

-

You will be taken to your Bank’s e-banking page. Enter your bank details and complete the payment

-

Your order will be placed successfully post successful authentication.