How do I open an account online?

Open Your Demat & Trading Account Online following below mentioned easy steps:

-

Visit the website

-

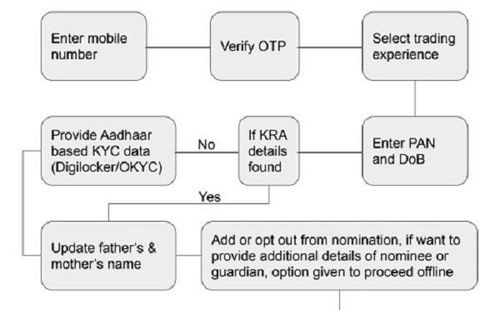

Enter your mobile no.

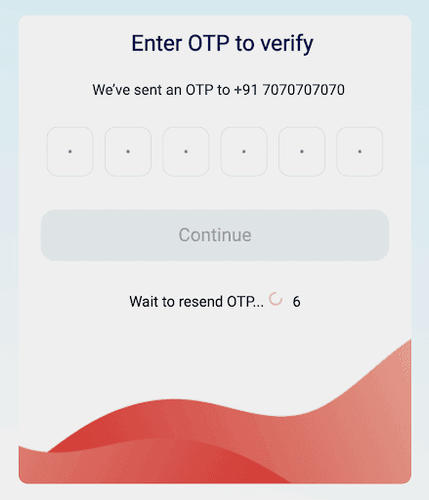

- Enter the OTP

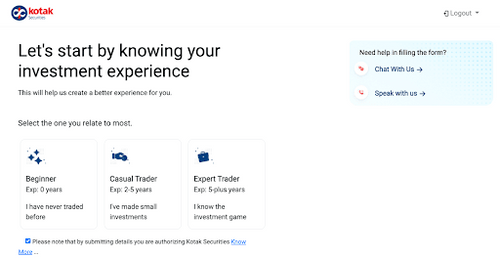

- Choose a card and tell us about your investment experience (How many years you have been trading)

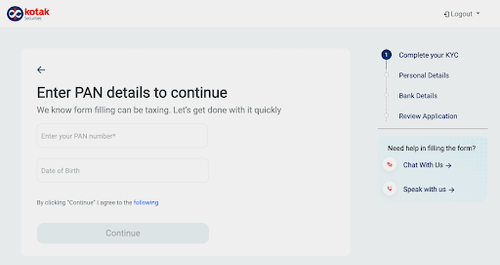

- Provide your PAN No. and Date of Birth

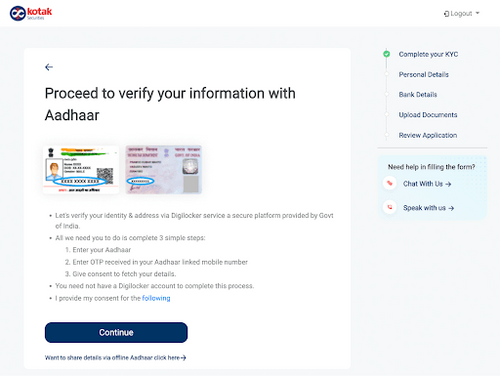

- Provide your Aadhar details:

If you click on Continue, you will be taken to Digilocker.

Enter Aadhar details in Digilocker portal. Enter the temporary OTP issued to the Aadhaar-registered mobile number.

Press the Continue button.

Provide required documents by clicking on Allow.

Alternatively you can provide your KYC details by uploading OYC .zip file and Password.

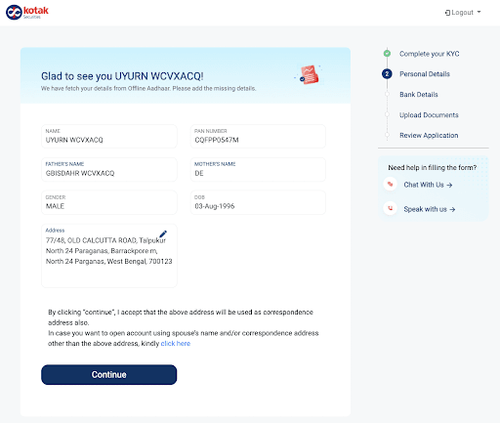

- Enter remaining details and click on Continue

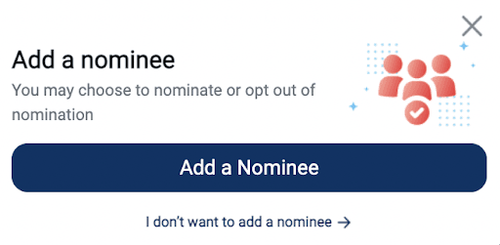

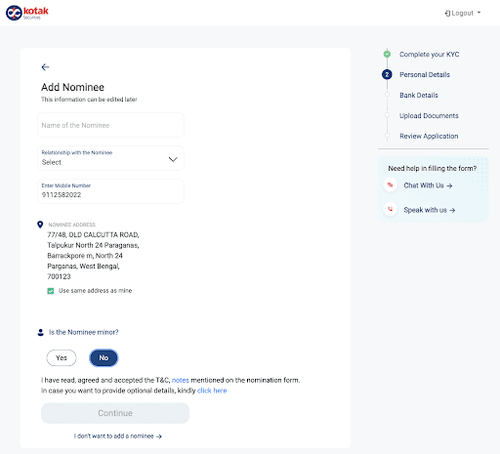

- Add a Nominee

Add details of the Nominee and Guardian details incase the nominee is a minor (below 18 years age)

If the nominee details are not same as yours then untick the checkbox given and add the required details

If you untick the checkbox of “use same address as mine”, then you need to manually enter the address.

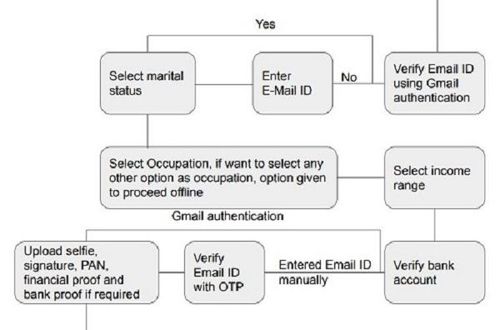

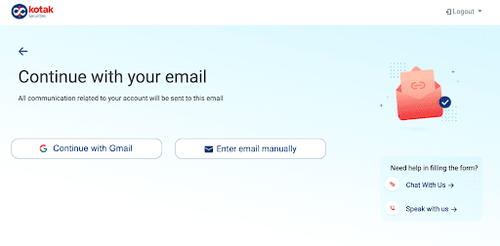

- Then you need to verify your email ID:

You can continue with Gmail or enter your other valid email ID

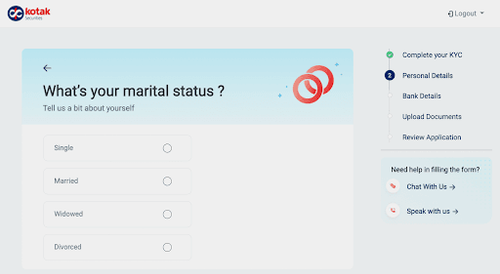

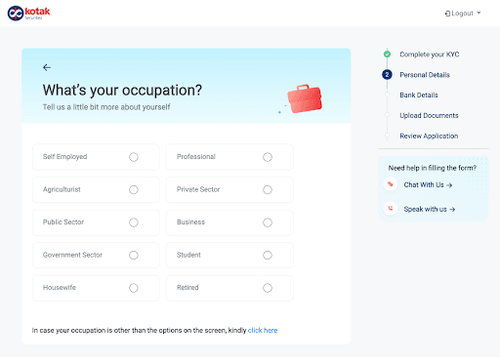

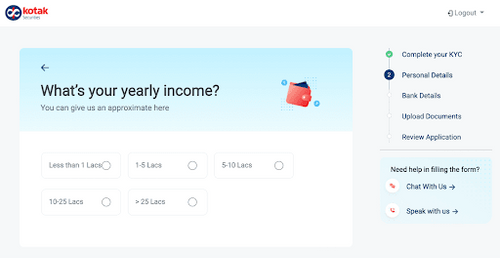

- Enter your other required details like: marital status, Occupation, Yearly Income

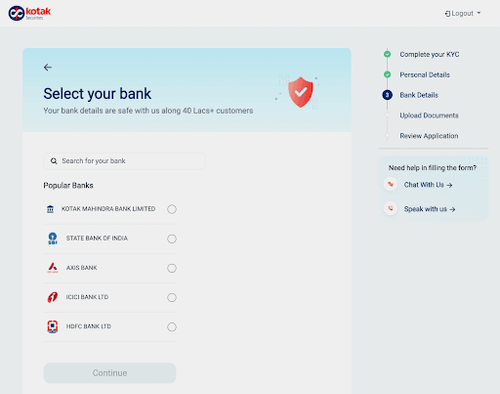

- Select your Bank or you can also search the back from the search bar And then click on Continue

For Kotak Bank: You only need to then add account Number and CRN No. associated with your Kotak Mahindra Bank Account. You do not need to upload any additional bank documents.

For Non Kotak Bank: You need to add your Account No. Click on Continue

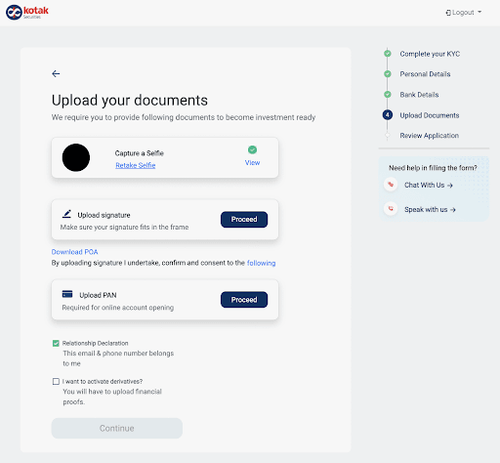

- You will need to submit your

- Selfie

- Signature

- PAN Card picture which shows your signature (If digital PAN card not available in Digilocker)

If you are any other non-Kotak Bank customer and your Bank Verification fails then you will have to upload the picture of your Bank documents like:

- Bank Account Statement

- Canceled Cheque

- You will have to untick the checkbox - incase you are not using your personal Mobile No. and Email ID. You will have to enter the details of the relationship with the person whose email ID and Mobile No. details have been provided by you.

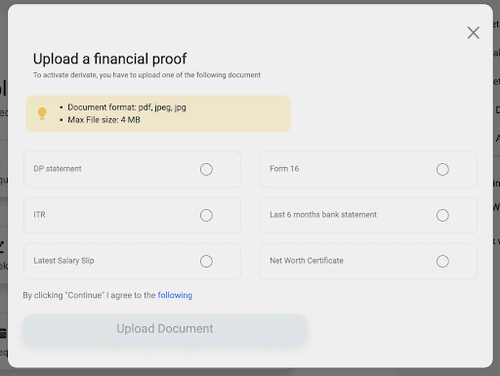

The Second Check box needs to be ticked (clicked) to activate your Derivatives & F&O Segment and upload your financial proof for the same - you can add any of the below documents (either in JPEG or PNG format) and it should not be password protected:

-

DP Statement

-

Form 16

-

ITR

-

Last six months Bank Statement

-

Latest Salary Slip

-

Networth Certificate

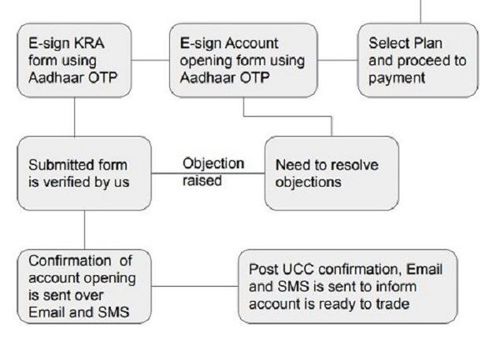

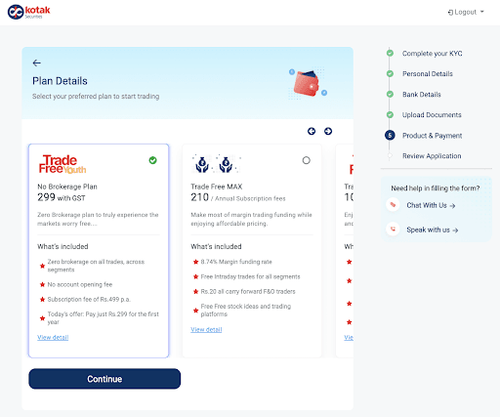

- Select the Tariff plan after this which could be Trade Free, Trade Free Youth, Kotak Agni and PCG Lite. as applicable

Click on Continue and you will be directed to payment page for the selected plan.

Note: If account is not opened due to some unforeseen reason, we will refund this fees as soon as we receive request from prospect

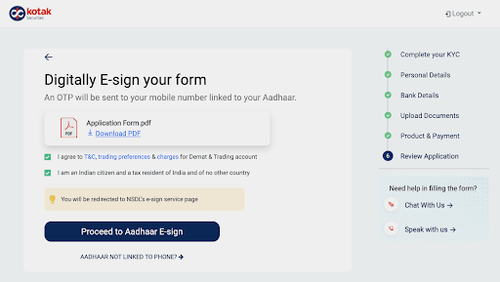

- Now you just need to Digitally E-Sign your form by clicking on Proceed to Aadhar E-Sign

i.e. You need to type in your Aadhar No. and authenticate via OTP in your application form and your KYC form digitally.

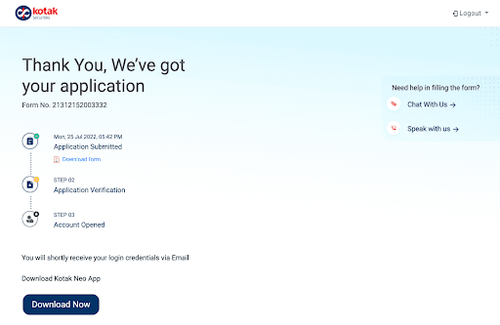

Your application will be submitted thereafter and you can proceed by Downloading the App

You will receive the confirmation on your registered Email id and mobile number, and you can start using our App.

You can also refer to the below flow chart for the summary of procedure of opening an account online with us.