How To Buy And Sell Futures Contracts

In this section, we look at how to buy and sell futures contracts:

How To Buy Futures Contracts

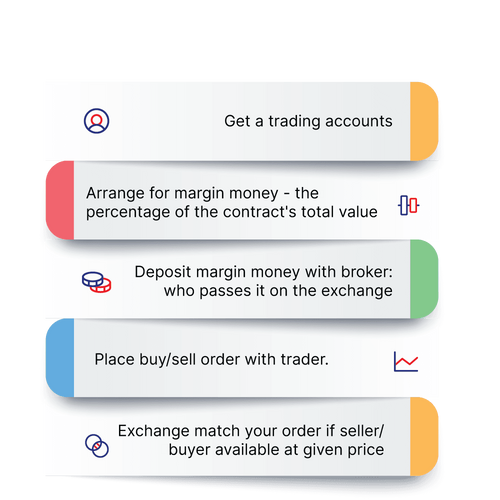

One of the prerequisites of stock market trading – be it in the derivative segment – is a trading account.

Money is the obvious other requirement. However, this requirement is slightly different for the derivatives market.

When you buy in the cash segment, you have to pay the entire value of the shares purchased – this is unless you are a day trader utilizing margin trading. You have to pay this amount upfront to the exchange or the clearing house.

This upfront payment is called ‘Margin Money’. It helps reduce the risk that the exchange undertakes and helps in maintaining the integrity of the market.

Once you have these requisites, you can buy a futures contract. Simply place an order with your broker, specifying the details of the contract like the Scrip , expiry month, contract size, and so on. Once you do this, hand over the margin money to the broker, who will then get in touch with the exchange.

The exchange will find you a seller (if you are a buyer) or a buyer (if you are seller) .

Click here to read about margin calls

How To Settle Futures Contracts

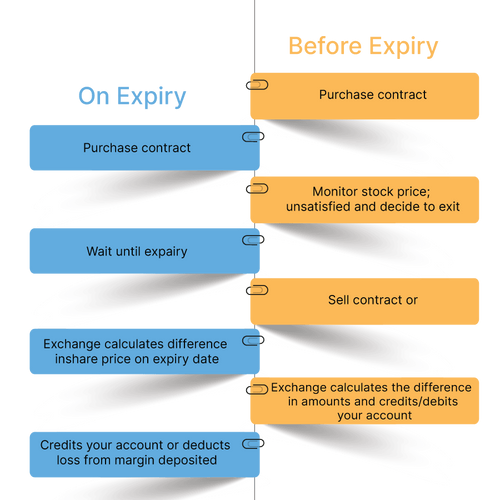

When you trade in futures contracts, you do not give or take immediate delivery of the assets concerned. This is called settling of the contract. This usually happens on the date of the contract’s expiry. However, many traders also choose to settle before the expiry of the contract.

Click here to know more about derivatives expiry

For stock futures, contracts can be settled in two ways:

On Expiry

In this case, the futures contract (purchase or sale) is settled at the closing price of the underlying asset as on the expiry date of the contract.

Example: You have purchased a single futures contract of ABC Ltd., consisting of 200 shares and expiring in the month of July. At that time, the ABC share’s price was Rs 1,000. If on the last Thursday of July, ABC Ltd. closes at a price of Rs 1,050 in the cash market, your futures position will be settled at that price. You will receive a profit of Rs 50 per share (the settlement price of Rs 1,050 less your cost price of Rs 1,000), which adds up to a neat little sum of Rs 10,000 (Rs 50 x 200 shares). This amount is adjusted with the margins you have maintained in your account. If you receive profits, they will be added to the margins that you have deposited. If you made a loss, the amount will be deducted from the margins.

Kotak Securities offer Value Added Features like the Auto Invest. Click here to know more.

Before Expiry

It is not necessary to hold on to a futures contract till its expiry date. In practice, most traders exit their contracts before their expiry dates. Any gains or losses you’ve made are settled by adjusting them against the margins you have deposited till the date you decide to exit your contract. You can do so by either selling your contract, or purchasing an opposing contract that nullifies the agreement. Here again, your profits will be returned to you or losses will be collected from you, after adjusting them for the margins that you have deposited once you square off your position.

Index futures contracts are settled in cash. This can again be done on expiry of the contract or before the expiry date.

- On Expiry

When closing a futures index contract on expiry, the closing value of the index on the expiry date is the price at which the contract is settled. If on the date of expiry, the index closes higher than when you bought your contracts, you make a profit and vice versa. The settlement is made by adjusting your gain or loss against the margin money you’ve already deposited.

Example: Suppose you purchase two contracts of Nifty future at 6560, say on July 7. This particular contract expires on July 27, being the last Thursday of the contract series. If you have left India for a holiday and are not in a position to sell the future till the day of expiry, the exchange will settle your contract at the closing price of the Nifty prevailing on the expiry day. So, if on July 27, the Nifty stands at 6550, you will have made a loss of Rs 1,000 (difference in index levels – 10 x2 lots x lot size of 50 units). Your broker will deduct the amount from your margins deposited with him and forward it to the stock exchange. The exchange, in turn, will forward it to the seller, who has made that profit. However if Nifty closes at 6570, you would have made a profit of Rs 1,000. This will be added to your account.

- Before Expiry

You can choose to exit your index futures contract before the date of expiry if you believe that the market will rise before the expiry of your contract period and that you’ll get a better price for it on an earlier date. Such an exit depends solely on your judgment of market movements as well as your investment horizons. This will also be settled by the exchange by comparing the index levels when you bought and when you exit the contract. Depending on the profit or loss, your margin account will be credited or debited.

Brush-up your investment knowledge by reading the investment basics. Click here

What Are The Payoffs And Charges On Futures Contracts

A futures market helps individual investors and the investing community as a whole in numerous ways.

However, it does not come for free. The main payoff for traders and investors in derivatives trading is margin payments.

There are different kinds of margins. These are usually prescribed by the exchange as a percentage of the total value of the derivative contracts. Without margins, you cannot buy or sell in the futures market.

Click here to read about the market indicators you must know

Here’s a look at the four different margins in detail:

-

Initial Margin:

Initial margin is defined as a percentage of your open position and is set for different positions by the exchange or clearing house. The factors that decide the amount of initial margin are the average volatility of the stock in concern over a specified period of time and the interest cost. Initial margin amounts fluctuate daily depending on the market value of your open positions.

-

Exposure Margin:

The exposure margin is set by the exchange to control volatility and excessive speculation in the futures markets. It is levied on the value of the contract that you buy or sell.

-

Mark-to-Market Margin:

Mark-to-Market margin covers the difference between the cost of the contract and its closing price on the day the contract is purchased. Post purchase, MTM margin covers the daily differences in closing prices.

-

Premium Margin:

This is the amount you give to the seller for writing contracts. It is also usually mentioned in per-share basis. As a buyer, your pay a premium margin, while you receive one as a seller. Margin payments help traders get an opportunity to participate in the futures market and make profits by paying a small sum of money, instead of the total value of their contracts.

However, there are also downsides to futures trading. Trading in futures is slightly more complex than trading in straightforward stocks or etfs. Not all futures traders are well-versed in the nitty-gritties of the derivatives business, leading to unforeseen losses. The low upfront payments and highly leveraged nature of futures trading can tempt traders to be reckless which could lead to losses.

FAQs on How to Buy and Sell Futures Contracts

Can you buy and sell a futures contract at the same time?

In general, you cannot buy and sell a futures contract at the same time. Many exchanges do not allow it. However, you can sell a futures contract any time before the expiration date.

When should you buy or sell a futures contract?

You may buy a futures contract if you think the price of the underlying asset will increase. Meanwhile, you may sell a futures contract if you believe the underlying asset will not perform well in future.