What is Derivatives In the Stock Market? Meaning, Participants, Types, and more

Key Highlights

-

Derivatives are financial contracts that derive value from an underlying asset, group of assets, or benchmark set by two or more parties.

-

A derivative can be traded on an exchange or over the counter. The fluctuations influence the price of derivatives in the underlying asset.

-

Derivatives are used as leverage instruments, increasing their potential risks and rewards.

-

Derivatives such as futures contracts, forward contracts, options, and swaps are common derivatives.

What are Derivatives:

Wondering, what are derivatives in share market?

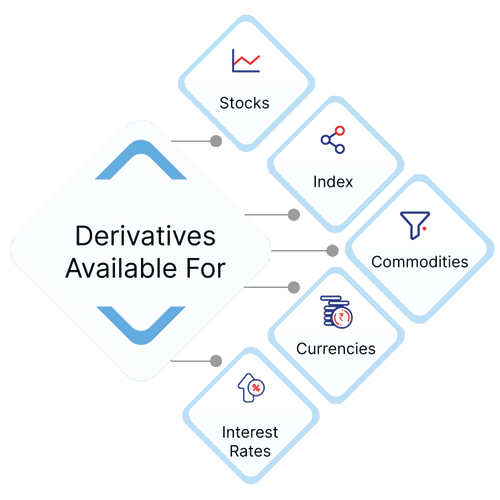

Derivatives are financial contracts that derive their value from an underlying asset. These assets could be stocks, indices, commodities, currencies, exchange rates, or the rate of interest. These financial instruments help you make profits by speculating on the future value of the underlying asset.

The value of derivatives is directly to the underlying asset, which is why they are called ‘derivatives’.

The price of these underlying assets fluctuates frequently.

For example, a stock’s value may rise or fall, the exchange rate of a pair of currencies may change, indices may fluctuate, and commodity prices may increase or decrease.

These fluctuations present opportunities for investors to make profits, though they also carry the risk of losses. Derivatives play a crucial role in managing these risks. They help you additional profits by accurately guessing the future prices, or act as a safety net to offset potential losses in the spot market, where the underlying assets are traded.

What is Derivative Trading?

Begin with the basics: a derivative is a financial contract that allows investors to buy or sell an asset at a future date. Next, you may wonder, what is derivative trading? This is simple to understand. Derivative trading involves using these contracts to speculate on the future value of various underlying assets, such as stocks, commodities, currencies, and benchmarks. Each derivative contract has a fixed and predetermined expiry date, and the appeal of derivative trading lies in its potential for significantly amplified gains compared to directly purchasing the underlying asset.

In addition, derivative trading is a leveraged form of trading, meaning you can buy a large amount of underlying assets by paying a small amount. Different derivatives, such as stocks, commodities, currencies, benchmarks, and so on, can be traded.

There are two types of derivative contracts: futures and options. Since both the seller and the investor forecast the underlying asset's price for a particular future date, they are essentially the same. However, futures and options are different because, in futures, there is a legal obligation on both buyers and sellers to honor the contract's expiration.

In the case of options, however, the buyer or the seller may buy and sell before the expiry of the contract by exercising their rights or by letting the contract expire without exercising their rights. The two types of options are the Call option and the Put option. Investors are confident that the underlying asset will increase by a call option. On the other hand, when they feel satisfied that the price of their underlying asset will fall, they purchase a Put option.

What Is the Use of Derivatives?

In the Indian markets, futures and options are standardized contracts, which can be freely traded on exchanges. These could be employed to meet a variety of needs.

-

Earn money on shares that are lying idle SoSo, you don’t want to sell the shares you bought for the long term but want to take advantage of price fluctuations in the short term. You can use derivative instruments to do so. The derivatives market allows you to conduct transactions without selling your shares - also called physical settlement.

-

Benefit from arbitrage Arbitrage trading is when you buy low in one market and sell high in another. Simply put, you are taking advantage of price differences in the two markets.

-

Protect your securities Protect your securities against fluctuations in prices. The derivative market offers products that allow you to hedge against a fall in the price of shares that you possess. It also provides products that protect you from a rise in the price of shares that you plan to purchase. This is called hedging.

-

Transfer of risk By far, the most critical use of these derivatives is the transfer of market risk from risk-averse investors to those with a risk appetite. Risk-averse investors use derivatives to enhance safety while risk-loving investors like speculators conduct risky, contrarian trades to improve profits. This way, the risk is transferred. There are a wide variety of products available and strategies that can be constructed, which allow you to pass on your risk.

If the benefits have intrigued you enough and you want to start trading immediately, here is how to buy and sell future contracts.

Who Are the Participants in Derivatives Markets

Let's understand the types of traders in the derivative market. Based on their trading motives, participants in the derivatives markets can be segregated into four categories - hedgers, speculators, margin traders, and arbitrageurs.

Let's take a look at why these participants trade in derivatives and how their motives are driven by their risk profiles.

If you’re a hedger looking to shield your portfolio against a small-cap crash, you might want to read up on 5 ways to hedge against a small-cap crash.

-

Hedgers

Traders who wish to protect themselves from price movements participate in the derivatives market. They are called hedgers. This is because they try to hedge the price of their assets by undertaking an exact opposite trade in the derivatives market.

Thus, they pass on this risk to those willing to bear it. They are so keen to rid themselves of the uncertainty associated with price movements that they may even be ready to do so at a predetermined cost.

For example, let's say that you possess 200 shares of a company – ABC Ltd., and the price is hovering at around Rs. 110. Your goal is to sell these shares in six months. However, you worry that the cost of these shares could fall considerably by then.

At the same time, you do not want to liquidate your investment today, as the stock can be appreciated soon.

You would like to receive a minimum of Rs. 100 per share and no less.

At the same time, if the price rises above Rs. 100, you would like to benefit by selling them at a higher price. You can purchase a derivative contract called an 'option' that incorporates all your above requirements by paying a small price.

This way, you reduce your losses and benefit whether or not the share price falls. Thus, you are hedging your risks and transferring them to someone willing to take them.

A day trader tries to take advantage of intra-day fluctuations in prices. All their trades are settled by undertaking an opposite trade by the end of the day. They do not have any overnight exposure to the markets.

On the other hand, position traders greatly rely on news, tips, and technical analysis – the science of predicting trends and prices- and take a longer view, say a few weeks or a month, to realize better profits. They take and carry out positions overnight or long-term. If you’re a beginner at intra-day trading, you might want to read what Kotak Securities says here.

- Speculators

As a hedger, you pass on your risk to someone who will willingly take risks from you. But why would someone do that? There are all kinds of participants in the market.

Some might be averse to risk, while some people embrace them. This is because the basic market idea is that risk and return always go hand in hand. The higher the risk, the greater the chance of high returns. Then again, while you believe the market will go up, some people will feel it will fall. These differences in risk profile and market views distinguish hedgers from speculators. Speculators, unlike hedgers, look for opportunities to take on risk in the hope of making returns.

Let's go back to our example, wherein you were keen to sell the 200 shares of company ABC Ltd. after one month but feared that the price would fall and eat your profits. In the derivative market, a speculator will expect the market to rise. Accordingly, he will agree with you, stating that he will buy shares from you at Rs. 100 if the price falls below that amount. In return for giving you relief from this risk, he wants to be paid a small compensation. This way, he earns the compensation even if the price does not fall and you wish to continue holding your stock.

This is only one instance of how a speculator could gain from a derivative product. Every opportunity the derivative market offers a risk-averse hedger provides a counter chance to a trader with a healthy risk appetite.

In the Indian markets, there are two types of speculators - day traders and position traders.

- Margin traders

Many speculators trade using the payment mechanism unique to the derivative markets. This is called margin trading. When you trade in derivative products, you are not required to pay the total value of your position up front. Instead, you must only deposit a fraction of the total sum called margin. This is why margin trading results in a high leverage factor in derivative trades. With a small deposit, you can maintain a sizeable outstanding position. The leverage factor is fixed; there is a limit to how much you can borrow. The speculator buys three to five times the quantity his capital investment would otherwise have allowed him to buy in the cash market. For this reason, the conclusion of trade is called ‘settlement’ – you either pay this outstanding position or conduct an opposing trade that would nullify this amount.

For example, let's say a sum of Rs. 1.8 lakh fetches you 180 shares of ABC Ltd. in the cash market at Rs. 1,000 per share. Suppose margin trading in the derivatives market allows you to purchase shares with a margin of 30% of the value of your outstanding position. Then, you can buy 600 shares of the same company at the same price with your capital of Rs. 1.8 lakh, even though your total position is Rs. 6 lakh.

If the share price rises by Rs. 100, your 180 shares in the cash market will deliver a profit of Rs. 18,000, which would mean a return of 10% on your investment. However, your payoff in the derivatives market would be much higher. The same rise of Rs. One hundred in the derivative market would fetch Rs. 60,000, which translates into a whopping return of over 33% on your investment of Rs. 1.8 lakh. This is how a margin trader, who is a speculator, benefits from trading in the derivative markets.

- Arbitrageurs

Derivative instruments are valued based on the underlying asset’s value in the spot market. However, there are times when the price of a stock in the cash market is lower or higher than it should be in comparison to its price in the derivatives market.

Arbitrageurs exploit these imperfections and inefficiencies to their advantage. Arbitrage is a low-risk trade where a simultaneous purchase of securities is done in one market, and a corresponding sale is carried out in another. These are done when the same securities are quoted at different prices in two markets.

In the earlier example, suppose the cash market price is Rs. 1000 per share but is quoting at Rs. 1010 in the futures market. An arbitrageur would purchase 100 shares at Rs. 1000 in the cash market and simultaneously sell 100 shares at Rs. 1010 per share in the futures market, thereby making a profit of Rs. 10 per share.

Speculators, margin traders, and arbitrageurs are the lifelines of the capital markets as they provide liquidity by taking long (purchase) and short (sell) positions. They contribute to the overall efficiency of the markets.

Whether you are an Arbitrageur, Speculator, Margin Trader, or Hedger, you stand to benefit from Kotak Securities' extensive research reports. Click here to read the latest research reports on the derivatives market.

Types Of Derivative Contracts

Four types of derivative contracts exist: forwards, futures, options, and swaps. However, for now, let us concentrate on the first three. Swaps are complex instruments not available for trade in the stock markets.

- Futures and forwards Futures are contracts that represent an agreement to buy or sell a set of assets at a specified time in the future for a specified amount. Forwards are futures that are not standardized. They are not traded on a stock exchange.

For example, in the derivatives market, you cannot buy a contract for a single share. It is always for a lot of specified shares and expiry dates. This does not hold for forward contracts. They can be tailored to suit your needs.

- Options These contracts are quite similar to futures and forwards. However, there is one key difference. Once you buy an options contract, you are not obligated to hold the terms of the agreement.

This means, even if you hold a contract to buy 100 shares by the expiry date, you are not required to. Options contracts are traded on the stock exchange.

Read more about what is options trading.

-

Swaps are the financial instruments that allow two parties to swap or exchange their financial obligations and liabilities. Both parties determine the cash flow in the contract based on a rate of interest. One cash flow is usually fixed in this contract, while the second varies according to a benchmark interest rate.

-

A forward contract is a financial contract between two parties based on a predetermined amount and the price of the underlying securities to be executed before the expiry date. Like futures, forward contracts bind both parties to take delivery of the contract before expiry. However, investors can only trade such contracts through an Over the Counter market rather than a supervised stock market exchange.

Advantages of Derivatives

The benefits of derivatives are as follows.

-

Low Expenses The charges are low compared to the shares or debentures, given that derivative trading is mainly a risk reduction exercise.

-

Transfer Risks Derivatives allow you to spread risks between all participants instead of stock market trading. Therefore, your risk is reduced to a great extent.

-

Hedge Risks You can hedge your position in the cash market by trading derivatives. For example, you can buy a Put option on the derivative market if you buy positional stocks in cash markets. The value of your Put option will increase when the stock falls on the cash market. Therefore, your losses will be minimal or nil.

Disadvantages of Derivatives

Derivatives trading may offer several advantages for hedging or increasing profits when invested with prior knowledge and extensive research. However, such financial instruments are complex and have certain disadvantages for market participants.

-

Counterparty risk: Although market participants can trade futures contracts through supervised exchanges, they can also trade options contracts over the counter. With the possibility of the other party defaulting on the payment or exercise of the promise, there needs to be an established due diligence system. Consequently, market participants may incur financial loss due to counterparty risk.

-

High risk These instruments are market-linked, and their value is derived from the change in the price of an asset using real-time. These prices are influenced by demand and supply factors, which can be volatile. As a result of the volatility, these financial contracts are exposed to risk, which could lead to significant losses for the undertakings.

-

Speculation: A system of assumptions is used for most parts of the derivatives market. Entities speculate on the possible price direction of an asset and hope to make money from a difference between strike prices and execution prices. However, entities may suffer losses if speculation moves in the opposite direction.

How Are Derivative Contracts Linked To Stock Prices?

Suppose you buy a Futures contract of Infosys shares at Rs 3,000 – the stock price of the IT company currently in the spot market. A month later, the contract is slated to expire. At this time, the stock is trading at Rs 3,500. This means you profit from Rs. 500 per share, as you are getting the stocks at a cheaper rate.

Had the price remained unchanged, you would have received nothing. Similarly, if the stock price fell by Rs. 800, you would have lost Rs. 800. As we can see, the above contract depends upon the price of the underlying asset – Infosys shares. Similarly, derivatives trading can be conducted on the indices also. Nifty Futures is a very commonly traded derivatives contract in the stock markets. The underlying security in the case of a Nifty Futures contract would be the 50-share Nifty index.

How To Trade In Derivatives Market

Trading in the derivatives market is a lot similar to that in the cash segment of the stock market.

-

First, do your research. This is more important for the derivatives market. However, remember that the strategies need to differ from that of the stock market. For example, you may wish you buy stocks that are likely to rise in the future. In this case, you conduct a buy transaction. In the derivatives market, this would need you to enter into a sell transaction. So the strategy would differ.

-

Conduct the transaction through your trading account. You will have to first make sure that your account allows you to trade in derivatives. If not, consult your brokerage or stockbroker and get the required services activated. Once you do this, you can place an order online or on phone with your broker.

-

Select your stocks and their contracts based on the amount you have in hand, the margin requirements, the price of the underlying shares, as well as the price of the contracts. Yes, you do have to pay a small amount to buy the contract. Ensure all this fits your budget.

-

You can wait until the contract is scheduled to expire to settle the trade. In such a case, you can pay the whole amount outstanding, or you can enter into an opposing trade. For example, you placed a ‘buy trade’ for Infosys futures at Rs 3,000 a week before expiry. To exit the trade before, you can place a ‘sell trade’ future contract. If this amount is higher than Rs 3,000, you book profits. If not, you will make losses.

-

Thus, buying stock futures and options contracts is similar to buying shares of the same underlying stock, but without taking delivery of the same. In the case of index futures, the change in the number of index points affects your contract, thus replicating the movement of a stock price. So, you can trade in index and stock contracts in just the same way as you would trade in shares.

What Are The Prerequisites To Invest

As mentioned earlier, trading in the derivatives market is very similar to trading in the cash segment of the stock markets. This has three key requisites:

-

Demat account: This account stores your securities in electronic format. It is unique to every investor and trader. Opening a Demat account should be pretty simple if you don't have one already.

-

Trading account: This is the account through which you conduct trades. The account number can be considered your identity in the markets. This makes the trade unique to you. It is linked to the Demat account and thus ensures that YOUR shares go to your Demat account. Click here if you want to open a Trinity account that relieves you from the hassles of operating different Demat, trading, and savings bank accounts.

-

Margin maintenance: This prerequisite is unique to derivatives trading. While many in the cash segment use margins to conduct trades, this is predominantly used in the derivatives segment. Unlike purchasing stocks from the cash market, when you purchase futures contracts, you must deposit only a percentage of the value of your outstanding position with the stock exchange, irrespective of whether you buy or sell futures. This mandatory deposit, which is called margin money, covers an initial margin and an exposure margin. These margins act as a risk containment measure for the exchanges and serve to preserve the integrity of the market.

Conclusion

Derivatives can be used by different investors to hedge against future losses or to profit from price differences. Although they may be of great benefit to the participant, it is important for them to be sold with caution as they require a large amount of experience in business success. Therefore, it is always advisable to consult your stockbroker and develop a strategy based on market analysis and the use of relevant techniques in dealing with those financial contracts effectively.

Read More:

What are the Different Types of Derivatives?

Risks involved in Derivatives Trading

What is Derivatives Trading FAQs

Is derivative trading profitable?

Yes. Derivative trading is a good way to earn profits if you have an in-depth understanding of its components.

How do I start trading in derivatives?

To start trading in derivatives, all you need to do is open an online trading account and choose from our wide range of accounts to suit your needs.

What is the meaning of Derivative Trading?

Derivatives are financial contracts that derive their value from an underlying asset. These could be stocks, indices, commodities, currencies, exchange rates, or the rate of interest.

What are the 3 derivative rules?

The three prerequisites are having a Demat account, a trading account, and ensuring optimal margin maintenance.

Are Derivatives low risk?

No. Derivatives are usually considered high-risk financial instruments. You can suffer losses if you don’t have the requisite knowledge and skill to trade derivatives effectively.

Are Derivatives the same as futures?

No. Derivatives refer to different financial instruments whose value depends on another underlying asset. Whereas, futures are just one type of derivatives. They are contracts that allow you to buy or sell an asset at a predetermined price in the future.

Can you lose money with derivatives?

Yes, you can lose money with derivatives. Derivatives are high-risk financial instruments whose value underlying securities. If you don’t implement proper trading strategies, you can face losses.