What is Future Contracts? Meaning, Types, Pros & Cons

A buyer may not know the identity of the seller and vice versa. Further, every contract is guaranteed and honored by the stock exchange, or more precisely, the clearing house or the clearing corporation of the stock exchange, which is an agency designated to settle trades of investors on the stock exchanges.

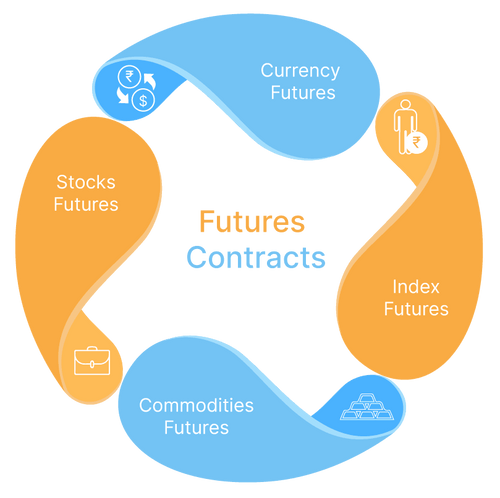

Futures contracts are available on different kinds of assets – stocks, indices, commodities, currency pairs and so on. Here we will look at the two most common futures contracts – stock futures and index futures.

Key Highlights

-

A futures contract is a financial derivative that entails the buyer purchasing some underlying asset (or the seller selling that asset) at a predetermined future price.

-

Investors can leverage futures contracts to speculate on the direction of securities, commodities, or financial instruments.

-

To help prevent losses from unfavorable price movements, futures are often used to hedge the underlying asset's price movement.

-

Almost every commodity can be traded as a futures contract, including grain, energy, currencies, and even securities.

Future Contracts Meaning

The futures contract is a legal agreement to buy or sell a commodity asset, or security at a predetermined price at a future date. The quality and quantity of futures contracts are standardized in order to facilitate trading on futures exchanges.

When the futures contract expires, the buyer is responsible for buying and receiving the underlying asset. At the expiration date, the seller of the futures contract is responsible for providing and delivering the underlying asset.

Attributes of Futures Contracts

In the table below, we discuss the attributes of futures contracts:

Aspect

Market Participant

Summary

The two main market participants that use these contracts are speculators and hedgers. A producer or hedger is someone who produces or buys an underlying asset hedge. The price at which the commodity would be bought or sold is also guaranteed by them. In contrast, speculators bet on price movements of assets through futures.

| Aspect | Summary |

|---|---|

Regulation | The FMC (Forward Markets Commission) regulates the commodity futures market. In addition, it regulates the withdrawal or recognition of any commodity market engaged in forward dealing. |

Availability | There are different types of futures contracts available, including exchange contracts, commodities, or currency contracts, and indices contracts. |

Margin | Due to the margin trading nature of futures, even those without sufficient funds can participate in trades and place orders. To do so, one would need to pay a smaller margin than the full value of the holding. |

Market Participant | The two main market participants that use these contracts are speculators and hedgers. A producer or hedger is someone who produces or buys an underlying asset hedge. The price at which the commodity would be bought or sold is also guaranteed by them. In contrast, speculators bet on price movements of assets through futures. |

Example of Futures Contracts

Suppose an oil producer wants to sell oil but is worried that oil prices will fall in the future. A futures contract could be used to ensure the oil producer gets a predetermined price and avoids incurring a loss. Using future contracts, the oil producer could also lock in the price at which the oil would sell, so that the oil could be delivered to the buyers once the contract expired.

In contrast, a manufacturing company would require oil to produce widgets. By planning ahead and ensuring that oil comes in every month, the company would also use a future contract.

By doing this, the company will know the price at which it will receive oil based on the price set in the futures contract.

What Are Stock Futures

Stock futures are derivative contracts that give you the power to buy or sell a set of stocks at a fixed price by a certain date. Once you buy the contract, you are obligated to uphold the terms of the agreement.

Here are some more characteristics of futures contracts:

-

Lot/Contract size: In the derivatives market, contracts cannot be traded for a single share. Instead, every stock futures contract consists of a fixed lot of the underlying share. The size of this lot is determined by the exchange on which it is traded on. It differs from stock to stock. For instance, a Reliance Industries Ltd. (RIL) futures contract has a lot of 250 RIL shares, i.e., when you buy one futures contract of RIL, you are actually futures trading 250 shares of RIL. Similarly, the lot size for Infosys is 125 shares.*

-

Expiry: All three maturities are traded simultaneously on the exchange and expire on the last Thursday of their respective contract months. If the last Thursday of the month is a holiday, they expire on the previous business day. In this system, as near-month contracts expire, the middle-month (2 month) contracts become near-month (1 month) contracts and the far-month (3 month) contracts become middle-month contracts.

-

Duration: Contract is an agreement for a transaction in the future. How far in the future is decided by the contract duration. Futures contracts are available in durations of 1 month, 2 months and 3 months. These are called near month, middle month and far month, respectively. Once the contracts expire, another contract is introduced for each of the three durations The month in which it expires is called the contract month. New contracts are issued on the day after expiry.

Example: If you want to purchase a single July futures contract of ABC Ltd., you would have to do so at the price at which the July futures contracts are currently available in the derivatives market. Let's say that ABC Ltd July futures trading are at Rs 1,000 per share. This means, you are agreeing to buy/sell at a fixed price of Rs 1,000 per share on the last Thursday in July. However, it is not necessary that the price of the stock in the cash market on Thursday has to be Rs 1,000. It could be Rs 992 or Rs 1,005 or anything else, depending on the prevailing market conditions. This difference in prices can be taken advantage of to make profits.

Types Of Futures

Types of futures trading can be defined as the strategies that traders and investors use to buy and sell futures contracts to make a profit or manage risk.

Most types of futures contracts are used for both hedging and speculation. For example, manufacturers and consumers can use futures contracts to hedge against price volatility and protect against potential losses. On the other hand, traders and investors can use futures contracts to speculate on the direction of livestock prices and make profits based on their expectations of future price movements.

Most futures contracts are settled through physical delivery or cash settlement. In a physically settled contract, the underlying asset is delivered on the expiration date of the contract. In a cash-settled contract, the buyer or seller receives a cash payment equal to the difference between the contract price and the prevailing market price at expiry.

Any type of futures trading carries risks, including the risk of price volatility, market fluctuations, and liquidity risk. Investors should carefully consider their investment objectives and risk tolerance before participating in livestock futures trading. It is also recommended to seek advice from a professional financial advisor before investing in futures.

While there are many types of futures contracts, let's have a look at some of them.

- Financial Futures

Financial future contracts are agreements between two parties to buy or sell an underlying asset at a predetermined price and time in the future. Financial futures contracts can be used by investors to hedge against potential losses, speculate on future price movements, and gain exposure to different asset classes. However, like any investment, financial futures trading carries risks and investors should carefully consider their investment objectives and risk tolerance before participating in financial futures trading.

- Currency Futures

A currency futures contract is a standardized agreement between two parties to exchange a specified amount of one currency for another at a predetermined exchange rate and a specific date in the future. Currency futures contracts are used as a hedging tool by businesses and investors to manage their foreign exchange risk. For example, an importer can enter into a currency futures contract to buy a certain amount of foreign currency at a fixed price, thereby locking in the exchange rate and protecting against potential losses from currency fluctuations.

- Energy Futures

An energy futures contract is a financial derivative that allows investors and businesses to buy or sell a certain amount of energy commodities, such as crude oil, natural gas, heating oil, or gasoline, at a predetermined price and on a specific date in the future.

- Metal Futures

A metal futures contract is a financial agreement between two parties to buy or sell a specific quantity of metal, such as gold, silver, copper, or platinum, at a predetermined price and on a specific date in the future.

- Grain futures

A grain futures contract is a financial agreement between two parties to buy or sell a specific quantity of grains, such as wheat, corn, or soybeans, at a predetermined price and on a specific date in the future.

- Livestock futures

A livestock futures contract is a financial agreement between two parties to buy or sell a specific quantity of livestock, such as cattle, hogs, or feeder cattle, at a predetermined price and on a specific date in the future.

- Food And Fiber Future Contracts

Food and fiber futures contracts are financial agreements between two parties to buy or sell a specific quantity of agricultural products, such as cotton, sugar, cocoa, coffee, and various types of grains, at a predetermined price and on a specific date in the future.

Pros & Cons Of Future Contracts

Pros

Hedging: Futures contracts are often used as a hedging tool by investors to reduce their exposure to market volatility. By locking in a price today, investors can protect themselves against future price fluctuations

Cons

Risk: Futures contracts are highly leveraged instruments and can be very risky. A small price movement in the underlying asset can result in a large gain or loss in the value of the futures contract.

Pros

Liquidity: Futures markets are highly liquid, meaning that there are a large number of buyers and sellers, and it is easy to enter and exit positions.

Cons

Margin requirements: To trade futures, investors must post a margin, which is a percentage of the contract value. Margin requirements can be high, and investors may need to maintain a certain level of margin in their accounts to keep their positions open.

Pros

Leverage: Futures contracts allow investors to control a large amount of the underlying asset with a relatively small amount of capital. This can amplify returns but also increases risk.

Cons

Counterparty risk: Futures contracts are essentially agreements between two parties, and there is always a risk that one party may not fulfill obligations.

Pros

Transparency: Futures contracts are standardized and traded on exchanges, making the pricing and terms of the contract transparent to all market participants.

Cons

Limited flexibility: Futures contracts are standardized, meaning that investors cannot customize the terms of the contract. This can be a disadvantage for investors who have specific needs or strategies.

| Pros | Cons |

|---|---|

Hedging: Futures contracts are often used as a hedging tool by investors to reduce their exposure to market volatility. By locking in a price today, investors can protect themselves against future price fluctuations | Risk: Futures contracts are highly leveraged instruments and can be very risky. A small price movement in the underlying asset can result in a large gain or loss in the value of the futures contract. |

Liquidity: Futures markets are highly liquid, meaning that there are a large number of buyers and sellers, and it is easy to enter and exit positions. | Margin requirements: To trade futures, investors must post a margin, which is a percentage of the contract value. Margin requirements can be high, and investors may need to maintain a certain level of margin in their accounts to keep their positions open. |

Leverage: Futures contracts allow investors to control a large amount of the underlying asset with a relatively small amount of capital. This can amplify returns but also increases risk. | Counterparty risk: Futures contracts are essentially agreements between two parties, and there is always a risk that one party may not fulfill obligations. |

Transparency: Futures contracts are standardized and traded on exchanges, making the pricing and terms of the contract transparent to all market participants. | Limited flexibility: Futures contracts are standardized, meaning that investors cannot customize the terms of the contract. This can be a disadvantage for investors who have specific needs or strategies. |

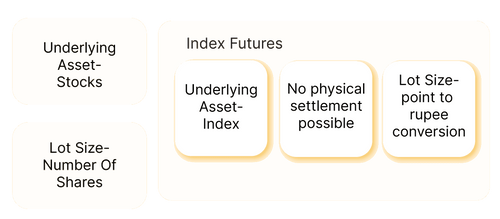

What Are Index Futures

A stock index is used to measure changes in the prices of a group stocks over a period of time. It is constructed by selecting stocks of similar companies in terms of an industry or size. Some indices represent a certain segment or the overall market, thus helping track price movements. For instance, the BSE Sensex is comprised of 30 liquid and fundamentally strong companies. Since these stocks are market leaders, any change in the fundamentals of the economy or industries will be reflected in this index through movements in the prices of these stocks on the BSE. Similarly, there are other popular indices like the CNX Nifty 50, S&P 500, etc, which represent price movements on different exchanges or in different segments.

Futures contracts are also available on these indices. This helps traders make money on the performance of the index.

Here are some features of index futures:

Contract size: Just like stock futures, these contracts are also dealt in lots. But how is that possible when the index is simply a non-physical number. No, you do not purchase futures of the stocks belonging to the index. Instead, stock indices points – the value of the index – are converted into rupees.

For example, suppose the CNX Nifty value was 6500 points. The exchange stipulates that each point is equivalent to Rs 1 , then you have to pay 100 times the index value – Rs 6,50,000 i.e. 1x6500x100. This also means each contract has a lot size of 100.

Expiry: Since indices are abstract market concepts, the transaction cannot be settled by actually buying or selling the underlying asset. Physical settlement is only possible in case of stock futures. Hence, an open position in index futures can be settled by conducting an opposing transaction on or before the day of expiry.

Duration: As in the case of stock futures, index futures too have three contract series open for futures trading at any point in time – the near-month (1 month), middle-month (2 months) and far-month (3 months) index futures contracts.

Illustration of an index futures contract: If the index stands at 3550 points in the cash market today and you decide to purchase one Nifty 50 July future, you would have to purchase it at the price prevailing in the futures market.

This price of one July futures contract could be anywhere above, below or at Rs 3.55 lakh (i.e., 3550*100), depending on the prevailing market conditions. Investors and traders try to profit from the opportunity arising from this difference in prices

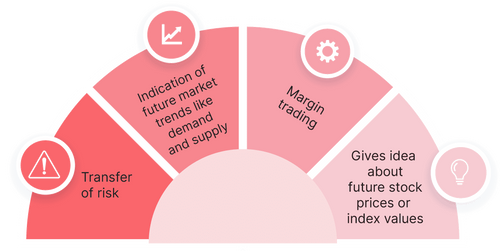

What Are The Advantages And Risks Of Futures Contracts

The existence and the utility of a futures market benefits a lot of market participants:

- It allows hedgers to shift risks to speculators.

- It gives traders an efficient idea of what the futures price of a stock or value of an index is likely to be.

- Based on the current future price, it helps in determining the future demand and supply of the shares.

- Since it is based on margin trading, it allows small speculators to participate and trade in the futures market by paying a small margin instead of the entire value of physical holdings.

However, you must be aware of the risks involved too. The main risk stems from the temptation to speculate excessively due to a high leverage factor, which could amplify losses in the same way as it multiplies profits. Further, as derivative products are slightly more complicated than stocks or tracking an index, lack of knowledge among market participants could lead to losses.

Conclusion

The futures market plays an important role in the smooth operation of the commodities market. In futures contracts, speculators can speculate on the price of some asset or security in the future. Whereas, hedgers use futures to lock in a price between now and delivery/receipt of a good to reduce market uncertainty. A price lock in advance allows farmers, miners, manufacturers, and other market participants to work without worrying about daily market fluctuations.

FAQs on What is Future Contracts

Buying and selling a futures contract is essentially the same as buying or selling a number of units of a stock from the cash market, but without taking immediate delivery.

Based on the current future price, it helps in determining the future demand and supply of the shares. Since it is based on margin trading, it allows small speculators to participate and trade futures in share market by paying a small margin instead of the entire value of physical holdings. Understanding what are futures in share market is key.

A futures contract is an agreement between two parties - a buyer and a seller - wherein the former agrees to purchase from the latter, a fixed number of shares or an index at a specific time in the future for a pre-determined price. Futures contracts are available on different kinds of assets - currency, metal, energy, and more.

Dow Futures are financial futures that allow an investor to hedge with, or speculate on the future value of various components of the Dow Jones Industrial Average market index.

Depending on your financial goals and risk tolerance, futures contracts may be a good investment. They are a useful tool to hedge against price fluctuations. Futures offer leverage and also help in portfolio diversification. However, leverage can increase the risk of losses.

Futures allow investors to buy or sell assets at a future date. This is why they are called futures contracts.

A Futures contract is a financial agreement between two parties to buy or sell an asset at a fixed price on a future date. The seller has the obligation to deliver the underlying asset on the expiration date. The buyer has the obligation to purchase it at the predetermined price.