Stock Market Terminology & Market-Related Concepts

- 4m•

- 5,225•

- 23 Jun 2023

Some of the stock market terminology and concepts you would frequently hear with respect to the stock markets are:

What Are Dividends?

A share is a portion of the companyand when the company makes profits, you often receive a part of it. This is the idea behind dividends. Every year, companies distribute a small amount of profits to investors as dividends. This is the primary source of income for long-term shareholders – those who don’t sell the stock for years together.

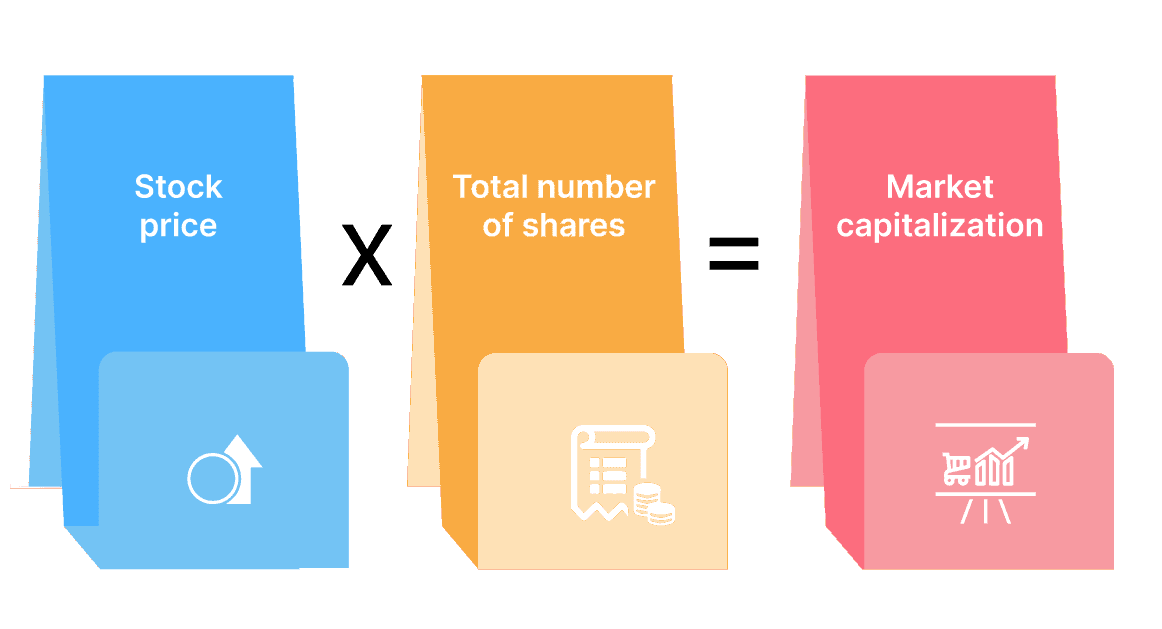

What Is Market Capitalization?

Different companies issue varied amounts of shares when they get listed. The value of one share also differs from that of another company’s stock. Market capitalization smoothens out these differences. It is the market stock price multiplied by the total number of shares held by the public. It, thus, reflects the total market value of a stock taking into consideration both the size and the price of the stock. For example, if a stock is priced at Rs. 50 per share, and there are 1,00,000 shares in the hands of public investors, then its market capitalization stands at Rs. 50,00,000.

Market capitalization matters when stacking stocks into different indices. It also decides the weightage of a stock in the index. This means, bigger the company’s market value, the more its price fluctuations affect the value of the index.

What Are Rolling Settlements?

A rolling settlement implies that all trades have to be settled by the end of the day. Hence, the entire transaction – where the buyer pays for securities purchased and seller delivers the shares sold – have to be completed in a day. Supposing your friend agrees to buy a book for you from a bookshop, you will have to pay him for it eventually. Similarly, after you have bought or sold shares through your broker, the trade has to be settled. Meaning, the buyer has to receive his shares and the seller has to receive his money. Settlement is the process whereby payment is made by the buyers, and shares are delivered by the sellers. In India, we have adopted the T+2 settlements cycle. This means that a transaction conducted on Day 1 has to be settled on the Day 1 + 2 working days. This is when funds are paid and securities are transferred. Thus, 'T+2' here, refers to Today + 2 working days. Saturdays and Sundays are not considered as working days. So, if you enter into a transaction on Friday, the trade will be settled not on Sunday, but on Tuesday. Even bank and exchange holidays are excluded.

What Is Short-Selling?

An investor sells short when he anticipates that the price of a stock may fall from the existing price. So, the investor borrows a share and sells it. Once the share price dips, he will buy the same share at a lower price, and return it back, while pocketing a profit in the bargain. Simply put, you first sell at a high and then buy at a low. Short-selling helps traders profit from declining stock and index prices. Since this is usually conducted in anticipation of a stock movement, short-selling is considered a risky proposition.

Let us take an example. Suppose you expect shares of Infosys to fall tomorrow for whatever reason, you enter an order to sell shares of Infosys at the current market price. Once the share price falls adequately tomorrow, you buy at the lower rate. The difference in the sale and buying prices is your profit. However, if the share prices increase after you sold at a reduced price, then you end up with a loss.

What Are Circuit Filters And Trading Bands?

Some stocks are more volatile than others. Too much volatility is not good for investors. To curb this volatility, SEBI has come up with the concept of circuit filters. The market regulator has specified the maximum limit the price of a stock can move on a given day. This is called a price trading band. If a stock breaches this limit, trading is halted in that stock for a while. There are three levels of limits. Each limit leads to trading halt for a progressively longer duration. If all three circuit filters are breached, then trading is halted for the rest of the day. NSE define circuit filters in 5 categories including 2%, 5%, 10%, 20% and no circuit filter.

Also, prices may not be same on the two exchanges – NSE and BSE. So, circuit filters can be different for shares on the two exchanges.

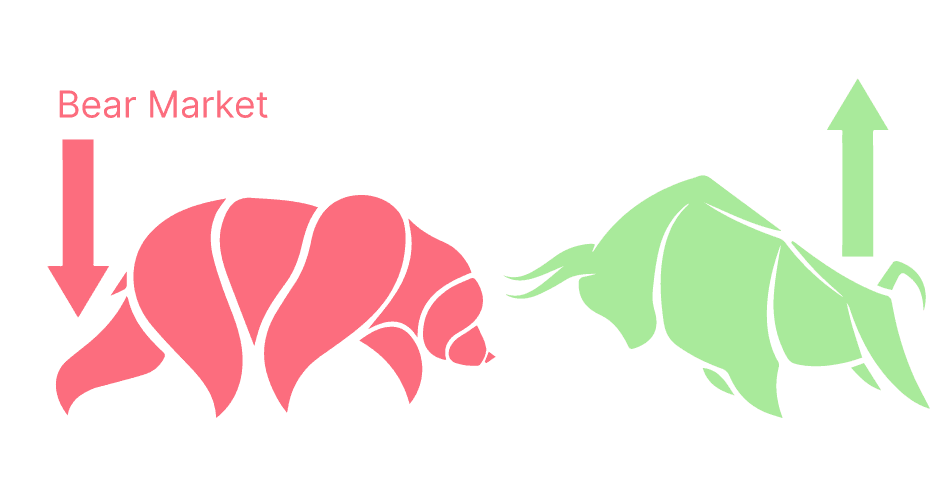

What Are Bull And Bear Markets?

Markets are often described as ‘bull’ or ‘bear’ markets. These names have been derived from the manner in which the animals attack their opponents. A bull thrusts its horns up into the air, and a bear swipes its paws down. These actions are metaphors for the movement of a market: if stock prices trend upwards, it is considered a bull market; if the trend is downwards, it is considered a bear market.

The supply and demand for securities largely determine whether the market is in the bull or bear phase. Forces like investor psychology, government involvement in the economy and changes in economic activity also drive the market up or down. These combine to make investors bid higher or lower prices for stocks. What are Bull & Bear Markets By Kotak Securities®

What Is Margin Trading?

Many traders trade on the stock market using borrowed funds or securities. This is called margin trading. It is almost like buying securities on credit. Margin trading can lead to greater returns, but can also be very risky. While it lets you actively seize market opportunities, it also subjects you to a number of unique risks such as interest payments charged for the borrowed money. Kotaksecurities.com offers its customers the facility of margin trading.

What Is Mahurat Trading?

Every year, the stock market is open for a few hours on the first day of Diwali. A special trading session conducted for an hour on the auspicious occasion of Diwali. Usually this takes place in evening. Mahurat trading has been going on for over 100 years on the Bombay Stock Exchange. It marks the beginning of a new financial year called 'Samvat'.

What Are Top-down, Bottom-up Approaches?

-

The top-down approach first takes into consideration the macro-economy. You understand the trends and outlook for the overall economy. Using this, you choose a one or more industries that are expected to do well in the near future. This is because every industry reacts to overall economic conditions like inflation, interest rates, consumer demand and so on, in a different way. Select one amongst the industries after in-depth analysis. Next, you understand the workings of the industry, the players and competitors and other factors that affect the sector. Based on this, you select one of the companies in the industry.

-

The bottom-up approach is just the opposite. You do not look at the economy or select an industry first, but concentrate on company fundamentals. You first understand what your priorities are – high growth or steady income through high dividends. Using appropriate ratios like the Price-to-Earnings ratio or the Dividend-yield, you select a bunch of stocks. Next, analyze each of these companies; find answers for questions like what factors drive profits? Is the company management efficient? Is the company heavily indebted? What is the future outlook? And so on. Based on the results, select the company that best fits your requirements.

-

The bottom-up approach is most suited for weak market conditions. This is because, the underlying belief is that these companies will perform well even if the economy is poor. They are thus anomalies – companies that don’t follow the normal market trend. What are Top-Down & Bottom-Up Approaches in Share Market By Kotak Securities

What Does Cost Averaging Mean?

Rupee-cost averaging is a concept when you buy a stock in small bunches, instead of buying in lump-sum. This helps reduce the average cost of your investment.

Let us use an example. Suppose you bought 100 shares of a company costing Rs. 10 each, your total investment cost is Rs. 1000. Instead of that, if you buy 50 shares for Rs. 100 and 50 for Rs. 95, your total cost of investment would be lower. Not just that, even your average cost per share would be lower. This is called rupee-cost averaging.

This concept comes handy when a stock falls after you have bought it. The fall in share price gives you an opportunity to buy more and reduce your average cost of investment. This way, when you finally sell the shares at some time in the future, you end up making more profits.

What Is Stock Volatility?

Stock prices constantly fluctuate. This is because the demand for the stock changes. As more stocks change hands, greater is the change in its share price. This is called stock volatility. Even the amount of volatility in the market changes on a daily basis. To measure this volatility, the National Stock Exchange introduced the VIX India index, also called the fear gauge. VIX is often used as an indicator of stock price trends. This is because, VIX rises when there is more fear and uncertainty in the market.

This means, investors perceive an increase in risk. This usually follows a fall in the market.

What Are Price-Targets And Stop-Loss Targets?

As an investor, to maximize your profits, you need to get your pricing right – both when it comes to buying and selling. However, sometimes, prices fluctuate more than expected. So, it can become a little difficult to gauge whether to trade now or wait a little more. This is where stock recommendations help.

Analysts put out price targets and stop-loss measures, which let you know how long you should hold a stock. A price target indicates that the price of share is unlikely to climb above the level. So, once the share price touches the target, you may look to sell it and pocket your profits. A stop loss, meanwhile, acts as a target on the lower end. It lets you know when to sell before the stock falls further and worsens your loss.

What Is Insider Trading?

Insider trading is 'the trading of shares based on knowledge not available to the rest of the world’. It is illegal to trade after receiving 'tips' of confidential securities information.

This applies to corporate personnel as well as traders and brokers. This is why company management have to report their trades to the exchange. For example, when corporate officers, directors, or employees trade the company’s stocks after learning of significant, confidential corporate developments, it is considered an illegal form of insider trading. This applies to employees of law, banking, brokerage and printing firms who were given such information to provide services to the corporation whose securities they traded. Even government employees, who trade after learning of such information, are considered to have broken the law on insider trading. It is a punitive offence.