Understanding How Call Options Work

- 7m•

- 5,225•

- 07 Feb 2023

What Are Options?

In the derivatives market, you may want to Buy shares or Sell them at a specific price in the future. On this basis, there are two types of options available in the derivatives markets – Call options and the Put options.

Call options are those contracts that give the buyer the right, but not the obligation to buy the underlying shares or index in the futures. They are exactly opposite of Put options, which give you the right to sell in the future. Let's take a look at these two options, one at a time. In this section, we will look at Call options.

What Are Call Options:

As a trader, you would choose to purchase an index call option if you expect the price movement of the index to rise in the near future, rather than that of a particular share. Indices on which you can trade include the CNX Nifty 50, CNX IT and Bank Nifty on the NSE and the 30-share Sensex on the BSE.

Revise your understanding about derivatives trading here

Let Us Understand With An Example:

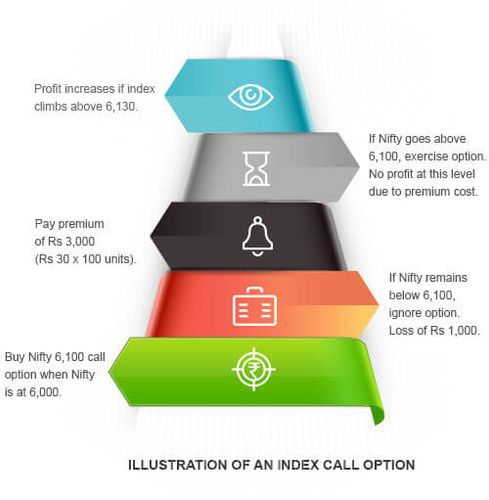

Suppose the Nifty is quoting around 6,000 points today. If you are bullish about the market and foresee this index reaching the 6,100 mark within the next one month, you may buy a one month Nifty Call option at 6,100.

Let's say that this call is available at a premium of Rs 30 per share. Since the current contract or lot size of the Nifty is 50 units, you will have to pay a total premium of Rs 3,000 to purchase two lots of call option on the index.

If the index remains below 6,100 points for the whole of the next month until the contract expires, you would certainly not want to exercise your option and purchase at 6,100 levels. And you have no obligation to purchase it either. You could simply ignore the contract. All you have lost, then, is your premium of Rs 3,000.

If, on the other hand, the index does cross 6,100 points as you expected, you have the right to buy at 6,100 levels. Naturally, you would want to exercise your call option. That said, remember that you will start making profits only once the Nifty crosses 6,130 levels, since you must add the cost incurred due to payment of the premium to the cost of the index. This is called your breakeven point – a point where you make no profits and no losses.

Kotak Securities offers stock research insights for traders. Click here to know more

When the index is anywhere between 6,100 and 6,130 points, you merely begin to recover your premium cost. So, it makes sense to exercise your option at these levels, only if you do not expect the index to rise further, or the contract reaches its expiry date at these levels.

Now, let's look at how the writer (Seller) of this call option is fairing.

As long as the index does not cross 6,100 , he benefits from the option premium he received from you. index is between 6,100 and 6,130, he is losing some of the premium that you have paid him. Once the index is above 6,130 , his losses are equal in proportion to your gains and both depend upon how much the index rises.

In a nutshell, the option writer has taken on the risk of a rise in the index for a sum of Rs 30 per share. Further, while your losses are limited to the premium that you pay and your profit potential is unlimited, the writer's profits are limited to the premium and his losses could be unlimited.

What Is A Stock Call Option:

In the Indian market, options cannot be sold or purchased on any and every stock. SEBI has permitted options trading on only certain stocks that meet its stringent criteria. These stocks are chosen from amongst the top 500 stocks keeping in mind factors like the average daily market capitalization and average daily traded value in the previous six months.

Let us understand a call option on a stock like Reliance Industries.

Suppose the annual general meeting (AGM) of RIL is due to be held shortly and you believe that an important announcement will be made at the AGM. While the share is currently quoting at Rs 950, you feel that this announcement will drive the price upwards, beyond Rs 950. However, you are reluctant to purchase Reliance in the cash market as it involves too large an investment, and you would rather not purchase it in the futures market as futures leave you open to an unlimited risk. Yet, you do not want to lose the opportunity to benefit from this rise in price due to the announcement and you are ready to stake a small sum of money to rid yourself of the uncertainty.

A call option is ideal for you. Depending on the availability in the options market, you may be able to buy a call option of Reliance at a strike price of 970 at a time when the spot price is Rs 950. And that call option was quoting Rs. 10, You end up paying a premium of Rs 10 per share or Rs 6,000 (Rs 10 x 600 units). You start making profits once the price of Reliance in the cash market crosses Rs 980 per share (i.e., your strike price of Rs 970 + premium paid of Rs 10).

Kotak securities offers various trading tools to assist you in your investments. Click here to read more about the trading tools.

Now let's take a look at how your investment performs under various scenarios.

Illustration Of Stock Call Option

If the AGM does not result in any spectacular announcements and the share price remains static at Rs 950 or drifts lower to Rs 930 because market players are disappointed, you could allow the call option to lapse. In this case, your maximum loss would be the premium paid of Rs 10 per share, amounting to a total of Rs 6,000. However, things could have been worse if you had purchased the same shares in the cash market or in the futures segment.

On the other hand, if the company makes an important announcement, it would result in a good amount of buying and the share price may move to Rs 1,000. You would stand to gain Rs 20 per share, i.e., Rs 1,000 less Rs 980 (970 strike + 10 premium), which was your cost per share including the premium of Rs 10.

As in the case of the index call option, the writer of this option would stand to gain only when you lose and vice versa, and to the same extent as your gain/loss.

Kotak Securities Research Centre brings to you fundamental, technical, derivatives and currency derivatives research report. Click here to know more.

When Do You Buy A Call Option:

Timing is of great essence in the stock market. Same applies to the derivatives market too, especially since you have multiple options. So when do you buy a call option? To maximize profits, you buy at lows and sell at highs. A call option helps you fix the buying price. This indicates you are expecting a possible rise in the price of the underlying assets. So, you would rather protect yourself by paying a small premium than make losses by shelling a greater amount in the future.

You thus anticipate a rise in the stock markets, i.e., when market conditions are bullish.

Timing is of great essence in the stock market. Same applies to the derivatives market too, especially since you have multiple options. So when do you buy a call option?

To maximize profits, you buy at lows and sell at highs. A call option helps you fix the buying price. This indicates you are expecting a possible rise in the price of the underlying assets. So, you would rather protect yourself by paying a small premium than make losses by shelling a greater amount in the future.

You thus anticipate a rise in the stock markets, i.e., when market conditions are bullish.

Buying And Selling Call Options:

As we read earlier, the buyer of an option has to pay the seller a small amount as premium. Seller of call option has to pay margin money to create position. In addition to this, you have to maintain a minimum amount in your account to meet exchange requirements. Margin requirements are often measured as a percentage of the total value of your open positions. Let us look at the margin payments when you are buyer and a seller:

-

Buying options:

When you buy an options contract, you pay only the premium for the option and not the full price of the contract. The exchange transfers this premium to the broker of the option seller, who in turn passes it on to his client.

-

Selling options:

Remember, while the buyer of an option has a liability that is limited to the premium he must pay, the seller has a limited gain. However, his potential losses are unlimited.

Therefore, the seller of an option has to deposit a margin with the exchange as security in case of a huge loss due to an adverse movement in the option’s price. The margins are levied on the contract value and the amount (in percentage terms) that the seller has to deposit is dictated by the exchange. It is largely dependent on the volatility in the price of the option. Higher the volatility, greater is the margin requirement.

As a result, this amount typically ranges from 15% to as high as 60% in times of extreme volatility. So, the seller of a call option of Reliance at a strike price of 970, who receives a premium of Rs 10 per share would have to deposit a margin of Rs 1,16,400. This is assuming a margin of 20% of the total value (Rs 970 x 600), even though the value of his outstanding position is Rs 5,82,000.

Stock markets are volatile and they face a few headwinds. Read more about these headwinds here.

How To Settle A Call Option:

When you sell or purchase an options, you can either exit your position before the expiry date, through an offsetting trade in the market, or hold your position open until the option expires. Subsequently, the clearing house settles the trade. Such options are called European style options.

**Let us look at how to settle a call option depending on whether you are a buyer or a seller.

-

For a buyer of a call option:

There are two ways to settle – squaring off and physical settlement. If you decide to square off your position before the expiry of the contract, you will have to sell the same number of call options that you have purchased, of the same underlying stock and maturity date and strike price.

For example, if you have purchased two XYZ stock’s call options with a lot size 500 and a strike price of Rs 100, which expire at the end of March, you will have to sell the above two options of XYZ Ltd., in order to square off your position. When you square off your position by selling your options in the market, as the seller of an option, you will earn a premium. The difference between the premium at which you bought the options and the premium at which you sold them will be your profit or loss.

Some also choose to buy a put option of the same underlying asset and expiry date to nullify their call options. The downside to this option is that you have to pay a premium to the put option writer. Selling your call option is a better option as you will at least be paid a premium by the buyer.

-

For the seller of a call option:

If you have sold call options and want to square off your position, you will have to buy back the same number of call options that you have written. These must be identical in terms of the underlying scrip and maturity date and strike price to the ones that you have sold.