All About Dematerialization

- 6m•

- 2,611•

- 03 May 2023

What Is Dematerialization?

Technology has brought about a drastic change in our everyday lives. The stock markets too have not been left untouched by the change. In 1875, the Bombay Stock Exchange was founded with an open outcry floor trading exchange. Traders would stand on the floor and shout prices of stocks for buying or selling. Then, money would be exchanged for physical receipts of the shares called the certificate. This led to a great amount of paperwork. Even the settlements of trade agreements took time because of the need to deliver the share certificates.

If you wish to better understand the basics of share market and how it all started, you can visit here.

Much has changed since. In 1996, dematerialization was embraced.

Benefits of Dematerialization

-

Common Bank:

Dematerialization is not just for shares, but also for debt instruments like bonds. Now, you can hold all your investments in a single account.

You can read all the benefits offered by Kotak’s Trinity account.

-

Automatic Update:

Since this is a common account, you don’t have to keep giving all your details like addresses every time you transact or every time you change the details. These details are automatically made available to companies you transact with.

However, you will have to complete your KYC in the first go.

-

Odd-lot Problem:

Earlier, shares were transacted in lots. A single or odd number of securities could not be transacted. This problem is now eliminated.

You’re lives have become a whole lot easier with a host of Trading Tools offered by Kotak Securities.

-

Delivery Risks:

Dematerialization has also eliminated the risks of fake shares, thefts, deliveries gone wrong, and so on, and reduced the paperwork involved. Time of delivery has also reduced drastically. Once your trade is approved, the securities are automatically credited to your account. This applies to other company-related activities like stock splits, stock bonuses, and so on.

-

Cost Reduction:

Earlier, when you transferred the securities, you incurred extra costs due to the stamp duty. This is not a problem with this form.

-

Easy To Hold:

Paper certificates are vulnerable to tears and damage. In contrast, the dematerialized format is a safe and convenient way to hold securities. You also have a nomination facility, whereby you can facilitate a transfer of shares in the event of your demise.

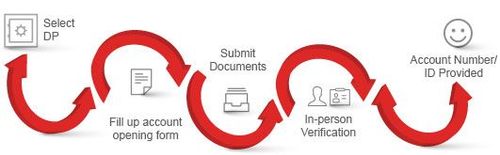

How To Open An Account?

- Then fill up an account opening form and submit along with copies of the required documents and a passport-sized photograph. You also need to have a PAN card. Also carry the original documents for verification.

- You will be provided with a copy of the rules and regulations, the terms of the agreement and the charges that you will incur.

- During the process, an In-Person Verification would be carried out. A member of the DP’s staff would contact you to check the details provided in the account opening form.

- Once the application is processed, the DP will provide you with an account number or client ID. You can use the details to access your account online.

- As a demat account holder, you would need to pay some fees like the annual maintenance fee levied for maintenance of account and the transaction fee -- levied for debiting securities to and from the account on a monthly basis. These fees differ from every service provider (called a Depository Participant or DP). While some DPs charge a flat fee per transaction, others peg the fee to the transaction value, and are subject to a minimum amount. The fee also differs based on the kind of transaction (buying or selling). In addition to the other fees, the DP also charges a fee for converting the shares from the physical to the electronic form or vice-versa.

- Minimum shares: A demat account can be opened with no balance of shares. It also does not require that a minimum balance be maintained.

To know the entire process in detail, you can check How to Open a Demat Account.

What Are The Documents Required For A Demat Account?

You need to submit proof of identity and address along with a passport size photograph and the account opening form. Only photocopies of the documents are required for submission, but originals are also required for verification.

Here is a broad list of documents that can be used as proofs:

You need to submit proof of identity and address along with a passport size photograph and the account opening form. Only photocopies of the documents are required for submission, but originals are also required for verification.

Proof of identity: PAN card, voter's ID, passport, driver's license, bank attestation, IT returns, electricity bill, telephone bill, ID cards with applicant's photo issued by the central or state government and its departments, statutory or regulatory authorities, public sector undertakings (PSUs), scheduled commercial banks, public financial institutions, colleges affiliated to universities, or professional bodies such as ICAI, ICWAI, ICSI, bar council etc.

Proof of address: Ration card, passport, voter ID card, driving license, bank passbook or bank statement, verified copies of electricity bills, residence telephone bills, leave and license agreement or agreement for sale, self-declaration by High Court or Supreme Court judges, identity card or a document with address issued by the central or state government and its departments, statutory or regulatory authorities, public sector undertakings (PSUs), scheduled commercial banks, public financial institutions, colleges affiliated to universities and professional bodies such as ICAI, ICWAI, Bar Council etc.

This is easy. All you need to do is fill in the Demat Request Form (DRM), fill in the appropriate details of the share certificates you hold, and submit it with the physical share receipt. Every share certificate needs a separate DRM form. Once the form is approved, your demat account will automatically be updated to reflect your newly dematerialized shares.

Click here to read up about the different accounts that Kotak Securities has to offer.