Cloning The Superstar Investors Of India

- 3m•

- 1,980•

- 18 Apr 2023

'Tell me and I forget. Teach me and I remember. Involve me and I learn.' - Benjamin Franklin

Can’t we just follow the footsteps of India’s most famous investors like Dolly Khanna, Ashish Kacholia, or Ramesh Damani to make money in the stock market? After all they are India’s top gurus and great practitioners of value investing. They have decades of experience, made money in millions and have mastered the art of compounding wealth. Wouldn’t it be a great idea to simply invest in stocks they invest? Did this thought ever cross your mind?

Let’s dig in deeper to know everything about the bests of the investing world.

Big Sharks Of The Investing World

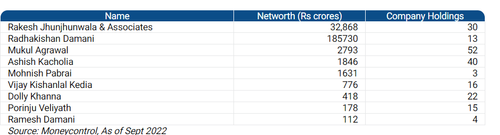

For the unversed, these guru investors are the big sharks of the investment world. They've seen many bulls, bears, crashes, recoveries, and more. They filter diamonds from dust to stay at the top of their game. Examples of some big and famous super investors of India:

It’s mindboggling massive wealth! But investing is not easy. You need to do a lot of work to be a successful investor. But why bother if these investors are doing all the work? Can't you follow them?

Riding In The Sidecar With India's Top Investors

You can. But it's not for everyone. Because they're not accountable to you for their mistakes. For them, losses are part of the game. In the long run, they win more than they lose.

There have been times when super investors bought stock and they spiked the next day. For instance, just last year, Sunil Singhania bought stake in TV Today Network and shares spiked the next day. When Dolly Khanna bought 1.4 lakh equity shares in Ajanta Soya in a bulk deal on 22 November 2021, the very next day, its shares locked in 20% upper circuit!

But there are many instances where these smart investors made wrong bets too. 2018 was a boring year for small caps. Even super investors made losses. One such big loss was Rain Industries, part of Mohnish Pabrai's portfolio. After a stellar 2017, it suffered a big drop in 2018.

Copycating Superstar Portfolios

So, if you wish to track their activity, keep these 3 points in mind.

-

You won’t know which of the multiple strategies they’ve used.

-

You won't know their holding period until they've sold it.

-

You won’t know why they sold a stock even if they have done well. They’ve their reasons.

There's more to this but you get the gist? It can be difficult to keep track of them. The first point to understand here is that you need to walk your own path in the market. No one ever got rich in stocks by copying someone else. So the real question to ask is – How can I create wealth for myself like Mohnish Pabrai or Rakesh Jhunjhunwala?

Creating Wealth Like Jhunjhunwala

Well, instead of worrying about buying specific stocks, understand wealth creation in the stock market. You should invest in only those businesses you understand. Warren Buffett calls this your 'circle of competence'. For example, Jhunjhunwala invested in Nazara Tech because he understood the gaming business. The key to long-term wealth creation is to buy quality stocks and hold them for years. Jhunjhunwala held Titan for 20 years!

These are the real secrets behind their wealth. If you want to create huge wealth for yourself in the stock market, dig deeper into how they got there. Finding the right stocks is only one part of the whole picture. All in all, always choose the mind over money. Don’t get caught in the herd mentality. Remember what Charlie Munger once said: "Go to bed smarter than when you woke up."

Happy investing!

References:

Top Investor Portfolios- Moneycontrol

Superstar Shareholder Portfolios