Fundamentals Of Corporate Governance & Shareholder Rights

- 2m•

- 5,201•

- Updated 23 May 2023

Corporate Governance And Stakeholder Rights

Companies have realised that their success is not just an outcome of the management and large shareholders’ efforts. There are a lot of shareholders who contribute to it. As a result, stakeholder rights are now very high on their list of priorities. The sum total of all the mechanisms put in place by a company to protect stakeholder rights, in particular shareholders rights, is referred to as its corporate governance structure. It consists of policies, procedures and regulations that define how the management must deal with its stakeholders, and the remedies available to them in case of a violation.

-

Shareholder Rights

Shareholders are collective owners of a company. As such, they have a wide array of rights. Principal among them are the right to timely and accurate receipt of information about its working, and the appropriate use of their funds. Accountability in this respect is ensured through the submission of annual and quarterly reports. They talk in detail about the company’s activities during the period and plans for the future.

Stakeholders have the right to, at any point, seek additional information from the management about any aspect of the company’s business. They also have the right to weigh on significant matters through a vote.

Shareholder votes are sought on all significant matters of the company such as those related to business combinations (mergers and acquisitions), major investments in assets and appointment of the board. Unless the shareholders ratify these proposals with the required majority, the management can’t go ahead with these activities.

-

Board Of Directors

The principal tool for governing shareholder rights in a company is its board of directors. It is a body elected by the stakeholders periodically for explicitly looking into the protection of their interests. It is particularly useful for small stakeholders who neither have the time to maintain active oversight on the management nor the expertise and influence to rein it in. Let’s look at how the board ensures this.

-

Functions Of The Board

The board is a means for the shareholders to exercise their authority. As their guardian, it is responsible for formulating and enforcing the moral code and systems of governance for the company.

In addition to this, it exercises its power in the following ways:

-

Appointing the top leaders of the company and deciding its compensation.

-

Stating the goals and objectives of the company and ensuring compliance.

-

Summoning the management and interviewing it in special situations.

-

Reviewing the performance of the management and ensuring adherence to legal and regulatory pronouncements.

-

Setting up various committees to look into specific matters of the company.

-

Reviewing the takeover proposal in case of a hostile takeover.

-

Ensuring the stakeholder interests are met in all the activities of the company.

Funtions Of The Board Of Directors

-

Board’s Audit Function

One of the primary concerns of shareholders is the accuracy of financial reporting and the proper use of their money. In order to ensure this, SEBI requires public listed companies to get their accounts verified by an external party before submitting them as a part of their annual report. This is called external audit. A similar audit is performed in-house by companies before the external audit. Quarterly reports are only audited internally. The board of directors forms an audit committee to look into all matters related to internal and external audit.

The committee is responsible for the appointment of the external auditor, deciding its compensation, ensuring it obtains the full cooperation of the management and is not influenced by it in any way. The audit committee is completely authorized to oversee the internal audit. All auditors are supposed to directly report to the chairman of the committee. This ensures that not only the annual and quarterly reports, but all other communications made by the company to the stakeholders is accurate and authentic. It is essential however, for the audit committee to exclusively consist of independent directors with sound knowledge of accounting standards.

-

Board Independence

As mentioned earlier, the board is an elected body. It consists of a diverse background of directors, frequently including top executives of the company, principal shareholders and independent directors. In order to devote themselves completely to the cause of stakeholders, it is critical that board members are beyond the influence of the management. This can only be ensured if the board has an overwhelming majority of independent directors.

However, this is not always the case. Company managements are frequently able to place people who are close to them on the board. This includes members of the top management, friends, relatives and business partners. Whereas representation of top management is necessary on the board to provide an insider’s perspective, others only contaminate the objectivity of the board by passing for independent directors. Another reason why directors tend to work towards the management’s ends is because the management has a say in their nomination and pays their compensation. People who are on the board for long come close to the management. Frequent elections must be held to avoid this.

Rights Of Other Stakeholders

In this segment, we will discuss the rights of two other important stakeholders in a company – lenders and customers.

-

Lenders

People who lend money to a company are its lenders. Companies may raise money in the form of loans from banks or bonds issued to investors. What lenders are chiefly concerned about is the timely recovery of their money. Rights of lenders are protected by a document called bond indenture. It contains positive and negative covenants that state the activities a company must and must not indulge in, respectively. The indenture is enforceable by law.

If a company violates its covenants, the lenders have the right to revoke further credit lines and request the immediate repayment of outstanding dues. Lenders’ rights are also protected by their preference over shareholders. Profits of a company are either used to pay dividends to stakeholders or retained for further use. However, before they can be deployed to either use, they must be used to repay the debt obligations for the period. This privilege also holds at the time of dissolution of the company.

-

Customers

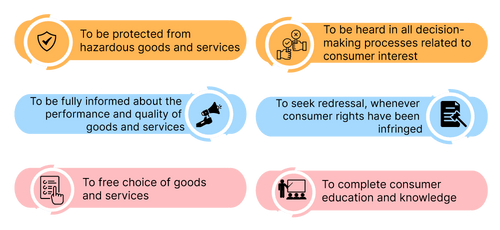

Consumer rights is a subject of immense popularity these days. Companies earn their income from customers and must therefore be sensitive towards their rights. They make a lot of efforts to ensure that there is transparency in their operations and consumers can consult them immediately if they feel their rights have been violated in any way. Most companies have a dedicated customer service team to look into such matters. However, the government plays a central role in ensuring the customer rights are not abused. Customers are basically concerned about the quality of the product and the price at which it is sold.

Consumerrights.org categorizes consumer rights in India into the following categories:

-

The right to be protected from all kinds of hazardous goods and services

-

The right to be fully informed about the performance and quality of all goods and services

-

The right to free choice of goods and services

-

The right to be heard in all decision-making processes related to consumer interests

-

The right to seek redressal, whenever consumer rights have been infringed

-

The right to complete consumer education

In a world where business is increasingly being conducted over the internet, cybercrime and data security are vital concerns. Companies are very active in fighting cyber abuse. Complex codes and encryptions are used to ensure cybersecurity. The Information Technology Act, 2000 is the predominant legislation in this respect.

Most of the consumer rights in India are protected by The Consumer Protection Act, 1986. However, some other legislations also spell out consumer rights in specific areas. Generally speaking, consumer rights are marginalized the most when a small group of companies dominate the market. Such dominance is prevented by antitrust laws that ensure that no company becomes too big to monopolize the market. In India, this is done through the Antitrust Act, 2002, the Competition Commission of India (CCI) and the Competition Appellate Tribunal (CAT).

All About Annual Meetings, Shareholder Votes And Conference Calls

We have talked in great detail about stakeholder rights and corporate governance. Now, let’s look at the three mediums through which shareholders get to directly interact with the management and express their opinion on various matters.

-

Lenders

An annual general meeting is held every year by a publically listed company to review its performance during the year and make important decisions for the following year. The meeting is attended by the top management, board of directors and interested stakeholders of the company. In India, regulations with respect to the AGM are provided in the Companies Act, 2013. According to the Act, a company must hold an AGM in at the end of every financial year, within fifteen months of the previous AGM.

The company is responsible for sending a notice for the meeting, along with its agenda to every shareholder, irrespective of the size of his holding. This must be done at least 21 days before the meeting in ordinary circumstances. The notice must also be sent to the auditors and directors. Along with the notice, all relevant facts and data about the matters to be discussed must also be sent. The meeting is required to have a quorum of two. This means that at least two stakeholders must be present at the AGM for it to be valid. At the AGM, shareholders may be required to vote on a number of issues.

These include, compensation of senior management, new directors of the board, the proposed dividend, proposed new investments and any other significant matter related to the working of the company. Stakeholders who are not present may vote through a proxy, i.e. a representative, or electronically, if they so desire. Resolutions cannot go through till they obtain the required shareholder votes. A report on the meeting has to be sent to the Registrar of Companies. A company may also call extraordinary general meetings (EGMs) in case there is a matter that requires the urgent attention of stakeholders.

-

Shareholder Votes

As discussed above, the right to vote is perhaps the most important right enjoyed by stakeholders. They are required to vote on all important decisions of the company. The majority required for different decisions is different. In India, for prospective business combinations (i.e. mergers and acquisitions), a minimum approval of 75% of shareholders is required. Voting is done by both the concerned companies, and the proposal only goes through when it is ratified by both sets of stakeholders. Votes for this are sought at a special meeting i.e. EGM. Shareholders may be present to vote, vote online or by proxy.

Voting on other important matters is done at the AGM, as described above. AGMs are normally only attended by major stakeholders. Others consider it an unimportant activity because they feel they don’t hold much sway with the management. However, AGMs present a very good platform for smaller shareholders to present their opinion before the management and other stakeholders, which they may not otherwise get. This is called shareholder activism. Management and large stakeholders may sometimes work hand in glove at the cost of smaller shareholders. However, the AGM provides them the opportunity to join forces with other small stakeholders and vote together against such resolutions. This phenomenon was brought to prominence recently by shareholders of United Spirits, a leading winemaker.

-

Conference Calls

A conference call takes place at the end of every quarter, just as an AGM takes place at the end of every financial year. However, unlike an AGM, it is conducted over a telephone rather than in person. It involves the company’s top management and legal advisors, who interact with leading asset management companies and stock analysts. Traditionally, common shareholders are not a part of conference calls. This is why they are sometimes called analyst calls. Conference calls begin with an address from the management, where it discusses the company’s activities during the period and gives financial figures pertaining to it. The plans for the future are also discussed. Then, the floor is opened for the audiences to ask questions. Since there are no shareholders in a conference call, no voting takes place.

Conference calls for major companies are broadcasted live on TV and are also available on the company websites. Although companies anyway release their quarterly results at the end of the period, conference calls allow analysts to ask questions to the management. This helps shareholders learn more about the company’s performance and take cues for the future. This results in better investment decisions. Stakeholders also take conference calls as an opportunity to mail their concerns to the company, to which managements frequently respond.