Difference Between Financial Planning And Wealth Management

- 2m•

- 1,696•

- 22 May 2023

Before we understand the difference between financial planning and wealth management, let us first understand what wealth management is all about:

What Is Wealth Management?

As the name suggests, wealth management is all about managing one’s wealth. This predominantly deals with preservation of wealth and further accumulation. As part of wealth management, investors often actively try to identify and take advantage of profit-making opportunities.

Difference Between Financial Planning And Wealth Management

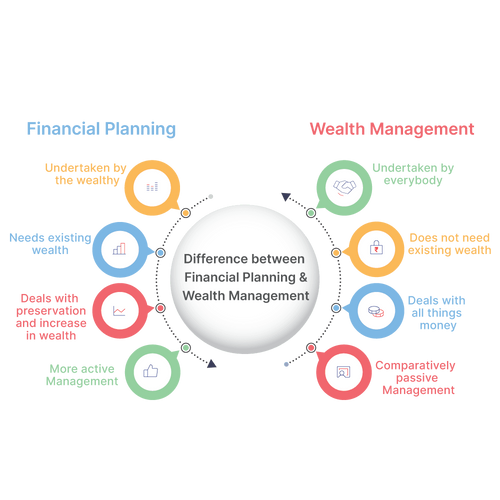

Financial planning and wealth management are inherently very similar. Yet, there are some key differences. The biggest difference is that you already need to be wealthy to ‘manage’ your assets. Financial planning, on the other hand, is even for those who aim to amass wealth. Financial planning, thus, is required by everybody, whatever your financial goals may be.

Financial Planning v/s Wealth Management

Let us look at when wealth management is required depending on the phase of your life:

Education Phase:

This is the phase in which you gain knowledge and education about investment, but you may not have a lot of financial wealth. So, no wealth management is required. However, even at this time, you will have to do financial planning to make the best use of your money. In such a case, financial planning includes decisions regarding how much to save for your daily expenses as well as investments, how much loan can be taken, how it will be paid off etc.

Retirement Phase:

In this phase, if individuals have accumulated wealth already, then wealth management is required. But, if they do not have large financial wealth, then it is not required. On the other hand, financial planning is still required with decisions relating to investment planning (where to invest money) and estate planning (how to transfer real estate assets).

Accumulation Phase:

This is the phase in which you start enacting your strategy and accumulating financial wealth. Here, wealth management may not be required at the start, but may be needed at later stages once a significant amount of assets are accumulated. Financial planning, however, is required even at this stage. Planning involves re-evaluating your strategy and changing it if required. Decisions in this phase will be related to accumulation of financial wealth, calculating how much to spend now and how much to accumulate for future spending etc. Thus, we can say that wealth management is required only by affluent investors, but financial planning is required by all at all stages of life. We can also say that in broader terms, wealth management is a part of financial planning.