Futures & Options

Analyze markets, build strategies & trade with confidence

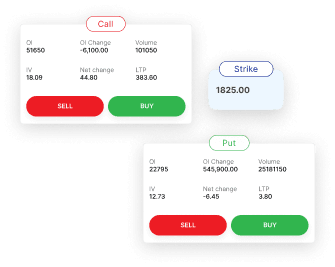

Instant trading in just one click. Charts, Options Chain, Positions & Orders – all in one view.

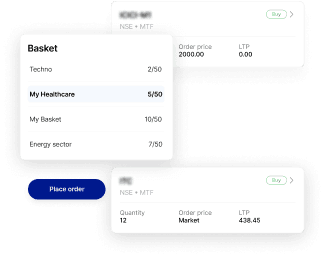

Automate the entry and exit of your multi-leg strategies with ease.

Build and analyse option strategies at your fingertips

One-click strategy execution with instant margin benefits.

Analyse charts with 100+ indicators

With Jimesh Chauhan Deputy Manager, Kotak Securities

23 May '25 06:00 PM onwards

We believe in quality first and a technology-led approach that makes us a reputable choice for investment advisors across the industry.

Still have questions?

What are Futures and Options(F&O)?

Futures and Options(F&O) are tools used by investors when trading in the stock market. As financial contracts between the buyer and the seller of an asset, they offer the potential to earn huge profits.

What are Futures and Options(F&O) contracts and what are its types?

Futures are contracts or an agreement between two parties to either buy or sell a fixed quantity of assets at a particular time in the future for a fixed price. An option is also a similar contract, except the parties are not obligated to fulfill the terms of the agreement. These contracts are then traded in the market. The minimum value of a contract is Rs 2 lakh.

Futures and Options(F&O) contracts can be of various types including shares, indices, currencies as well as commodities.

What are advantages Futures and Options(F&O)?

There are many advantages of trading in futures and options. Futures and Options(F&O) contracts have hedging, arbitrage and leverage benefits.

Arbitrage: Arbitrage implies taking advantage of price differences in the same or similar financial instruments.

Hedging: The most common use of derivatives trading is hedging. It's possible to use Futures and Options(F&O) contracts to set up a trading strategy in which a loss for one investment is mitigated or offset by a gain in a comparable derivative.

Margin trade: While trading in the derivatives market, you only pay a margin. This is because the actual value of the contracts would be too large in lakhs and crores. However, when you make a profit, the percentage of growth is exponentially higher. This allows you to make more money.

How are Options contracts priced?

Options can be bought for an underlying asset at a fraction of the actual price of the asset in the spot market by paying an upfront premium. The amount paid as a premium to the seller is the price of entering an options contract.

Do you need a trading account for Futures and Options(F&O)?

Yes. You would need a trading account to trade in Futures and Options(F&O).

What is the lot size in Futures and Options(F&O)?

Lot size refers to a fixed number of units of the underlying asset that form part of a single Futures and Options(F&O) contract. The standard lot size is different for each stock and is decided by the exchange on which the stock is traded.

How to start Futures and Options(F&O) trading?

To start trading in Futures and Options(F&O), all you need to do is open an online trading account.

When you buy in the cash segment, you have to pay the entire value of the shares purchased – this is unless you are a day trader utilizing margin trading. You have to pay this amount upfront to the exchange or the clearing house.

This upfront payment is called ‘Margin Money’. It helps reduce the risk that the exchange undertakes and helps in maintaining the integrity of the market.

Once you have these requisites, you can buy a Futures and Options(F&O) contract. Simply place an order with your broker, specifying the details of the contract like the Scrip, expiry month, contract size, and so on. Once you do this, hand over the margin money to the broker, who will then get in touch with the exchange.

The exchange will find you a seller (if you are a buyer) or a buyer (if you are seller).

What are the risks in Futures and Options(F&O) contracts?

There is no upfront cost when entering into a futures contract. But the buyer is bound to pay the agreed-upon price for the asset eventually.

The buyer in an options contract has to pay a premium. The payment of this premium grants the options buyer the privilege to not buy the asset on a future date if it becomes less attractive. Should the options contract holder choose not to buy the asset, the premium paid is the amount he stands to lose.

In both cases, you may have to pay certain commissions.

What is the difference between shares and Futures and Options(F&O) trading?

Equity trading is simply buying and selling the shares. However, Futures and Options(F&O) are derivatives.

The term ‘Derivative’ itself indicates that it has no independent value. Here, the value of the derivate is entirely derived from the underlying asset.

How can you square-up or execute the Futures and Options(F&O) contract?

A futures contract is executed on the date agreed upon in the contract. On this date, the buyer purchases the underlying asset.

Meanwhile, the buyer in an options contract can execute the contract anytime before the date of expiry. So, you are free to buy the asset whenever you feel the conditions are right.

What is initial and mark-to-market margin?

Initial margin is defined as a percentage of your open position and is set for different positions by the exchange or clearing house. The factors that decide the amount of initial margin are the average volatility of the stock in concern over a specified period of time and the interest cost. Initial margin amounts fluctuate daily depending on the market value of your open positions.

Mark-to-Market margin covers the difference between the cost of the contract and its closing price on the day the contract is purchased. Post purchase, MTM margin covers the daily differences in closing prices.

What is Physical Settlement?

As per the SEBI circular, starting October 2019, it is mandatory for all Stock Futures and Options to be physically settled. Index Futures and Options will be cash-settled. Physical settlements will be applicable only for Stock Futures and In-The-Money Stock Options. If a trader has an open position in Stock Future or In-The-Money Stock Option that has not been squared off on the expiry date, the contract will be physically settled. Read More

How does futures trading work?

Futures trading involves buying a futures contract. It specifies the price at which the underlying assets will be traded on a predetermined future date.

How do I buy Options?

To buy options you will need a trading account that facilitates trading derivatives like options. Then add the required funds in it. After that you can fill out the agreement and buy the options contact. Remember, to read the terms of an options agreement carefully before purchasing it.