What Makes A Company?

- 6 min•

- 1,185•

- 17 Oct 2023

Management, Board, Stakeholders, Employees, Suppliers, Customers

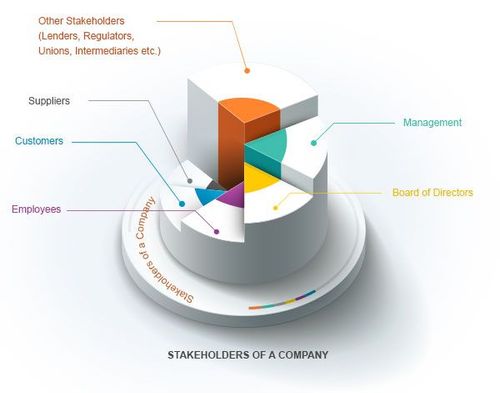

Companies come into existence for the fulfillment of certain objectives. To help them do so, a number of stakeholders have to come together and contribute.

Let’s take a look at the role played by certain key stakeholders of a company.

Following are some of the characteristics that help determine the intensity of competition in a market:

-

Management :

Management is the spearhead of a company. It consists of all the people responsible for formulating its policies and overseeing their execution. The success of a company is therefore completely dependent on the quality of its management. The management is expected to be committed to the shareholders of the company as they, being its owners, appointed the management. It must therefore be the management’s foremost priority to maximise the wellbeing of shareholders.

Other things that define the quality of management include, the skills, knowledge and experience it has for the industry it is in, its track record of policy formulation and execution and its moral character (i.e. history of involvement in unfair practices such as embezzlement and incorrect financial reporting).

-

Customers :

The importance of its customers to a business can never be overemphasised. They are the source of its income and it must, therefore take pains to meet their every requirement. It must continuously innovate to provide better products, at a lower cost and through more convenient channels to its customers. All these, put together can propel a company to the position of leadership in its industry.

We have already looked at the dynamics of bargaining power that define the customer-company relationship. Like with suppliers, the terms of business between a company and its customers are also critical. A tilt of bargaining power towards the company allows it to offer shorter credit periods to its customers, thereby avoiding short-term borrowing to repay its suppliers. If the bargaining power is tilted towards customers, this benefit goes away.

-

Board:

Company managements sometimes work at cross-purposes with shareholders to perpetuate their own position. The board of directors protects the interests of shareholders in such situations. It is a periodically elected body that normally comprises large shareholders, management representatives and independent directors of the company. It is particularly concerned with protecting the interests of marginal investors, like you, who have little influence over the management and don’t always know what’s best for them.

All important activities of the company, such as takeovers, require the explicit consent of the board. It also has the right to investigate any matter regarding the company, upon its own initiative. Other powers of the board include summoning any member of the top management for questioning, appointing the CEO, fixing the compensation of the top management, and so on. More independent the board, the better it is for the shareholders.

-

Stakeholders :

Suppliers provide raw material and other inputs for the production of a company’s goods. It is important for companies to maintain a steady supply of the right quality inputs, at a reasonable cost. In the last section, we discussed how suppliers can hold bargaining power over individual companies in an industry. This happens when there are few suppliers and the nature of inputs they supply is unique or highly specialized. What is also essential is the terms a company enjoys with its suppliers.

The time a company gets from its suppliers to pay their dues in lieu of materials purchased from them is called credit period. Companies hope to enjoy longer credit periods with their suppliers than they offer their customers. This helps them pay off their dues using the money received from customers, rather than borrow money for it. Again, the terms a company enjoys with its suppliers is based on the distribution of bargaining power between the two.

Who Is A Promoter?

A promoter is anyone who conceives the idea of starting a company, invests his own/ borrowed funds into it, is the principal decision making authority in it and is accountable to the stakeholders for its activities. He may be an individual, a group of people or another company. They hold a significant proportion of the company’s shares themselves or through their close relatives, such as spouse and children. The top leadership of the company generally comprises of the promoters or individuals designated by them. The entire lot of people and other companies that control a company in this way is called its promoter group. Their combined shareholding is called promoter holding. Higher the promoter holding in a company, greater is the promoters’ control over it.

Promoters exercise their control by taking key decisions of the company and appointing people in ranking positions of its management and board. They also provide the vision for the existence of the company and steer it to its fulfillment. It is, therefore, necessary that the promoters continue to hold a dominant shareholding position in the company. A large promoter group also provides stability to a company when other companies are trying to acquire it forcefully. A large promoter holding prevents such companies from acquiring it. However, absolute authority can also make the promoter group autocratic. This can work to the disadvantage of other stakeholders, who may be ignored at the behest of the selfish interests of the promoter group.

Understanding Ownership And Insider Sale

The promoters of a company are commonly referred to as its ‘owners’. However, for a variety of reasons, they have to sell parts of their stake in the company at various points of time. Principal among these are the inability of the promoters to single-handedly contribute all the money (called capital) for starting the company and the requirement for further capital as the company grows.

As a result, the following categories of investors emerge over time:

Ownership Structure Of A Company

-

Promoter Group :

As discussed above, promoters are the people who conceive the idea of a company and put it into execution. They generally come across as the face of the company as they hold key decision making positions in it. They may offload some stake in the company over time, but tend to retain important positions in the management and dominate the board. When a company is acquired by another company, the acquirer buys most of the promoter‘s stake.

By virtue of this, it becomes the new promoter. The corporate hierarchy of the resulting entity depends on the negotiations between the promoters and the acquirer. Sometimes, the promoters sell their entire stake in the company and exit it. On other occasions, they retain a small stake and continue holding key leadership positions and representation on the board of directors.

-

Retail Investors :

This category is made up of common investors like you, who purchase small stakes in the company. Generally, this is one of the largest categories of shareholders in a company. However, it is also at the greatest risk because it is the least technically-aware investor class. Common investors know little about the working of a company and their shareholder rights. Additionally, since they hold tiny individual stakes, they have the least amount of influence over the company’s management. Their importance to the company owes itself exclusively to their large numbers. They buy and sell shares more frequently on the stock market than any other category. As a result they have a major influence on the market price of the company’s shares.

-

Institutional Investors :

This category mainly consists of financial institutions such as investment banks, private equity (PE) funds, insurance companies, pension funds and venture capitalists (VCs), who acquire an interest in the company at various stages. Together, they are called financial investors. The stake held by such institutions is only financial in nature. They don’t want to be a part of the company for the long term. All they want is to make a profit by selling their stake in few years and exit the company. However, because their stake is fairly substantial, they want to have a say in the management of the company.

For this reason, they have a presence on its board. Sometimes, promoters don’t have the necessary money to start a business. Financial investors, such as PE funds and VCs like to invest in the company at this stage, in return for a stake. Others, such as investment banks and pension funds have at their disposal a lot of money that belongs to their clients. They can invest this for few years. They do so in companies that are relatively well established in the market and promise good returns in the medium to long term. However, very few institutional investors stay invested in a company beyond a few years.

-

Strategic Investors :

This category of investors stays invested for longer period of time. Sometimes, other companies from the same industry invest in a company. They may be above, below or at the same stage of the value chain. The objective if such an investment is to get a share of the action from another stage of the value chain and is therefore called a ‘strategic interest’.

Insider Sale

We have established that retail investors are the most active class of company owners in the stock market. They rarely hold the shares throughout the company’s lifecycle.

Does this mean that other categories of investors sit patiently on their shares for an indefinite period? No. The promoters and management of a company frequently buy and sell shares of the company in the stock market. This is called insider sales.

Such transactions are done for three main reasons – for covering conversions, share repurchases and signaling. Companies issue a lot of hybrid investment instruments such as warrants and bonds, with options that provide for their conversion into equity shares in the future. Shares have to be bought for the conversion of these. Also, companies sometimes like to reward their shareholders by buying back their shares at a high price. This is called share repurchase.

Lastly, investors take a cue from the management’s activities in the stock market. Sometimes companies like to buy shares when their value is falling to signal to shareholders that they are confident of their future. Similarly, sometimes, they need money to invest in a variety of projects. This too can be raised by selling their own shares. This is typically done when the stock price is high.

Insider Selling V/s Trading

It must be remembered though, that insider selling is unrelated to the illicit practice of insider trading. Here, companies trade in shares with the full knowledge and consent of the market regulator (SEBI in India). In insider trading, company promoters, top management or any of the employees buy and sell shares of the company based on material information not known to other investors.