Why Smart-Beta Funds Should Be A Part Of Your Satellite Portfolio

- 3 min•

- 1,287•

- 17 Oct 2023

The new fund offer (NFO) of ICICI Prudential’s Alpha Low Volatility 30 Exchange Traded Fund (ETF) is on at present. This ETF belongs to an emerging category that is referred to as factor-based or smart-beta investing. Several such ETFs and index funds exist already, based on themes like quality, low volatility, value, equal weight, and so on.

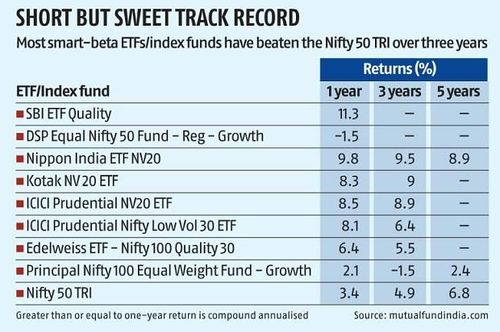

Most of these products have a three-year track record (only a couple have been around for five years). Over this period, while most have outperformed the Nifty Total Return Index (TRI), one has lagged behind (see table). Going by performance so far, investors should keep a close watch on this category.

Smart-Beta And Its Advantages:

Indian investors are most familiar with actively-managed funds where a fund manager decides both the stock selection and the weights of each stock in his portfolio. In recent times, a majority of fund managers, especially on the large-cap side, have failed to beat their benchmarks. Active fund managers also lack consistency — a fund manager may beat his benchmark one year but not the next.

Many informed retail and institutional investors have hence moved to low-cost passive funds (ETFs and index funds), which replicate an index. Fund houses keep their expense ratios low so that their returns match that of the index. These funds cannot outperform the markets, but they also remove the risk of underperformance.

Smart-beta products are a cross-over category — they lie between active and passive funds. To create a smart index, certain factors — one may also call them criteria or filters — are applied to a universe like the Nifty 50. The smaller number so obtained is used to create a smart-beta index. “The endeavour is to offer higher returns or lower risk than a basic market capitalisation-based index like the Nifty or the Sensex would,” says Anil Ghelani, head of passive investments and products, DSP Investment Managers.

Style drift — the issue of active fund managers saying they will follow a certain strategy but doing something else — gets eliminated here since portfolio construction is rule-based. These funds also have a lower expense ratio than active funds (though they are usually costlier than a pure passive fund).

Though these strategies eliminate human judgement, they are not entirely passive. “There is an element of active fund management here because certain consciously chosen criteria are used to filter stocks from an index,” says Vishal Jain, head, Nippon India ETF.

Most smart-beta indices in India are based on a single factor. ICICI Prudential's newly-launched product is based on two factors — alpha and low volatility. The purpose behind adding more factors is to try and create a more all-weather portfolio.

Things To Watch Out For:

Investing in a pure passive fund, like a Nifty 50 or Sensex, is a simple strategy. You invest in a diversified basket of stocks and accept the returns it offers. In factor-based investing, once you apply filters and reduce the number of stocks, a couple of things happen. One, the level of diversification comes down and the portfolio risk goes up. Two, no single strategy works all the time. “The source of alpha creation in the market keeps changing,” says Vishal Dhawan, chief financial planner, Plan Ahead Wealth Advisors. Investors will have to be prepared for

periods of underperformance. They could move in and out of these products or wait out periods of underperformance if they have a long horizon.

Even though fund houses may show numbers to prove that the strategy has done well in backtests run by them on historical data, there is no guarantee the strategy will do well. This is because market conditions keep changing and the future is often different from the past.

The ETFs based on these strategies have a small asset under management (AUM). There is very little liquidity in them due to which there can be times when there is significant divergence between the net asset value (NAV) and the trading price. This risk can be circumvented by opting for an index fund (if that format is available). ETFs also don’t lend themselves to SIPs and STPs.

Each of these strategies may take care of some issues but not of others. For instance, a portfolio that promises high quality could have a high valuation. Who should go for them?

Investors who don’t want to go with a fund manager but are looking for returns better than that of an index may go for these products. They are suited for savvy investors. “Those who understand the underlying concept may invest in such products provided they have the risk appetite,” says Nitin Kabadi, head-ETF business, ICICI Prudential Asset Management Company. According to Dhawan, the investor needs to understand the characteristics of his existing portfolio, so that he can select a smart-beta index that complements it. “Only, for instance, if an investor knows that his portfolio is high-beta can he opt for a low-volatility strategy,” he says. Others should take the advice of a financial advisor in selecting these products. Investors who wish to take tactical bets on them should either know when to enter and exit or take an advisor’s help.

The Bottom Line:

Investors should build a core and a satellite portfolio. The core portfolio should be filled with a low-risk product like a Nifty 50 or Sensex-based ETF or index fund. Investors may then take a small exposure to these smart-beta strategies in their satellite portfolios. Exposure to these products should not exceed 5-10 per cent of the total equity portfolio until they acquire a longer track record.