The Wave of De-Dollarization and What It Means for Global Economy

- 4m•

- 4,201•

- 04 Oct 2023

As the sun rose over Mumbai, Raju, a young entrepreneur, checked the exchange rate between the Indian rupee and the U.S. dollar.

For decades, the dollar has been the dominant global currency. But did you know that in 1944, India was one of many countries that initially opposed using the dollar as the world's reserve currency?

Despite the opposition, the Bretton Woods conference ultimately agreed to use the dollar as the reserve currency, and today, India holds over $570 billion in foreign exchange reserves.

But many countries are now looking for alternatives to the dollar. It’s something that has come to be called de-dollarization and it could have many implications for the global economy. Wish to trade the currency markets during this exciting time? Click here to explore the largest & most liquid market.

As Raju worked on his invoice, he couldn't help but wonder what the future held for the dollar and the global economy as a whole.

In this blog, we'll dive deeper into de-dollarization and explore:

- Why countries are looking for alternatives to the dollar

- How they're attempting to create alternative currencies

- Implications for the markets and the economy

So, let’s have a cup of chai or coffee and unpack these topics one sip at a time

Here is some interesting dollar history to kick things off…

How the Dollar Became the Reserve Currency

It was 1917.

The United States entered the World War and emerged far stronger than its European counterparts.

And then boom – it became the leading financial power, displacing the pound as the international reserve currency. Plus, it also became a significant recipient of wartime gold inflows.

These factors contributed to the dollar’s popularity, but it still wasn’t used for trade on a massive scale.

It wasn’t until 1944 that the dollar became the centre of attraction for almost 44 countries.

These countries signed the Bretton Woods Agreement to create a collective international currency exchange regime pegged to the U.S. dollar, which was again pegged to the price of gold.

And so began the international trade in U.S. dollars!

Since then, the dollar has seen many ups and downs but it still retains its status as the reserve currency. Here’s a look:

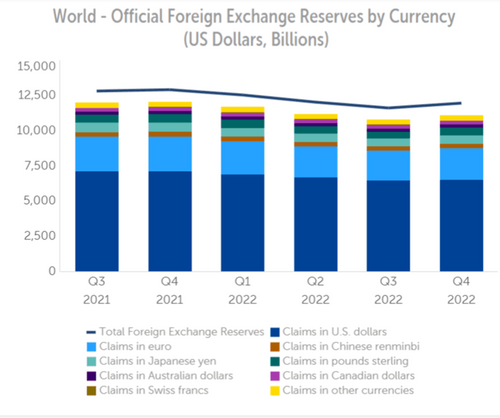

The table basically shows the exchange reserve currencies central banks across the world hold with them. These reserves for dollars stood at around 59% in Q42022. So, central banks hold about 59% of their foreign exchange reserves in dollars - a lion’s share in the global exchange market!

This makes us ask: Why is the U.S. dollar so popular?

All thanks to its stability, liquidity, and the trust that has been placed in the U.S. economy and its government.

Not only that but the world uses the dollar because the U.S. has the deepest and the most flexible financial markets.

The greenback is widely accepted and used across the world. And most importantly, it plays a significant role in oil markets where every transaction is backed by dollars.

So agar sab kuch dollar me ache se chal raha hai TOH PROBLEM KYA HAI?!

Countries are looking at an alternative to the dollar to reduce their dependence on the U.S.

De-Dollarization

Enter de-dollarization which is basically the process of substituting the U.S. dollar as the currency used for trading commodities and other goods and services.

How has this been going? The roots can be traced back to 2014 when Russia prioritised the process in response to Western sanctions levied on it.

Fast forward to 2022, central banks across the world have been increasing their exposure to gold. They have been buying gold at the fastest pace since 1987. Here’s more on this

Then we saw the war in Ukraine which resulted in Western Sanctions against Russia. In a counter attack, Russia and China deepened their co-operation between their financial systems and ruble-yuan trade increased 80 times in 8 months!

But that’s not all.

On March 29th, the world’s second largest economy – China, and Latin America’s biggest economy – Brazil – announced that they will conduct bilateral trade in their local currencies. These are the Chinese yuan (or Renminbi) and the Brazilian reais which will surpass the dollar.

In January, Iran and Russia also formed an agreement to connect their interbank messaging systems – the SEPAM and the SPFS – and bypass the U.S. denominated SWIFT banking communication and transfer system.

And for the first time in 48 years, Saudi Arabia said that the oil nation is open to trading in currencies besides the U.S. dollar.

The latest in the club are the BRICS nations which have made key moves away from the U.S.-denominated international trade and financial systems.

However, all this doesn’t necessarily mean a threat to the dollar.

Market Implications and Trading Strategies

Giving up use of the U.S. dollar for global trade and reserve accumulation wouldn’t be an easy process.

The U.S. economy remains the largest and most influential in the world, and the dollar is seen as the safe haven currency in times of global economic uncertainty.

So, the above measures won’t pose major concerns or displace the dollar overnight.

Conclusion

While giving up the use of the U.S. dollar for global trade and reserve accumulation may not pose an immediate threat to the dollar's status as the world's primary reserve currency, it is likely to have significant implications for global financial markets.

As more countries and central banks seek to diversify away from the U.S. dollar, we can expect to see increased volatility in forex, commodity, and stock markets.

To capitalise on the evolving global economy, investors and traders can closely monitor currency movements, commodity prices, and global events.

They should have effective stock market strategies that align with their risk tolerance and investment goals.

To know the current trends in currency markets, tune in to the below podcast where Anindya Banerjee, Vice President, Currency & Interest Research, sheds light on the current currency pair dynamics and much more.

And to keep yourself updated with the latest and most interesting currency and commodity moves, subscribe to the following podcasts:

-

Currency Outlook with Anindya Banerjee

-

Commodity Catch-Up with Ravindra Rao

-

Daily Trade Talk with Shrikant Chouhan

Have a great weekend!

Sources: IMF, CEIC, Atlantic Council, Economic Times