Phones To TVs: Tracking Xiaomi’s Smart Rise In India's Gadget Market

- 4m•

- 1,110•

- 21 Apr 2023

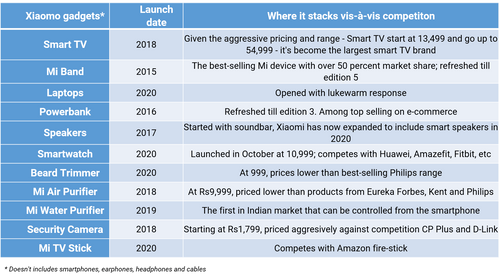

Xiaomi became India's No. 1 smartphone brand in September 2017: a remarkable rise for a company that first grabbed attention by selling an affordable fitness band. Xiaomi now sells TVs, laptops, speakers, watches, and products in a dozen other spaces. Xiaomi's products are affordable and offer features otherwise seen in higher-end devices. India's smart home market is worth $3 billion and it will double over the next two years, according to one estimate. Yuvraj Malik explains how Xiaomi is working to be at the top of that market.

When Xiaomi pipped Samsung to become the No. 1 smartphone brand in September 2017, little did people outside of the Chinese firm know that another, much bolder, strategy was in the works.

Three years into India at the time, Xiaomi had delighted consumers with low-cost feature-rich smartphones. The firm understood the pulse of the market and gained a mighty foothold in the supply chain. It then set its eyes on the ‘smart’ gadgets crown.

Before 2017, all Xiaomi had outside of smartphones was a fitness tracker. The Mi Band was a modest 2,000-rupee wearable pedometer. Yet, it was an instant hit. Tech aficionados loved doodling with this new kind of device, and its styling made it a fashion statement as well. On its fifth iteration today, Mi Band commands a massive 50 per cent market share in the fitness wearable category.

Getting Smart

The success of Mi band emboldened Xiaomi’s ambition, and executives in Beijing and Bengaluru began identifying consumer gadget categories to enter and designing products. The idea was to expand, using the brand currency it earned from smartphones, to areas where new-age consumers were looking for style and convenience.

In 2020, Xiaomi has confidently moved ahead of its bread-and-butter smartphones, into big- ticket categories like TVs, laptops, speakers, smart-watches, and a dozen other spaces.

“Xiaomi is a young company that started in 2010. But in 2014-15, the vision (globally) became larger,” Xiaomi India’s chief business officer Raghu Reddy told Business Standard in an exclusive interview over Zoom.

“Putting smartphone at the centre, we thought what gadgets and devices can we create that bring joy and convenience to consumers. That’s when the whole genesis of the ecosystem came into play,” said Reddy, who has been with the firm since 2014, when it launched in India.

In each of the non-smartphone categories, Xiaomi’s offering is unique. The products typically offer features otherwise seen in higher-end devices, are priced lower than competition, and are sometimes industry-first. Take for instance, Xiaomi’s no-touch soap dispenser launched this month--a timely appliance and, at Rs 999, a steal.

In the larger categories, Xiaomi’s rise has offset old guards in a short span. Mi TVs, launched in 2018 and refreshed thereafter, are the number one-selling smart TVs, past those from LG, Sony and Samsung, according to Counterpoint Research.

Xiaomi is relying on simple business math here. A Xiaomi phone user will be tempted to try out Mi Band or Mi TV, or vice versa, and is enticed into the ecosystem. It’s about identifying pain-points and launching models that appeal to the TG. This diversification strategy is seen among global players, too. Fellow Chinese brand OnePlus, owned BBK Group, launched a range of TVs in 2019, and Amazon.com Inc, through is Amazon Basics private label, has all but taken over the e-reader and smart speakers market.

The other bit is software. One of the reasons why iPhone owners are also MacBook or iPad owners is because the devices share the same operating system (OS) and, in industry parlance, “user experience”. Xiaomi is attempting to deliver the experience through IoT (internet of things). Its latest range of ‘smart’ appliance, such as water purifier, air purifier, lights, and security cameras, among others, are controlled through a Mi companion app on the smartphone.

“It’s part of our future,” said Karan Mohla, a partner at VC firm Chiratae Ventures. “More and more OEMs (original equipment manufacturers) will have to adopt to that. It’s an ecosystem play. Apple has done that very well. It’s (Apple) as much of a hardware company as a software company.”

“And what Xiaomi has shown is that if you marry the right products to the right features, and also allow control over the smartphone, it’s a delight. At the end of the day, users want to control things digitally,” said Mohla.

Reddy said Xiaomi India doubled down on the strategy two years back, with the launch of its first edition of Smarter Living event in 2018. The event was created to showcase new non- smartphone products.

The third edition, which happened virtually on September 29, saw Xiaomi enter some more bold categories. It opened with Manu Jain, the India managing director, pacing up and down in his Bengaluru backyard.

30 Crore Customers

“After we launched Mi TV, the number one request was to launch laptops. We fulfilled that earlier this year,” Jain said, spotting his signature gleaming smile. “As of date, 30 crore people have bought a Mi consumer IoT product around the world.”

He went on to launch a Rs 10,999 smartwatch and a smart speaker, powered by Google Assistant, for Rs 3,499, among other nit bits. For the watch, Jain pitched its 14-day-long battery life as the stand-out feature, and in speakers, it was superior sound quality, often overlooked by most smart speakers in the market.

CBO Reddy told Business Standard, “at a broad overall level, the understanding is that we, as a company, may not be able to do justice to each and every (consumer appliance) category and that’s why Xiaomi is focussed on only a few categories where we can provide value.”

It’s also about moving beyond smartphones, a market that has become saturated not only in India but across the world, said Tarun Pathak, associate director, Counterpoint Research.

“By going big on home appliances and IoT, Xiaomi is creating a divergent revenue stream. In that sense, with 5G coming in as well, Xiaomi is betting on the future.” In the recent past, BBK Group brands – OnePlus, Vivo and Oppo – as well as Samsung have been fairly aggressive in the Indian market lately.

According to a Counterpoint, Xiaomi has been an early mover to the IoT sector, among smartphone vendors. Its founder Lei Jun had eyed the consumer IoT sector from mid-2013, and built a team to scout and invest in product start-ups. By Q1 2020, he had invested in over 300 in China and South East Asia.

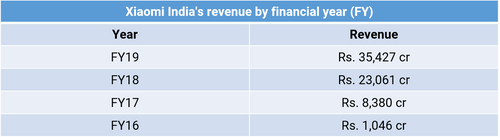

Reddy did not break up the portion of revenue Xiaomi India earns from gadgets other than smartphones, but said its percentage in the total mix has grown over the years. In FY19, Xiaomi India made Rs 35,427 crore in revenue and net loss of Rs 148.5 crore. The most recent FY20 figures are unavailable.

Its most successful product has been Mi TVs, which became top sellers last year. Mi Laptops have not gained the same flavour so far.

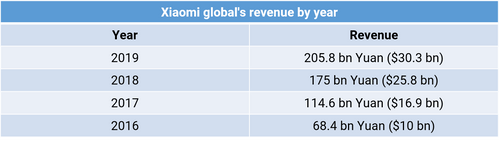

Globally, the share of IoT is much more pronounced. In 2019 (Xiaomi follows calendar year), the IoT and lifestyle products grew 41.7 percent to reach RMB 62.1 billion ($9.3 billion) and accounted for over 30 percent of Xiaomi’s total revenue. The number of connected IoT devices (excluding smartphones and laptops) on Xiaomi’s IoT platform reached 234.8 million the same year.

With the Indian smart home market already worth $3 billion, according to Statista, and set to double in size over the next two years, Xiaomi intends to be at the forefront of the smart products space. Already, some of these products—smart TVs, for example—have become category leaders.