Here Is Why Volume Analysis Is A Must For Traders

- 4m•

- 1,612•

- 13 Apr 2023

Learning technical analysis is a tedious task which takes years of practice and study to master. Traders undergo a whole lot of emotions till they can get a fair idea about the structure and skills involved in technical analysis. And, because of this, a few market participants tend to deviate from the core ideology of technical analysis. However, doing so may lead to losses which in turn, destroys the trading morale.

Volume is defined as the number of shares/contracts of a stock traded in a given time. It plays a crucial role in technical analysis and is recognised as an indispensable indicator.

Although the analysis of volume structure is a difficult endeavour, mastering it helps in studying stock price movement with greater clarity. Moreover, a clear idea of the volume assists market participants in developing appropriate trading strategy. This indicator can be combined with other oscillators and the momentum indicators for better results. Whenever volume analysis joins hands with the Relative Strength Index (RSI) or Moving average convergence divergence (MACD), performances tend to be remarkable.

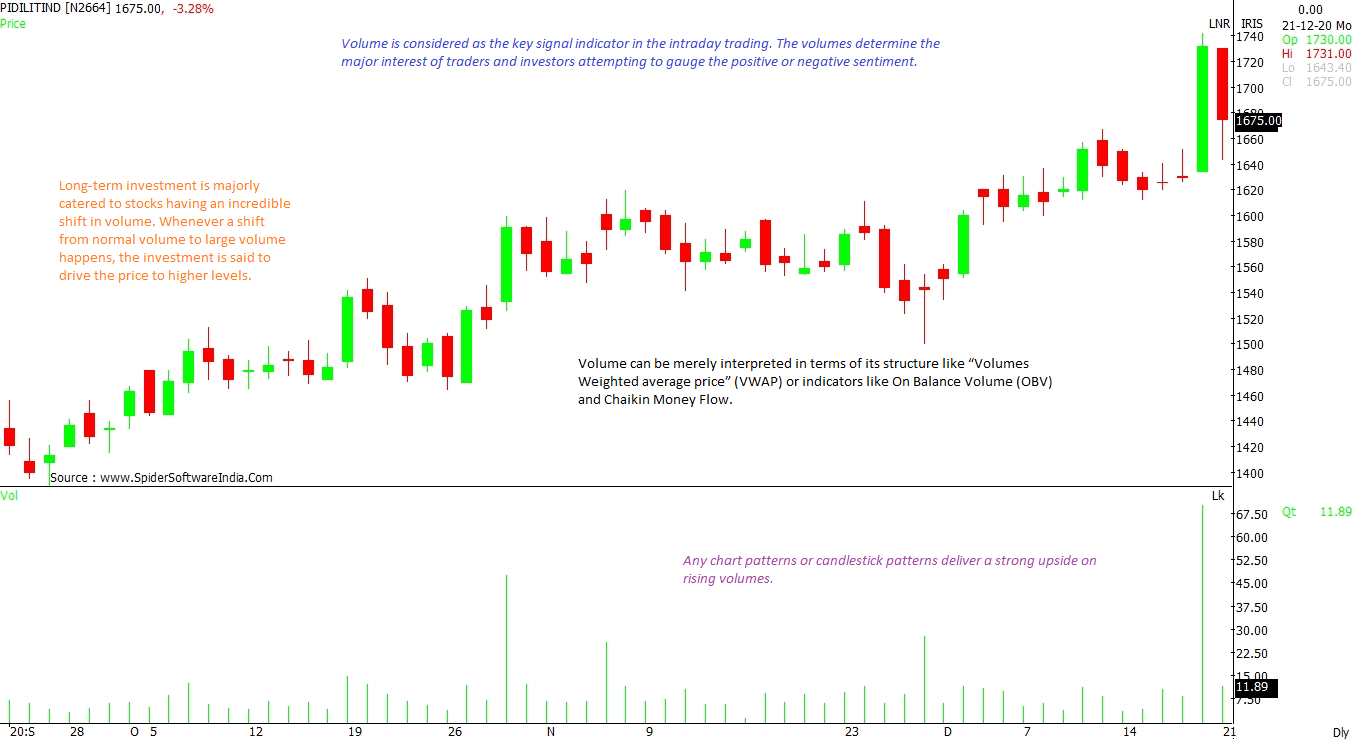

Follow-up buying needs to be clearly watched as the structure reflects the gradual interest of market participants. Volume can be interpreted merely in terms of its structure like “Volumes Weighted average price” (VWAP) or indicators like On Balance Volume (OBV) and Chaikin Money Flow. Each component has its unique significance.

How To Interpret Volume?

-

Volumes can show the interest of market participants on the expected trend or reversal

-

Stocks having firm support of volumes can witness accumulation and buying sentiment on weakness or fall

-

Chart patterns or candlestick patterns deliver strong upside when supported by rising volumes

-

A moving average, trendline, or gap-up breakout needs to have sparkling volumes to provide gradual rise

-

A continuous rise in stock price with increasing volumes exhibits a bullish trend

-

Investors can reach a balanced view by studying volumes in daily, weekly or yearly charts.

Significance Of Volume Indicators

-

Volume is considered as the key signal indicator in intraday trading. It determines the major interest of traders and investors and helps in gauging the sentiment.

-

Volume alone can facilitate taking a long or short position in the market. It is not absolutely necessary to add another indicator to volume. It can, by itself, provide sufficient information of the trend and strength. Although, there is no doubt that the volume indicator, when used in combination with other indicators, provides more accurate confirmation.

-

Long-term investment is majorly focused towards stocks that display an incredible shift in volume, which in turn, drives the price to higher levels.

Volume, as a whole, is a broad topic and holds utmost significance in trading. Meanwhile, there exist some stocks that rise without a major shift in volume structure. However, focusing on such stocks is a risky bet, considering the illiquidity and the fear that a few investors may be pushing the stock to high levels. And therein lies the other benefit of having in-depth knowledge of volume analysis, which is that it helps in predicting, comparatively safely, the future stock prices.