Buzz In The Market: Are IT Sector Valuations In Bubble Zone?

- 3m•

- 1,129•

- 17 Apr 2023

The returns on stocks of information technology companies have been so good that investors may be wondering if the sector is in bubble territory. Most IT stocks have managed to maintain sales and profitability despite the coronavirus pandemic. The sector is perhaps over-valued but it is less over-valued than the broad market, writes Devangshu Datta.

Stocks of information technology (IT) companies have outperformed the market in 2020. Indeed, it is one of the few sectors to generate excellent returns despite, or perhaps because of, the pandemic. Indeed, the returns have been so good that investors may be wondering if the sector is now in bubble territory.

A glance at the chart 'IT Index Vs Nifty' makes this outperformance clear. The Nifty has returned negative 3 per cent since January 1 this year while the IT index has returned a positive 33.7 per cent. When we look at the constituents of the IT index, it also becomes clear that the outperformance across the sector is broad.

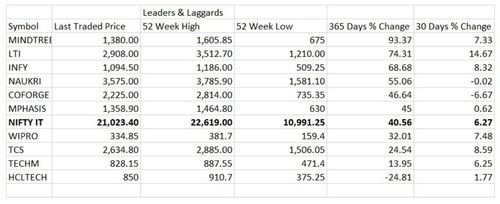

Take a look at the table 'Leaders and Laggards' for a comparative performance over the past year and past month. Only one stock out of the ten constituents of the index has delivered a negative return in the past 12 months. Six stocks have beaten the index performance with outstanding returns of 45 per cent or more.

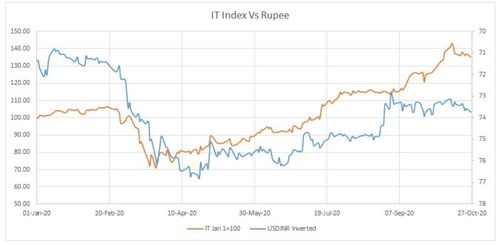

The IT index is also often said to be negatively correlated to the rupee’s performance versus the US dollar. That has a sound basis as IT industry revenue is heavily US dollar-oriented and more than two-thirds is derived from North America.

However this relationship is less clear when we look at performance through 2020. In the chart, 'IT Index Vs Rupee', the IT index has been plotted against the USD-INR on an inverted scale. There is a negative correlation in that the index has gone up, while the rupee has gone down across the entire ten-month period. But the negative correlation is not very strong even though it’s significant. Considering changes on daily basis, the correlation is a negative -0.4, which means that the IT index does move up (down), when the rupee moves down (up), but it does not do this consistently.

IT Stock Valuation

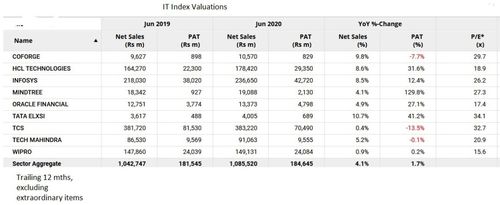

The table 'Valuations' lists the prevailing valuations across the IT index stocks, alongside recent revenues and profits. Advisories across the sector have tended to be cautiously optimistic. Most IT stocks have managed to maintain sales and profitability despite the pandemic. The quarter-on-quarter (QoQ) results are misleading because the April-June 2020 quarter was extraordinarily bad. Investors will have to account for this low-base effect next year as well.

From a valuation perspective to ascertain whether the IT stocks and the index itself is in a bubble zone, one needs to look at the price-to-earnings ratio, or the PE ratio. There are many ways to interpret PE ratios. One is by historical comparison. As of now, IT industry ratios are somewhat higher than they have been in the past few years. However, the PE ratios are not in bubble territory in terms of historical comparison with the sector’s own ratios.

The Nifty is trading at roughly PE of 34x on trailing 12-months (TTM) basis, though allowances have to be made for a terrible first quarter of the fiscal 2020-21 (Q1FY21). Again, comparison with the market-wide valuations suggests that the IT sector is not over-valued as such. All the stocks in the IT Index are trading at a discount to the market average PE.

A third way to look at PE ratios is in terms of expected futures earnings growth. Here, the entire market could be arguably over-valued. Most corporates will see weak or negative growth through 2020-21 and first half of 2021-22 at least. The IT sector is better placed than most other industries in terms of earnings visibility and it is also a hedge against currency weakness.

A fourth way to examine PE ratios is in relationship to interest rates. As of now, policy rates are below inflation, which means that the real return from debt is negative. This gives investors an incentive to enter equity and other risky assets. It is some justification for the market-wide over- valuation that we are seeing.

Share Buybacks

The buyback offers from the big guns, Wipro and Tata Consultancy Services (TCS), are worth examining in broad terms. Apart from the specifics of possible arbitrage, especially in Wipro, buyback usually means higher valuations for the stock post-buyback. Investors will have to weigh the possible benefits of a quick, tax efficient return versus prospects of long-term capital gains.

However, a buyback also indicates that the company doesn’t see a better way to generate high returns on its accumulated profits. This implies that the company doesn’t see great growth prospects. Bear that in mind: It is unlikely that the sector has great growth prospects if TCS and Wipro are both handing out buybacks.

Overall, the IT sector is one of the few which could come out of the pandemic with decent prospects. The enforced retooling of office processes that has resulted has meant that the service firms in India’s IT sector have reorganised workflow in ways that should mean leaner, more cost-efficient operations going forward.

Summing up all the above-mentioned factors, the IT sector is perhaps over-valued but it is less over-valued than the broad market. It does create a hedge against rupee weakness. There seems to be cautious optimism going forward. The global recovery, as and when it does come, will help in revenue growth and earnings recovery.

(Devangshu Datta is an independent market expert. Views in this article are his own.)