Mind Over Money: Gambler’s Fallacy

- 2m•

- 1,490•

- 27 Jan 2023

We like to predict everything, isn’t it?

“That family has had three girl babies in a row. The next one is bound to be a boy.”

“India won 5 cricket matches in a row. They will lose this time”,

Back in 1913, something phenomenal happened…

One night, at the roulette tables of a Monte Carlo casino in 1913, something interesting happened. For the last 10 spins of the roulette wheel, the ball had landed on black. Because the gamblers thought a red was long overdue, they started betting against black. But the ball kept on landing on black. It was only after 26 consecutive blacks that the ball finally landed on red and the streak came to an end. By this time, the losses were staggering. This event was truly remarkable and became to be known as the “Monte Carlo fallacy,” or Gambler’s Fallacy. The gambler’s fallacy is all around us and tends to distort good decision making. Hence, gambler’s fallacy is nothing but the belief that if something happens more frequently now, it is less likely to happen in the future. Say a coin is flipped three times and lands on heads on each occasion. Suppose someone forces you to spend thousands of dollars of your own money betting on the next toss. Would you bet on heads or tails? If you think like most people, you will choose tails, although heads is just as likely. The gambler’s fallacy leads us to believe that something must change.

Gambler’s Fallacy And Stock Markets

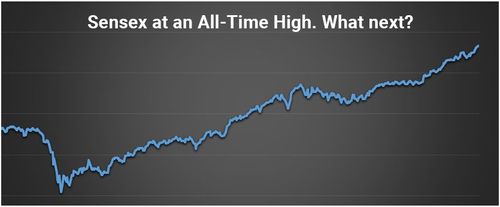

Take a look at this chart. This is BSE Sensex chart for the last one year. It has been hitting new highs every day and currently it is at 61,766, gained almost 50% since Jan 2020, when it was hovering around 41,000 levels. Do you think, there will be a correction or will it keep hitting new highs?

Source: BSE

Most of you will likely think that it will correct. But there is no certainty in the markets. No one technique will tell you the outcome in advance. Of course, based on some in-depth analysis, your odds of winning can improve.

Why Predicting Can Be Harmful In Stock Markets?

Suppose if you are a trader. You place a bet on Sensex with a stop loss, which soon gets triggered. But you do not lose hope, you place your bet again and repeat this for say next 7 trades. After your continuous losing streak, what would you do next?

Let me remind, you have faced 7 consecutive losses. But at this point, your conviction that the 8th trade will be a winner would be very high. Am I right? This is called ‘Gambler’s fallacy’.

This is true in the reverse situation also. Imagine you have made 7 consecutive right calls and now you think, in the 8th one you will definitely lose money. In reality, the odds of making a loss on the 8th trade is as high (or low) as it was when you placed your first bet.

Perhaps, this explains why many of us keep losing money or make very little money despite having profitable trades.

If You Can’t Predict Markets, Then What?

Investors should instead base their decisions on fundamental evidence-based analysis. One should not chase the best performing mutual fund or buy stocks only because they are buzzing around their 52-week low. Let data and reasoning be the decision making anchors for your investments and not your perceived predictability skill.

Nobody can predict interest rates, the future direction of the economy or the stock market. Dismiss all such forecasts and concentrate on what's actually happening to the companies in which you’ve invested. - Peter Lynch

References:

21 Best Peter Lynch Quotes on Investing

Gambler's Fallacy: Overview and Examples

Gambler’s Fallacy: What is it and How to Avoid it While Investing