Let Not the Variety Confuse You, Keep Your Passive Fund Investments Simple

- 3m•

- 1,109•

- 18 Apr 2023

Let not the variety confuse you, keep your passive fund investments simple

With just three or four passive products, you can build a solid, long-term portfolio

As markets evolve, active fund managers find it harder to beat the indices. When this happens, investors gravitate towards passive funds, which mimic an index. To prepare for that scenario, fund houses are launching a slew of passive products. Currently, the Securities and Exchange Board of India’s (Sebi) website shows that fund houses have applied for approval to launch eight passive products.

With such an avalanche of products, however, the lay investor can get confused regarding how to build his core portfolio using passive products.

Building Blocks Of Your Core Portfolio

On the large-cap side, there is growing consensus among financial advisors that active funds are finding it hard to beat their benchmarks, and hence investors will be better off going with passive products.

Retail investors can build their core portfolio with just two passive products. “Use a Nifty 50 fund and a Nifty Next 50 Fund as the basic building blocks of your portfolio,” says Anil Ghelani, head of passive investments at DSP Investment Managers. These two funds will give you exposure to large caps and also provide a flavour of midcaps, since the Nifty Next 50 index often has a few mid cap stocks (typically 8-10 per cent of the portfolio).

Once an investor has taken care of his large-cap exposure, he will want exposure to the mid-cap segment. Here, many advisors are reluctant to suggest a passive fund. Many believe that there is greater scope for active fund managers to outperform their benchmarks.

Besides performance, there are issues due to which it is difficult to run a passive fund in this category. The quality of stocks is one issue. Many stocks in this space can have corporate governance issues. Their accounting standards can be poor. The management quality can be poor. If a passive fund manager blindly picks all the 150 stocks in the midcap 150 index, and a couple of them blow up, the passive fund could suffer losses.

Many stocks have low liquidity. This can result in high impact cost (which means that the price shoots up on large buying and moves down on large selling).

Many advisors, therefore, suggest that you go for an active fund in this space. If you choose a passive fund, go with one that selects a few good-quality stocks (out of the universe of 150) by applying quantitative filters and invests in them.

The problems mentioned above (those points are truer for the smaller midcaps) get even more exacerbated in the case of small-caps. Investors may either avoid this space—it can be very volatile—or go for an active fund there.

Once an investor has built his domestic portfolio, he should take some international exposure—to the extent of 15-20 per cent of his equity portfolio. “You can use both an S&P 500 based fund and a Nasdaq 100 based fund for overseas exposure,” says Avinash Luthria, a Sebi-registered investment advisor and founder, Fiduciaries.

While a number of other products are available in the passive space, they are better suited for evolved investors or those who have advisors.

ETF, Index Fund, Or Fund-Of-Fund?

For most retail investors, an index fund is a better option than an ETF. Many retail investors do not have a demat account which is needed to invest in ETFs. In addition to the expense ratio of an ETF, investors will also have to bear the annual demat charge. There is also the brokerage charge that has to be paid at the time of buying and selling.

The biggest reason why many advisors suggest index funds is the bid-offer spread. “The market price of the ETF often differs from the net asset value (NAV), especially in the case of those that have low trading volumes. This imposes an additional cost on the investor. Most retail investors are not aware of this,” says Deepesh Raghaw, founder, PersonalFinancePlan, a Securities and Exchange Board of India-registered investment advisor.

In an index fund, the investor buys from or sells his units to the fund house, where he is assured of always being able to do so at the NAV. Investors can also run systematic investment plans (SIPs) in index funds.

Currently, however, there are more ETF options and fewer index fund options in many passive fund categories.

To do away with the issues in ETFs, many fund houses offer the same product as a fund-of-fund. Again, the expense ratio is higher in the fund-of-fund than in the ETF, but the former also does away with issues like the bid-offer spread.

Select The Right Product

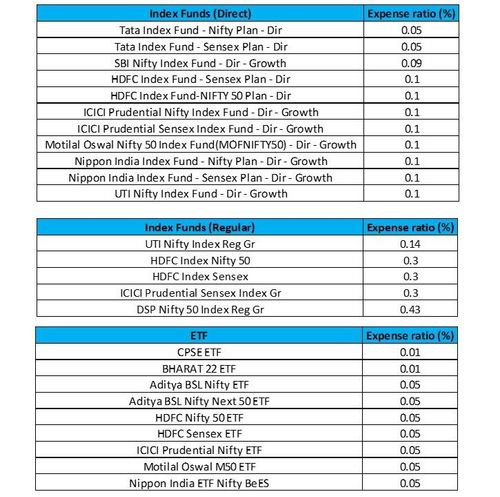

To select the right product, pay attention to two factors primarily. The first is the expense ratio. When investing in passive products, be paranoid about high costs. In the core categories, expense ratios have plummeted to very low levels nowadays (see table).

In an ETF, liquidity is an equally important criterion as cost. If you choose a low-cost product that has very little liquidity, the losses you suffer at the time of buying and selling (buying at higher than the NAV and selling at lower than NAV) can chip away a considerable portion of your returns.