Introduction to Technical Analysis

- 6m•

- 3,532•

- 23 May 2023

However, the fundamentals of technical analysis are fairly easy if explained right. Once you know that, you can easily understand how to do technical analysis of stocks. And that is what we are going to do this section—explain the importance of technical analysis and learn technical analysis of stocks using these fundamentals. But first, let’s hit the basics.

What Is Technical Analysis

Technical analysis is the study of chart patterns and statistical figures to understand market trends and pick stocks accordingly. Sounds complicated? Here is a simpler definition.

One day the share price is up, another day it may be down. But over time, if you look at the stock price’s movement, you may see trends and patterns emerge. The study of these chart patterns and trends in stock prices is called technical analysis of stocks. When you learn technical analysis of stocks, you will understand the big role that technical indicators play.

First before we learn how to do technical analysis of stocks, let us understand some of its broad features:

-

History Repeats:

Technical analysts believe that historical price trends tend to repeat over time. So, they sit with historical stock charts, look at price and volume information and then using trends, they try to figure out how the stock’s price may move in the future. Accordingly, they pick stocks that they feel will appreciate and sell the ones they feel will depreciate.

-

Technical Analysis V/s Fundamental Analysis:

The technical-analysis approach to the study of stock charts is the opposite of the fundamental approach. If you were a fundamental analyst, you would study a company’s financial statements, such as the income statement and the balance sheet, to ascertain its growth potential. You would also try to monitor factors outside these financial statements that would increase the company’s earnings in the future. For example, you would keep track of the new businesses the company is investing in, the new markets it is entering, and the new technology it has adopted, and so on.

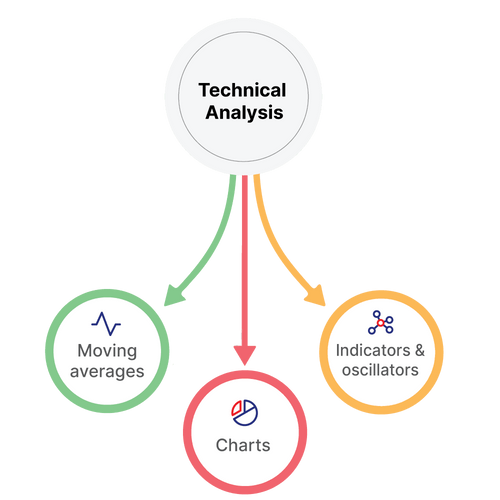

Technical analysis doesn’t believe in this approach. It believes that stock prices move in circles. If you can spot the section of the circle the price is currently in, you will be able to make sound investment decisions. To identify the current stage of the price pattern, you would use some analytical tools. These include various types of stock charts, some momentum indicators and moving averages. We will get into these in detail in further sections.

Fundamentals Of Technical Analysis:

In order to use technical analysis for predicting stock prices, we have to assume that there is some relationship between historical chart patterns and future stock prices. This is the only way we can meaningfully use historical data to predict future prices.

There are three fundamental assumptions in the technical analysis of stocks. They are:

-

Market Prices Reflect All The Information About A Stock:

Earlier, we said that fundamental analysis concerns itself with financial and other information about a stock. Technical analysis of stocks, though completely detached from fundamental analysis, works on a similar premise.

If you are a technical analyst, you believe that all investors are aware of everything there is to know about a stock. They actually use this information when making buy/sell decisions.

This information subsequently gets reflected in the stock’s price and ultimately the stock chart. This is why they only study chart patterns to gauge market trends, and not concern themselves with fundamental factors.

-

Patterns Tend To Repeat Themselves:

The last assumption that validates a technical analysis is that trends are repetitive. In other words, suppose a stock chart moves in a hypothetical pattern- A-B-C. So, each time we reach ‘C’, we will again start from ‘A’, and then go to ‘B’ and eventually ‘C’. This pattern will repeat itself without fail.

Only once you make this assumption can you predict future stock prices based on technical analysis. Without this assumption, there is no way to tell where the price will go next by simply looking at a chart.

-

Stock Prices Follow Trends:

Technical analysis of stocks is based on the idea that each stock chart has its own unique trend. Prices move only within this trend. Every move in the stock price will indicate the next move. Let’s take the hypothetical example of a ripple.

When you throw a stone in a pond, you know that consecutive ripples will get formed as soon as the stone hits the water. After a few ripples, the trend will die out. However, the next time you throw a stone, a similar ripple will appear again.

Similarly, even for stock charts, you know the trend from past experiences. Naturally, the move in either direction may be larger or smaller than before, just like ripples. If you throw a larger or a smaller stone, ripples too will be larger or smaller respectively. However, the pattern of these ripples will not change dramatically.

Based on these assumptions, you can use three important technical indicators to identify market trends and predict future stock prices. They are:

-

Charts:

Price and volume charts are the most typical tools that are used as technical indicators for technical analysis. A volume chart depicts the number of shares of a company that were bought and sold in the market during a day.

For the purpose of technical analysis, you may choose one of the traditional line or bar charts, or alternatively, use a candlestick chart. A candlestick chart is a special kind of chart that is particularly relevant for technical analysis. It is in the form of a series of consecutive candles. We will discuss candlestick charts in detail in the section on stock charts. Charts are used together with trendlines.

Trendlines indicate the direction of movement of a stock over a period of time. We will discuss them later too.

-

Momentum Indicators:

Momentum indicators are statistical figures that are calculated based on price and volume data of stocks. These technical indicators act as supporting tools to charts and moving averages.

Once you are through with forming an opinion about a stock based on the other tools we have discussed, you can use these indicators to confirm your views. Some momentum indicators are signs that occur before the price move you expected occurs. They confirm that the price is indeed going to move as you thought it would.

These are called leading indicators. Other signs come after the stock has started moving in a particular direction. They are called lagging indicators. They confirm that the stock will continue moving in this direction. Indicators are also used together with moving averages.

For example, when a stock price moves in such a way that it starts falling within a moving average, it is a confirmatory sign that it will continue to move as expected. This is called a crossover. Other popular momentum indicators include moving average convergence divergence (MACD), accumulation/distribution line and Aroon. We will discuss some of these in subsequent sections.

-

Moving Averages:

Moving averages are calculated to remove sharp, frequent fluctuations in a stock chart. Sometimes, stock prices can move very sharply in a small period of time.

This makes it hard to discover a trend in the stock chart. To remove the impact of this, and make a trend more prominent, an average of a few days price is calculated. For example, if a five day pattern of a stock’s price is Rs.50, 53, 47, 45 and 52, it is difficult to tell the direction in which prices have actually moved. However, if you can calculate the average of these prices and compare them with the average of the next five days and the previous five days, you can ascertain a broad trend.

This kind of moving average is called simple moving average (SMA). Other commonly used moving average concepts are exponential moving average (EMA) and linear weighted average (LWA). It may be noted though, that moving averages are calculated for longer durations than five days. Ten days and one month moving averages are more common.

Importance Of Technical Analysis

Technical analysis is gaining popularity worldwide. Here are some of the reasons why it is so important to the analysis of financial markets :

-

Mathematical Approach :

Technical analysts use probability to pick stocks. By using probability, they are able to predict the outcome of an action without necessarily needing to scrutinize it in great detail.

So, technical analysis tells you how prices are going to move without requiring you to bother about the nitty-gritties that will cause the price to move. It is much quicker and less laborious than fundamental analysis.

-

Signs Of Upcoming Danger:

Sometimes, a major fall in stock prices is just around the corner but nobody can see it coming. Fundamental analysis tools are unable to predict it. However, by using historical chart patterns and other technical tools, one can predict the fall.

Now naturally, technical analysis cannot tell you the reason for the fall, but it can tell you that it is about to come. You can prepare yourself for it accordingly.

For example, before the 2009 financial crisis, everything was going well in the US stock markets. Nobody could say that stocks will fall so soon and so sharply. However, technical analysts predicted beforehand that markets are about to enter one of the biggest falls ever.

-

Identification of Short Term Trends

Fundamental analysis is more relevant for investors who want to invest for a long period of say three to five years or more. This is because any profitable business model takes time to be successful.

So, investors too have to remain patient. This is not so with technical analysis. Eventually, the success of a stock depends on the company’s profitability. This cannot be predicted by technical analysis. It can only tell you whether the stock is going to move up or down in the near future.

For example, if a company acquires a new plant and starts producing more output from it, its revenues will go up. This should lead to an increase in its stock price. But how can you predict such a change by simply studying past charts and trends? In the short run, however, fundamental factors can only have a small effect on prices. For example, the plant we just talked about cannot start producing overnight. It will take time. In such cases, technical analysis presents a clearer picture. Thus, technical analysis is more relevant if you want to make a quick buck in say three to six months, or even three.