Don’t Ignore the Power of Compounding and Early Investing!

- 4m•

- 1,285•

- 24 Apr 2023

Turning Rs 30,000 into Rs 69 lakhs is possible…

“Yay! I got my first salary today. Gonna buy a Royal Enfield!” exclaimed Rahul. I will ask Dad to fund the balance amount”. Rahul’s friend Kavita hi-fived him, “Awesome Rahul, but why don't you save up and invest now? Then buy something even better and something you can afford later,” suggested Kavita.

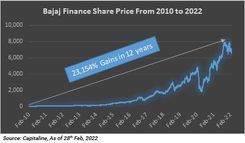

“Live in the moment yaar, Kavita. Itna time kaun wait karega.” Rahul disposed-off the idea. Kavita pulled out her tablet, and quickly drew up this chart:

If anyone would’ve bought Rs 30,000 worth of Bajaj Finance’s shares in 2010, they would be worth Rs 69.7 lakhs compounded annually at 57%! “Now, you could’ve bought a premium car with this amount!” exclaimed Kavita.

She was speaking about the ‘Power of Compounding’. What she meant was, small investments made consistently over time build upon themselves and, eventually, amount to something big.

It’s The 8th Wonder Of The World!

Noticing confused expressions on Rahul’s face, Kavita explained further. “At first glance, compound interest may come across as an insider catchword. But it is not. Your day-to-day activities also have compounding effect. Be it regularly brushing your teeth, reading, meditating, eating veggies, doing yoga…”

You see? You build on what you did today tomorrow. You start the next day a bit better, may be so little that you can’t even measure it, than you were the day before. But if you add up these increments over the course of time, the results can be massive. In fact, Albert Einstein once said “Compounding is the 8th wonder of the world”.

Kavita Shows Magic Of Compounding

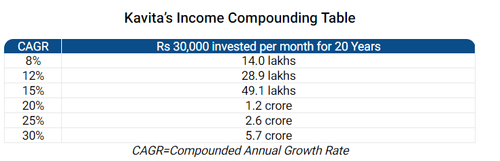

Compound interest is one of the most useful and relatively low-effort tools to help you take control of your life. Kavita was hell-bent on changing Rahul’s mind. She drew up another table:

With compound interest, the first year's interest is added to the principal. For the second year, therefore, the principal which is now earning interest is higher. The principal will be more the next year, still more the year after that, etc. Thus, each succeeding year's interest will be correspondingly greater than in past years. If the holding period is high, the more compounding can work its magic and in turn higher will be the returns. Yes, that's correct. Starting early matters too. That’s why, Kavita wanted to ensure Rahul started investing right away.

Kavita added, “Do you get the point I am trying to make here? This is what the power of compounding can do. We all have heard stories of people carrying out children's marriage or education by encashing on their investments in shares of Hindustan Unilever, Asian Paints, HDFC Bank, Reliance Industries, Infosys... The key here is time frame - 10, 15, 20 years holding an investment which funded one big life expense.”

To add to Kavita’s argument, not only do individual stocks have the compounding power. If you look at Nifty index as a whole, in the last 20 years it has compounded by 14%! Hence, simply replicating the index would’ve made you a lot of money.

Put Your Money To Work For You, Rahul

In terms of behavioural finance, compounding is nothing but consistency coupled with patience. As they say, ‘Rome was not built in a day’. The takeaway is simple: The higher your compounding rate and the longer the time horizon, the bigger the corpus will eventually be. Rahul was listening to her carefully throughout. Rahul was about to ask something and Kavita interrupted, “But Kavita….”

“However, hang on Rahul…” said Kavita, “I would like to add a caveat that few stocks are able to give such returns for an extended period of time. You have to be really cautious while putting money with the hope of benefiting from this strategy.” “Aah,” said Rahul, I think I am starting to get this...” He paused. Seeming to go into deep thinking.

While Rahul still figures this out, what do you think? Are you making YOUR money work for you?