Is India's Rising Population a Boon or Bane for the Economy?

- 4m•

- 4,379•

- 15 May 2023

In the bustling city of Mumbai, lives a young woman named Anjali. She is part of a generation of Indians driving the country's growth. As Anjali heads to work, she notices new shops and restaurants popping up in her neighbourhood. The area has undergone a rapid transformation in recent years, with new businesses catering to the needs and aspirations of the burgeoning middle class. Anjali is part of the middle class and enjoys the benefits of her newfound prosperity. She has a good job, a comfortable home, and the means to indulge her passions and hobbies. She’s also part of a digitally savvy population that adapts to the opportunities presented by the digital age. As Anjali finishes her day at work and returns home, she reflects on the opportunities and challenges ahead. With nearly 80% of households expected to be middle-income in the next decade, India is on the cusp of an economic shift that will drive consumer spending and fuel growth for years.

With an average age of just 30, India has one of the youngest populations in the world. This unique demographic profile presents an opportunity for the country to leverage its human capital and achieve growth & development.

Let’s understand how with the example of Japan.

The Population Pyramid of Japan

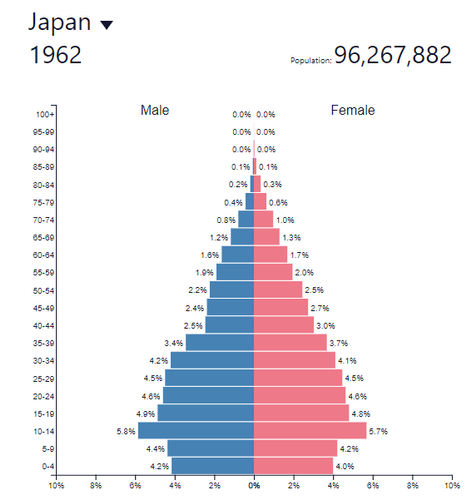

In 1962, Japan had an ideal population pyramid, as shown in the chart below, with a well-balanced distribution of ages.

Source: Population Pyramid

Japan's demographic bonus has contributed to its economic growth over the past few decades.

The reason behind this is that businesses need a growing demand to succeed, which is driven by productivity gains, which are predominantly contributed by the working-age population.

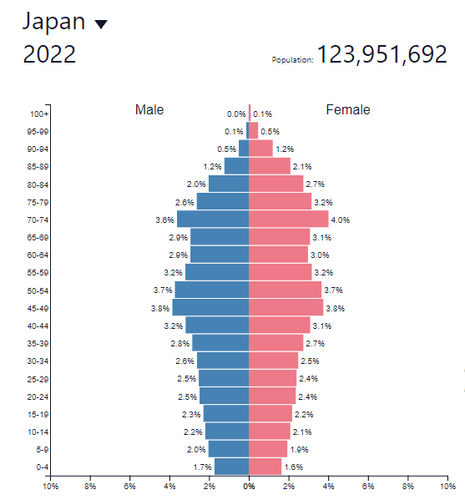

Now look at the same chart but for the year 2022.

Source: Population Pyramid

As you can see, Japan is currently experiencing a rapidly ageing population and declining birth rates. This has resulted in a shrinking workforce and a strain on social welfare systems. The Japanese government has implemented various policies to address this issue, including incentives for childbirth and immigration policies, but the impact remains to be seen.

That is why India's young population is a key advantage in the economy in many ways. Unlike many developed countries, India is unique because it has a demographic gift that will last decades. Over 60% of the country's working-age population is between 15 and 60 years, giving it a clear edge over countries like Japan.

India’s Unique Opportunity

As our team sat down to read the recent issue of The Economic Times, one particular headline piqued our interest.

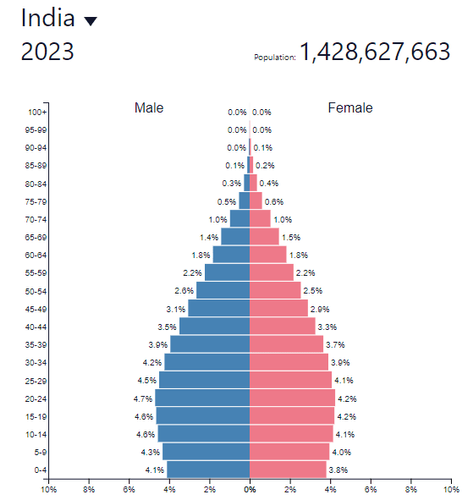

India has most likely pipped China as the most populous country in the world. India’s population surpassed 1.428 billion, slightly higher than China’s 1.425 billion people.

This makes us wonder how investors can decide on their investments based on the above data because there are multiple ways to look at it and play the trend.

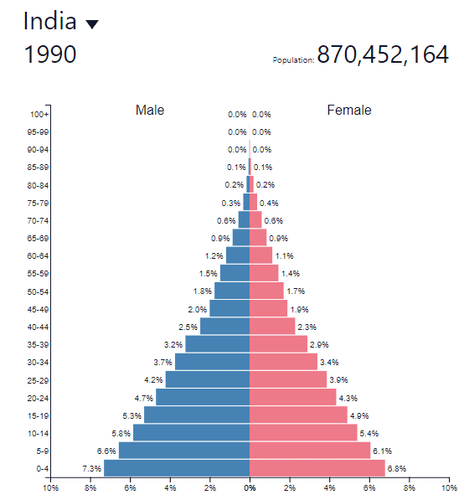

Like Japan, even we had the perfect pyramid back in the 90s:

Source: Population Pyramid

India's population pyramid in the 1990s had a broad base, indicating a large population of young people. This was in contrast to the global population pyramid, which had a narrower base and a larger proportion of older people.

A large youth population provides a demographic dividend, as these individuals are often in their prime working years and can contribute significantly to the economy.

India's favourable demographic profile in the 1990s was a key factor in the rapid growth of India Inc. So, what does the pyramid tell us today?

Source: Population Pyramid

As you can see, it’ll be a long time before ageing sets in. Smart investors would do well to choose their stock picks from specific sectors expected to benefit from India’s rising population.

Sectors to Watch Out

Remember that we are focusing on the long-term trend when we say sectors to watch.

Infrastructure

This is the prominent industry that stands to benefit from this trend. The government must create jobs for this growing labour force to avoid unemployment and social unrest. To take advantage of this demographic shift, the Indian government has been actively pushing for infrastructure development across the country with a focus on creating jobs, boosting economic growth, and improving quality of life. This can also lead to the growth of related industries such as cement, steel, and other construction materials. Note that the government is focusing on infra to get more foreign investments and it’s paying off. Companies looking to move away from China for production are preferring India as a manufacturing hub. Take the example of Apple, Inc. The company’s CEO Tim Cook said “India is going to be our major focus from now”. Watch this short video to know why:

Real estate

The rate at which India's population is ageing and becoming more affluent is rising. As a result, there is a growing demand for premium and comfortable living spaces, including second homes and vacation homes. The real estate sector becomes the obvious beneficiary.

Technology

India has a large pool of tech talent. As the population grows and more young people enter the workforce, this talent pool can increase. This means that there will be more individuals with the skills and knowledge necessary to start and grow successful tech companies. The Indian government has also been actively supporting the tech sector's growth through initiatives such as Startup India and Digital India. Click here to see the sectors that should benefit from structural changes towards digitization.

Before We Wrap Up…

Remember Anjali from our story? She comes to the conclusion that India's rising population presents both opportunities and challenges for the economy, and that the country must navigate the challenges carefully to achieve sustainable growth and development. There should be increased focus on societal health and on monitoring inflation, to get more foreign direct investment (FDI) flows interested in the nation. But she is optimistic about the future and believes that with the right policies and investments, India's young population can drive the country towards a brighter tomorrow. Until next time…

Sources: Kotak Securities, Economic Times, Population Pyramid