Considering Sovereign Gold Bonds? Read This First

As good as Gold. To be sitting on a Gold mine. To be worth one's weight in Gold. To go for the Gold.

These are commonly used idioms. Notice how Gold sets a high standard. This can also be seen in India’s love for Gold. In fact, according to the RBI Indian Household Finance report from July 2017, the average Indian household holds 11% of its wealth in Gold. So, let’s understand the interest in Gold.

Why Invest In Gold?

Gold is considered to be one of the most lucrative and liquid investment assets. “In dollar terms, Gold has delivered an annualised return of 8% since 1970,” says an ET Now report. The return is even better when we see in INR terms. In 1970, 10 grams of 24-carat Gold was Rs 184. Today, it is Rs 46,000, as of 5th June, 2020. This roughly translates to an annualised return of ~12%.

Why? Because Gold gets a double benefit

-

Asset price appreciation in dollar terms

-

Impact of rupee depreciation

Since 2008, rupee itself has depreciated by almost 80-85% (39.40 to 75 now).

So, when one is invested on Gold in INR terms, he/she not only benefits from an increase in Gold prices in dollar terms, but also gets the advantage of the Rupee’s weakening, if any. Gold is also considered to be a real hard currency in today’s world of fiat currency, where one can print as much currency as possible.

Gold, a good hedge

Hedging is important for every portfolio. It’s even more important during volatile situations. The underlying principle is simple: When one asset falls, your portfolio relies on another asset to deliver returns.

Generally, investors rely on Gold to hedge against the stock markets. Take the two instances of market crashes—2008 and 2011-12. Both times, Gold moved higher even while stock prices fell, according to this research paper.

Gold vs Dollar

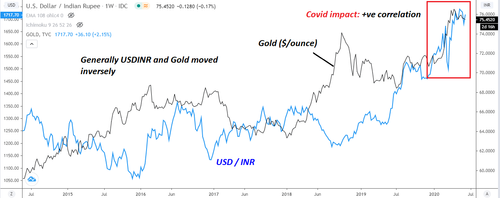

‘Correlation’ is an often-used important metric. It measures whether prices of different assets move in the same direction or if they move in opposite directions, and by what degree.

Gold is usually considered to move opposite to the US Dollar. These days, the US Dollar and the gold seem to be moving in the same direction. Here’s a chart that shows Gold’s upward movement in 2020.

Asset allocation

If you’re one of those investors who have not invested in Gold at all, consider this: Financial planners and advisors usually recommend investing around 5-10% of your portfolio in Gold. After all, asset allocation helps diversify your investments, thereby reducing the potential for loss.

Outlook for Gold

Here’s what our Commodity research team has to say about the outlook for Gold.

Gold prices are likely to stay firm in coming months. This is because global economies may struggle to recover from the slump caused by the virus outbreak. Meanwhile, central banks and governments may continue with stimulus measures to boost growth. The huge monetary infusion by central banks may increase challenges for economies in the form of inflation and currency devaluation. This is expected to further increase the appeal for gold. In the long run, investors may consider gold to diversify their portfolio, especially to withstand times of uncertainty.

How To Invest In Gold During Covid-19?

Visiting jewellers may not be easy during the current Covid-19 pandemic. So how do you invest in Gold?

Here’s a better option: The Sovereign Gold Bond (SGB).

What is the Sovereign Gold Bond?

A SGB is simple. The government offers you a bond which is as good as buying real Gold. You pay an amount and buy a bond by paying an equivalent amount of money. In exchange, the bond pays a regular interest for a fixed amount of time. After this ‘time period’, you can redeem your bond at the then market value. Simply put, you can potentially enjoy both an interest income as well as an increase (if any) in the value of your investment.

Instead of buying real Gold, you buy Gold in exchange for an equivalent amount of money. This way, you can buy as less as 1 gram of Gold.

In FY21, the Reserve Bank of India has announced a new ‘tranche’ of the Sovereign Gold Bond to be issued every month. Each set comes at a different fixed price, depending on the prevalent market conditions.

The last tranche—2nd in the series of 8 tranches scheduled for this financial year — was offered between 11th May and 15th May 2020, priced at Rs. 4,540 (including a Rs.50 discount for online applications).

The latest offer—the 3rd tranche—is scheduled for 8th June until 12th June 2020. This issue is priced at Rs. 4,677, again including a Rs.50 discount for online applications.

So what should you consider while deciding to invest in the SGB? Here are some factors that may help:

Advantages of the Sovereign Gold Bond (SGB)

1. Safety

Pedigree matters, right. When buying stocks, you may often look at the quality of the company’s management. Similarly, when it comes to investing in bonds, it matters who issues it. In this case, it’s the Government of India, the ‘Sovereign’. Government-backed securities are generally considered very safe.

2. Interest income

Another important requirement in the Covid-19 times—income. The current issue of SGB reaps a 2.5% annual interest. This is counted as a percentage of the value you bought the Bond at. Here’s the calculation: If you bought 100 grams through SGB at Rs. 4,54,000, it would bear Rs 11,350 as annual interest. (Do note that each unit of SGB is equivalent to 1 gram of Gold) This is in addition to any increase in the Gold price throughout your investment.

3. Tax-efficient

Speaking of an increase in Gold price, when you redeem your SGB investments after the maturity period, the gains will attract zero tax. Yes, SGB redemptions are exempted from Capital Gains tax. In case you sell your SGB investments on the exchange, then you may attract capital gains.

4. Buy small amounts

When it comes to buying physical Gold, you may have to buy a certain minimum amount. Plus, you’ll have to pay making charges too. These hassles are avoided with SGB. There are no extra charges, and you can start with a small investment of a few thousands as per the latest price of a single unit of SGB. For the June 2020 subscription, this means a minimum investment of Rs 4,677. This amount, though, will vary if you are buying on the Exchange, depending on the recently traded price.

Disadvantages Of The Sovereign Gold Bond (SGB)

1. Hold until maturity

As an investor, you always consider how long you will hold the investment. In the case of SGB, the maturity period of 8 years. However, you can redeem the Bond early after 5 years.

That said, your SGB holdings are credited to your demat account. This can then be sold in the stock market just like any listed stock, however after the lock-in period. This trading is possible 15 days after issuance, on a date notified by RBI. The only concern is that you may not find enough buyers in the secondary market.

2. Interest is taxable

All the gains during redemption may be exempt from tax. But the interest income is taxable. You will have to add it to your taxable income and pay tax as per your Income Tax slab rate.

An alternative to the Sovereign Gold Bond

Another investment you can consider is a Gold Exchange Traded Fund (ETF). This is an investment vehicle that allows investors to pool money to buy Gold. Every investor is allocated an equivalent ‘Unit’ of a Gold ETF depending on the investment amount. Each unit of Gold ETF is equivalent to 1 gram of Gold. These are then traded on the exchange like a regular stock. This allows investors to buy and sell the financial version of Gold. You can learn more about Gold ETFs here.