Introducing Kill Switch on Kotak Neo.

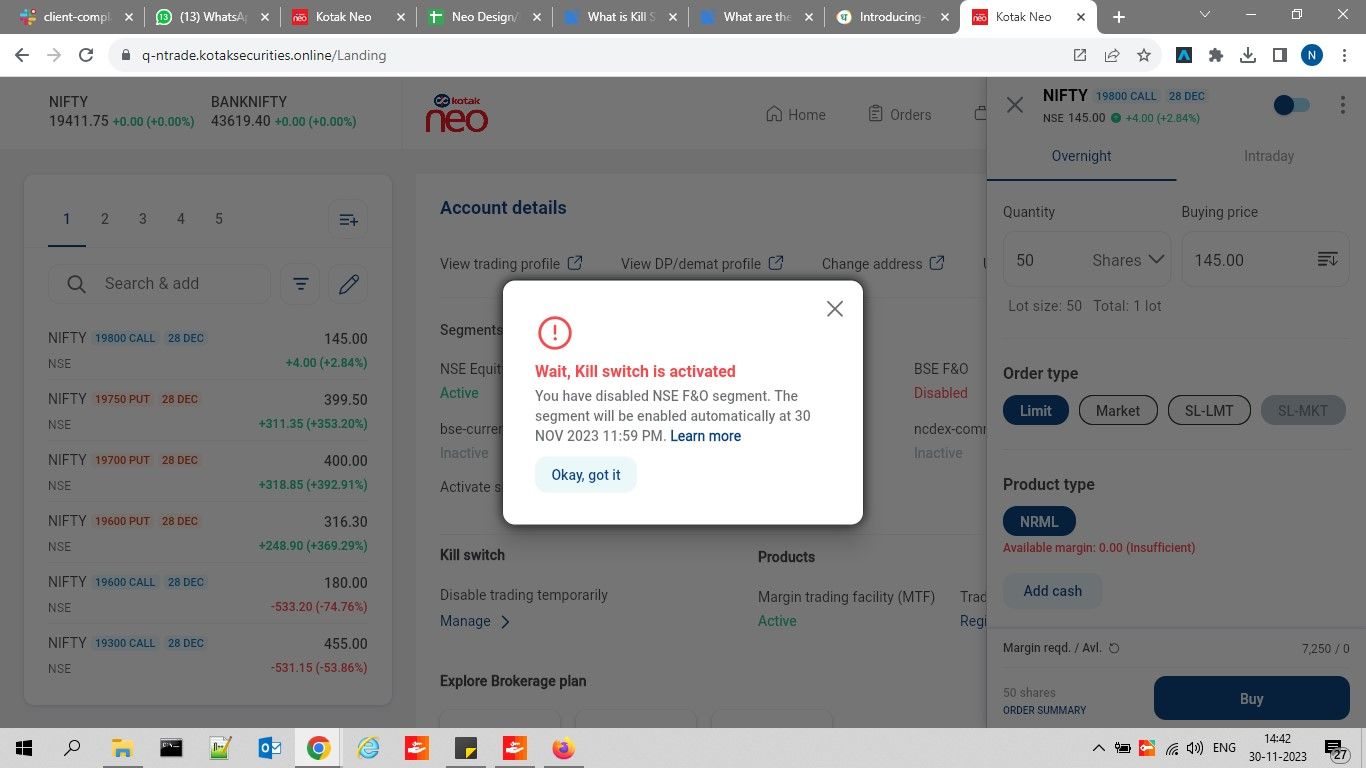

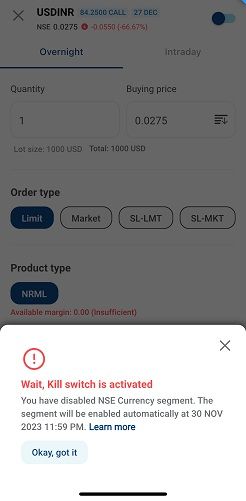

Introducing Kill Switch on Kotak Neo, a revolutionary feature that empowers traders with greater control over their trading activities. Keeping in mind the importance of discipline in the dynamic world of trading, Kill Switch allows you to selectively disable specific trading segments on Kotak Neo for the entire day hence preventing fresh order placements.

How to use Kill Switch:

To activate the Kill Switch on the Neo Mobile App or Neo Website, just follow these simple steps:

Step 1: Navigate to Profile > Account Details > Under Segments > Kill Switch.

Step 2: Click on “Manage”.

Step 3: Choose one or multiple segments to disable, or disable all segments at once.

Step 4: Click on the "Disable Segments" button, confirm your choice, and the selected segments will be instantly disabled.

Step 5: Once a segment is disabled, order placement will be blocked until the end of the day (11.59 PM).

You could also follow the video below to understand how to enable Kill Switch on desktop:

You could also follow the video below to understand how to enable Kill Switch on mobile:

Important Note:

Before disabling a segment, cancel your open orders and exit/square-off your open positions.

Automatic Re-enablement:

The system will automatically re-enable the segments at midnight (12.00 AM) on the next day, allowing you to resume the order placement/trading with a refreshed perspective.

Experience a more balanced and controlled trading journey on Kotak Neo. Take breaks when needed.

Frequently Asked Questions

You will be able to cancel & modify your open/pending orders. However, it is advisable to cancel them before activating the Kill switch.

Open positions remain active, and you can only exit/square-off at the market price, by using the multiple square-off functionality available in the positions section. It is recommended to exit/square-off all your positions before activating the Kill Switch, as you will not be able to place a single contra order.

SIP orders under the equity segment will not be blocked. They will proceed as scheduled.

The orders will be blocked only on the Neo mobile app & website - for single orders, basket orders and orders placed via Trade from Charts. You will still be able to place orders from Strategy Bot, InstaTrade, Stockcase, Smallcase, SIPIT, Cherry, Nest Trader, Trade APIs and other integrated Fintech platforms.

There is no manual re-enable option on the Neo mobile app or website. The system will auto-enable segments at midnight. For urgent matters, contact us through the Support or Feedback options on the platforms.

If you are logged in and actively using your account on multiple devices at the same time and activate the Kill Switch from one device while placing orders from another, the orders will get placed from the other device. It is highly recommended to log out from all devices and re-login to ensure the Kill Switch is effectively applied across all sessions.

Yes you can place orders through InstaTrade if your Kill Switch is activated. Kill Switch will not be applicable for InstaTrade feature.

Yes you can place orders through Strategy Bot if your Kill Switch is activated. Kill Switch will not be applicable for Strategy Bot feature.