Basic Terms & Concepts Of Mutual Funds

- 3m•

- 3,423•

- Updated 09 Aug 2023

As you learn and understand all about mutual funds, you will come across terms and concepts of mutual funds that are specific to it.

Here’s a jargon de-buster for you:

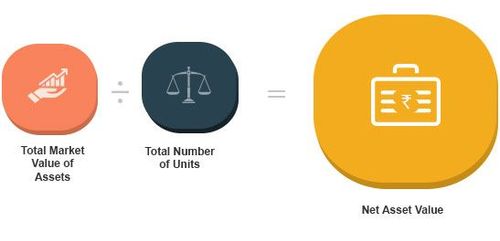

Net Asset Value

It is the market value of all the securities held by the scheme. It is measured on a per-unit basis. Since the market value of securities changes every day, the NAV of a scheme also varies on a day-to-day basis.

NAV is calculated by dividing the total net assets by the total number of units issued. Total net assets is the market value of all the assets a mutual fund holds, less any liabilities, as of a certain date.

For example, if the market value of securities of a mutual fund scheme is Rs 200 crore and it has issued 10 crore units to investors, then the fund’s NAV per unit is Rs 20. NAV is required to be disclosed by mutual funds on a regular basis – either daily or weekly depending on the type of scheme.

Assets Under Management (AUM):

A mutual fund pools money from investors and uses this money to buy assets like stocks, bonds and other securities. The total value of the assets a fund buys is called the assets under management (AUM).

-

Automatic Reinvestment

A mutual fund gives return in two ways – dividends and an increase in value. The latter can be utilized only when you sell the mutual fund unit. The dividends, however, are accessible as soon as they are distributed. As an investor you can use this in two ways – reinvestment or payout. When you choose the payout option, the dividend amount will get credited in your bank account. In case of reinvestment, the dividend amount will be utilized to buy more MF units of the scheme. The automatic reinvestment option is a service the fund house provides to shareholders, giving them the option to purchase additional shares using dividends automatically.

-

Capital Gains Distributions

Apart from dividends, mutual funds also distribute the profits it makes from selling some of the underlying assets at higher values. This is called capital gains distribution. This can also be used to buy more MF units (reinvestment).

-

Compounding

When you invest in a financial asset, you earn on the amount invested. Over time, you can either reinvest this amount or put it in a bank account. Either way, you earn some amount on your existing profits – either through investment returns or from bank interest. Thus, your total returns over time increase. This is called compounding. Over time, compounding can produce significant growth in the value of an investment. For example, you invest Rs 1000 today and earn Rs 100 profit a year from now – a return of 10%. You decide to reinvest this amount too. The next year, a return of 10% gives you Rs 110, not Rs 100. The greater the frequency of investment or interest payments, the higher is the effect of compounding.

-

Depreciation

This is the decline in your investment’s value in the mutual fund. This means, you will make a capital loss when you sell the mutual fund units. It is just the opposite of ‘appreciation’.

-

Diversification

Diversification is one of the key benefits as well as characteristic of a mutual fund. It is the practice of investing in different types of securities or asset classes. This is done to reduce risk. The underlying principle is that not every asset moves in tandem. Some rise, while some fall at the same time. So when you own both the stocks in your portfolio, any losses from one would be nullified by the gains in the other, thus reducing your overall risk.

-

Average Portfolio Maturity

The average maturity of all the securities in a bond or money market fund’s portfolio.

-

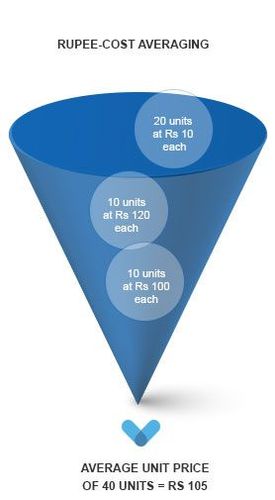

Rupee-Cost Averaging

Every day, values of financial assets change. So, when you buy at two different times, your purchase/market price will differ. For example, today you buy 10 units at Rs 100 each. Tomorrow, you may buy another 10 units for Rs 120 each. Your average price of the 20 units will be Rs 110 – the average. So, when you finally sell the units for Rs 150, your profit will be Rs 40/unit. Usually, investors fix the amount to be invested every month or quarter. This is usually done in the hopes of reducing the average price by buying more units when the prices are low, and fewer units when prices are high.

-

Portfolio

This is the collection of assets owned by the mutual fund or even you as an individual. It includes all the financial instruments invested in like stocks, bonds, and other securities. In a mutual fund, an expert handles all these assets. He or she also decides which assets to buy and sell. This specialist is called the Portfolio Manager. The frequency of the trading activity – how often assets are bought and sold – in the fund’s portfolio is called the Portfolio Turnover.

-

Ex-Dividend Date

Just like companies, mutual fund houses announce the amount of dividend to be distributed a few days before the actual distribution. The date of the distribution is called the dividend date. Once this happens, the fund’s net asset value reduces as the dividends are deducted from the fund’s assets. The day of this deduction is called the ex-dividend date.

-

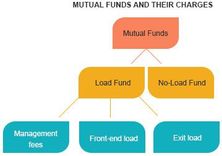

Load

This is the amount a mutual fund charges investors for various reasons. There are different kinds of loads – management fees, entry or front-end loads, exit loads.

- The amount paid to your fund manager for his expertise and portfolio management skills is called management fees.

- Entry/front-end load is the amount a mutual fund charges when units are purchased by investors. This is usually rare.

- Exit load is the amount a mutual fund charges you for selling or redeeming your shares.

All these shares usually differ from fund to fund. There are funds which do not charge any fees or loads. These are called No-load funds. MFs that charge investors are called Load funds. To compare one fund from another on the basis of the amount they charge investors, the expense ratio is used. It is calculated by dividing a fund’s total expenses to its total assets, expressed in percentage format. Apart from this, investors may also have to pay their brokers or sales agents a small fee called Commission.

-

Total Return

This is the total amount of profits an investor makes keeping in mind the dividends, capital gains from selling units, distribution of fund income as well as returns earned on reinvestments. The total amount paid to funds in the form of fees or commissions should be deducted to get the total return. It can be used to measure a fund’s performance. It is often written as a percentage of the total initial investment. Yield is also used by analysts to measure the income earned by the underlying assets in a fund’s portfolio. It is calculated by subtracting the fund’s expenses from the income earned by the assets through dividend payments and capital gains, and then dividing by the total price per share. The yield is usually expressed as a percentage.

-

Fund Switch/ Exchange Privilege

Many fund houses group a set of mutual funds together based on their investment objectives, or other factors like management. This is called a family of funds. Fund houses then give investors an option to transfer their investments within the fund family from one scheme to another as and when they require. This is called a fund switch or an exchange privilege. For example, a family of funds may include an equity scheme, a debt scheme and a balanced scheme. An investor could then choose to move his/her money amongst the funds as and when needs and objectives change.

-

Investment Objective

Every investor puts his money in financial instruments for a particular reason. This may be to increase wealth or accumulate money for buying something in the future, or simply to preserve your money from inflation. This goal is called your investment objective. Similarly, the mutual fund also has a goal, which it aims to achieve on behalf of its investors. It could be capital appreciation – profits – in the long-term or distributing regular fixed income.

-

Prospectus

Every mutual fund is supposed to give details about its company, the investment objectives of the fund, the risks it perceives, services offered as well as fees. This official document is called the prospectus. This is a must, and every investor should read the fine print carefully. Some mutual funds also offer a shorter version of this document in addition. This is called the summary prospectus.

-

Investment Company

A mutual fund is registered with SEBI as an investment company. This is the corporation or trust that invests the funds collected from investors on their behalf across securities.

-

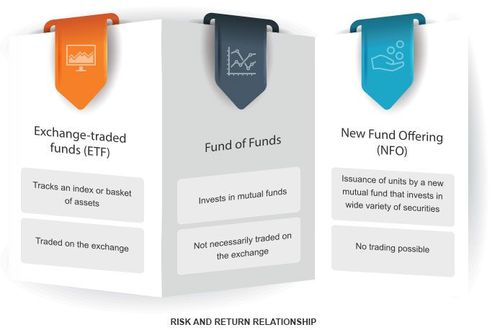

Exchange-Traded Fund (ETF)

An exchange-traded fund is an investment vehicle much like a mutual fund, but which is traded on stock exchanges. It generally tracks an index, a basket of assets or a commodity. The value of the fund keeps fluctuating like a share due to demand-supply forces. Since most ETFs track a certain benchmark asset, it does not need active portfolio management services. For this reason, its charges are usually lower.

-

New Fund Offering (NFO)

When a stock gets listed on the exchange, it comes up with an IPO or Initial Public Offering. Similarly, when a mutual fund starts a new scheme and invites investors to put in money in exchange for units, it is called a New Fund Offering or NFO.

-

Redeem

There are two ways to exit a mutual fund – sell it to another investor or back to the fund. The latter is called ‘redeeming’. Once an investor redeems his or her lot of MF units, the NAV of the fund changes. This is because the total number of units issued to investors differs. Many mutual funds charge investors for existing within a certain period of time. This charge is deducted from the Net Asset Value (NAV) and the remaining is paid to the investor. This price is called the redemption price.

-

Risk/Return Tradeoff

What is risk in the securities market? It is simply the degree of fluctuation in your asset’s price. A high risk is when the asset’s price changes a lot. It could be on the higher side or on the lower side. For this reason, it is believed that high return is possible only if you take a great risk. Similarly, if you are not willing to take a high risk, you must be satisfied with low returns. As an investor, you have to choose how much risk you are willing to take, and how much you are willing to compromise on your returns. The principle of risk-return tradeoff is similar to this. It believes that an investment would potentially give higher returns to compensate for the likelihood of higher volatility. Simply put, you as an investor could be compensated more richly if you take more risks.

Debt market-related terms

While investing in a debt mutual fund , you may come across some terms specific to bonds and the debt market. These will help you understand your debt mutual fund better.

Here are some of them:

-

Issuer

This is the organization that issues debt-market securities like bonds, commercial papers and certificates of deposits. It could be a company, a government organization or the government itself.

-

Commercial Paper

These are again a debt-market instrument, issued by corporations to raise money for the short term. They are usually not secure as the company does not pledge any of its assets as collateral. They have small maturity periods. Commercial paper – as a form of investment – is rarely available to retail investors.

-

Certificate Of Deposit (CD)

This is a kind of debt-market instrument issued by banks or financial organizations. It acts as a proof of saving by the investor and promises interest payments. A certificate of deposit is usually valid only for a certain period of time, after which the entire principal amount is returned with the interest. This period is called maturity.

-

Interest Rate Risk

In a bond market, there are two different interest rates prevalent. One is the fixed rate for interest payment, and the other is called the yield-to-maturity. This is the rate of return you can expect if you hold the bond till its maturity. Simply put, it is a kind of interest rate. This takes into account the return you earn on reinvestment of your interest payments. YTM is linked to a lot of factors like bond’s current price, maturity period, coupon interest rate as well as market factors. It changes regularly. The YTM is inversely proportional to the bond’s price – the amount at which the bond is traded in the market. As the interest rate or YTM increases, your bond’s price falls. Similarly, as the YTM falls, your bond’s price rises. This fluctuation in interest rates exposes investors to a risk. This is called the interest rate risk.

Popular Mutual Funds

| Fund Name | 3Y Return | ||||||||

|---|---|---|---|---|---|---|---|---|---|

21.86% | |||||||||

14.50% | |||||||||

21.00% | |||||||||

23.02% | |||||||||

14.98% | |||||||||

Check allMutual Funds | |||||||||