Mutual Funds Basics

- 3 min read•

- 4,871•

- Updated 06 Dec 2024

What is mutual fund investment?

A mutual fund is an investment vehicle, which pools money from investors with common investment objectives. It then invests their money in multiple assets, in accordance with the stated objective of the scheme. The investments are made by an ‘asset management company’ or AMC.

For example, an equity fund would invest in stocks and equity-related instruments, while a debt fund would invest in bonds, debentures, etc.

As an investor, you put your money in financial assets like stocks and bonds. You can do so by either buying them directly or using investment vehicles like mutual funds.

In this segment, we will understand mutual funds and how to trade in them.

Understanding Mutual Funds

It is an investment fund that pools money from a variety of investors and invests it in a variety of investment products. Products such as government bonds, shares of publicly traded companies, debt funds, shares of companies, equities, corporate bonds, and other assets, or a combination of these investments. An expert fund manager manages the money and selects investment tools according to the investor's investment objective and risk tolerance.

The fund manager will invest a substantial portion of the funds in stocks if you state in your offer document that you would like to invest in equities. When it comes to debt funds, a significant portion of the funds will be invested in bonds.

Mutual Funds can be divided into different types within the equity Mutual Fund category. In the world of funds, there are large-cap funds and mid-cap funds. An objective of these funds is to maximize returns by investing in certain stocks at a certain time.

There may be more than one fund manager to manage your funds, depending on the Asset Management Company (AMC). Each day, these managers assess the funds and decide where they should invest and when certain investments should be bought and sold. According to the fund's investment objectives, the managers make these investment decisions.

In a Mutual Fund, money is collected from you and other investors, and the fund manager allots units to them. In Mutual Funds India, the Net Asset Value (NAV) is the price of each fund unit. A fund manager decides how to allocate the portfolio based on the scheme's investment objectives.

History Of Mutual Funds In India

Mutual funds in India have come a long way since 1964 when the Unit Trust of India was the only player.

By the end of 1988, UTI had total assets worth Rs 6,700 crore. Soon after, eight funds were established by banks, LIC and GIC between 1987 and 1993. The total number of schemes went up to 167 and total money invested – measured by Assets under Management (AUM) – shot up to over Rs 61,000 crore.

In 1993, private and foreign players entered the industry, marking the third phase. The first entrant was Kothari Pioneer Mutual fund, which launched in association with a foreign fund.

The Securities and Exchange Board of India (SEBI) formulated the Mutual Fund Regulation in 1996, which, for the first time, established a comprehensive regulatory framework for the mutual fund industry. Since then, several mutual funds have been set up by the private and joint sectors.

Currently there are around 45 mutual fund organizations in India together handling assets worth nearly Rs 10 lakh crore. Today, the Indian mutual fund industry has opened up many exciting investment opportunities for investors. As a result, we have started witnessing the phenomenon of savings now being entrusted to the funds rather than in banks alone. Mutual Funds are now perhaps one of the most sought-after investment options for most investors.

As financial markets become more sophisticated and complex, investors need a financial intermediary who can provide the required knowledge and professional expertise on taking informed decisions. Mutual funds act as this intermediary.

What Is Mutual Fund Investment Benefit And Risk?

Mutual funds offer the following benefits:

-

In India, there are various types of Mutual Funds that cater to different types of investors. No matter what your monthly income or expenditure is, you can easily find a Mutual Fund that fits your investment goals and risk tolerance.

-

Section 80C of the Income Tax Act allows tax deductions for investments in mutual funds up to Rs 1.5 lakh.

-

The reason why many investors prefer mutual funds is that they don't have to do the research; the fund manager does the research and manages your investments for you.

-

The benefit of investing in Mutual Funds is diversification. Depending on your financial objectives, you can invest in equities and debt. When one asset class doesn't perform well, you can still gain valuable returns from the other and avoid losses in the process.

However, there are risks to investing in mutual funds. Such as:

-

Macroeconomic risks: There are risks that affect the entire economy, like an oil shortage causing commodity prices to rise, causing a dependent company to lose profits or fall in sales. Equity mutual funds are specifically affected by falling share prices of companies in their portfolio, which decreases the fund's value (NAV). When interest rates rise, inflationary pressures also affect bond funds, as bond prices decline when interest rates increase.

-

Liquidity Risk: A liquid investment is one that can be bought or sold easily. When the fund manager's strategy does not allocate enough cash to handle expected or even unexpected fund sales (redemptions), funds are vulnerable to liquidity risk.

-

Credit Risk: It is a risk that applies to companies that have issued debt. When the economy is weak, or when their interest or capital repayments are dependent on future earnings, their credit is deemed risky - any change in potential earnings will affect their ability to repay. As a result, investment values will fall, affecting the value of any fund that holds them. If a company is deemed to have a high credit risk, its share price will decline.

-

Interest Rate Risk: As bond yields fall, money moves out of bonds and into equities, causing equities to rise. The purpose of investing in this way is to capture a higher return than investing in bonds. In a down market, coupon (interest) payments may be lower, making bonds a less attractive investment. The reverse is also true, and investors may choose bonds over equities in a rising interest rate environment.

-

Investor Biases: Any preexisting bias that may lead investors to make a mistaken investment decision is known as investor bias. An example of this would be buying or selling at the wrong time or investing incorrectly due to behavioral reasons.

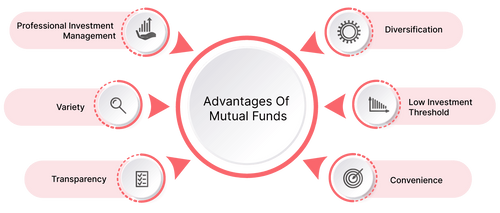

Why Invest In Mutual Funds

Investing in mutual funds offers a multitude of benefits. Let’s have a look:

-

Professional Investment Management

When you invest in a mutual fund, your money is managed by professional experts. This is one of the primary benefits of investing in mutual funds. Being full-time, high-level investment professionals, a good investment manager is more resourceful and capable of monitoring the companies the mutual fund has invested in, rather than individual investors.

The managers have real-time access to crucial market information and are able to execute trades on the largest and most cost-effective scale. Simply put, they have the know-how to trade in the markets that retail investors may not possess.

-

Low Investment Threshold

A mutual fund enables you to participate in a diversified portfolio for as little as Rs 5000, and sometimes even lesser. And with a no-load fund, you pay little or no sales charges to own them.

For example, some bonds and fixed deposits have a minimum investment amount of Rs 25,000. Instead, you can give your money to a mutual fund, which will in turn invest in the bonds and fixed deposits. This could be done for as little as Rs 1000.

-

Professional Investment Management

When you invest in a mutual fund, your money is managed by professional experts. This is one of the primary benefits of investing in mutual funds. Being full-time, high-level investment professionals, a good investment manager is more resourceful and capable of monitoring the companies the mutual fund has invested in, rather than individual investors.

The managers have real-time access to crucial market information and are able to execute trades on the largest and most cost-effective scale. Simply put, they have the know-how to trade in the markets that retail investors may not possess.

-

Convenience

Investing in mutual funds has its own convenience. You save up on additional paper-work that comes with every transaction, the amount of energy you invest in researching the stocks, as well as actual market-monitoring and conduction of transactions. With a mutual fund, you don’t have to do any of that.

Simply go online or place an order with your broker to buy a mutual fund. Another big advantage is that you can move your funds easily from one fund to another, within a mutual fund family. This allows you to easily rebalance your portfolio to respond to significant fund management or economic changes.

-

Liquidity

In open-ended schemes, you can get your money back at any point in time at the prevailing NAV (Net Asset Value) from the Mutual Fund itself.

This makes mutual fund investments highly liquid. Compare that with a fixed deposit or a bond which may have a fixed investment duration.

-

Variety

While investing in mutual funds, you are spoilt for choice. You have a number of mutual fund schemes to choose from, which may invest in a whole range of industries and sectors, different kinds of assets, and so on. You can find a mutual fund that matches just about any investment strategy you select.

There are funds that focus on blue-chip stocks, technology stocks, bonds, or a mix of stocks and bonds. In fact, the greatest challenge can be sorting through the variety and picking the best for you.

-

Transparency

SEBI regulations for mutual funds have made the industry very transparent. You can track the investments that have been made on your behalf to know the sectors and stocks being invested in.

In addition to this, you get regular information on the value of your investment. Mutual funds are mandated to publish the details of their portfolio regularly.

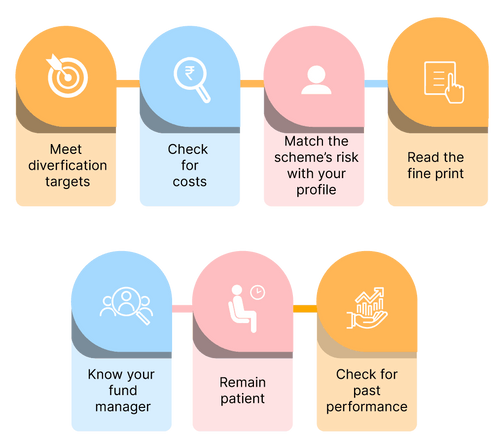

How To Choose A Mutual Fund

Money is precious. It is hard-earned. You can’t just put your money in an investment vehicle or mutual fund without some research.

Here are some things to keep in mind while choosing a fund:

-

Past Performance

History is important. Before investing, check the historic performance of the mutual fund scheme, the asset manager’s investment decisions, fund returns and so on. While the past performance is not an indicator of the future, it could help you figure out what to expect in the future. You can understand the investment philosophies of the fund and the kind of returns it is offering to investors over a period of time. It would also make sense to check out the two-year and one-year returns for consistency.

Statistics such as how the fund had performed in the bull and bear markets of the immediate past would help you understand the strength of a fund. Tracking the fund's performance in the bear market is particularly important because the true test of a portfolio is often revealed in how little it falls during a bearish phase.

-

Match The Scheme's Risk With Your Profile

Even though a mutual fund diversifies its portfolio to reduce risk, they may eventually invest in a single type of asset. The risk of the fund varies with the kind of assets it is invested in. For this reason, check if the mutual fund fits your risk profile and investment horizon. For example, certain sector-specific schemes come with a high-risk, high-return tag. Such plans are suspected to crash in case the industry or sector loses the market's fancy. If the investor is risk-averse, he could instead opt for a debt scheme with little risk.

However, if you are a long-term investor, who doesn’t mind risk, you could go ahead with the sector-specific mutual fund scheme. For this reason, most investors prefer balanced schemes, which invest in a combination of equities and debts. They are less risky than pure equity or growth funds, which are likely to give greater returns, but more risky than pure debt plans.

-

Diversification

While choosing a mutual fund, one should always consider factors like the extent of diversification that a mutual fund offers to your portfolio. A mutual fund can offer diversification either by investing in multiple assets, or by balancing your overall portfolio.

For example, suppose your portfolio contains 70% exposure to stocks from different industries, then it makes sense to invest the 30% in a debt fund to balance the portfolio. Similarly, if your portfolio has a lot of exposure to a particular sector like IT, then avoid investing in a mutual fund that also invests in IT. This way, you can balance your exposure to a similar kind of risk.

Conclusion

The purpose of mutual funds is to pool together people's money to invest in stocks and bonds. To make the money grow, a special expert called a fund manager decides where to invest it. In the event the investments are profitable, all contributors share in the profits. There are different types of mutual funds, some of which invest in companies and some of which invest in bonds.

Their benefits include professional management as well as diversification, which reduces risk by spreading money across several different areas. In addition, there are risks, such as if the companies the fund invested in don't do well, the value may decrease. The choice of a mutual fund should be based on your investment goals and risk tolerance. Overall, with the help of Kotak, understanding mutual fund basics is a smart way to invest your money.

FAQs On Understanding Mutual Fund

What are the benefits of a mutual fund?

Among the benefits of mutual funds are advanced portfolio management, dividend reinvestment, risk reduction, convenience, and fair pricing.

What are the 3 types of mutual funds?

Equity (stocks), fixed income (bonds), money market funds (short-term debt), or a combination of both stocks and bonds (balanced or hybrid) are the types of mutual funds.

What are mutual funds, and how it works?

In mutual funds, money is pooled from many investors and invested in stocks and bonds. It is a professional fund manager who makes investment decisions on behalf of investors. A percentage of profits and losses is shared between investors depending on how much they invested.

What is the safest mutual fund?

Hybrid funds are the safest mutual fund.

Are mutual funds good for beginners?

Mutual funds may be good for beginners. This is because they don’t have to actively manage the allocation of funds. The fund managers take this responsibility and invest in suitable assets to generate optimum returns for investors.

How do I start learning about mutual funds?

You can start learning about mutual funds on financial portals that provide all the details about mutual funds. You may also read investment books, take mutual fund investing courses, and attend seminars and workshops.

How should beginners invest?

Beginners should start investing after learning the basics of the share market. They can start with low-risk securities like mutual funds and bonds. After they gain experience, they can invest in other assets like stocks.

Popular Mutual Funds

| Fund Name | 3Y Return | ||||||||

|---|---|---|---|---|---|---|---|---|---|

21.32% | |||||||||

12.70% | |||||||||

19.19% | |||||||||

20.27% | |||||||||

15.68% | |||||||||

Check allMutual Funds | |||||||||