FII or DII or Retailers, Who is Dominating the Markets?

Stock markets are a sum total of the actions of all the traders and investors. Any market participant’s buy or sell decision results in an impact on the price of any stock. Therefore, it is crucial to understand which segment of market participants are dominating.

People who individually invest in the stock market all come under the retail category. Investment institutions like mutual funds, pension funds fall under the foreign institutional investors (FII) or domestic institutional investors (DII) category. All three together form a critical part of the markets.

Historically, FIIs have been key participants in the Indian markets. Their moves have often weighed heavily on the direction of the markets. Are they still a dominant force? Let’s take a look.

FII Activity in India - A Timeline

A Glimpse of FII Participation in Indian Equity Markets

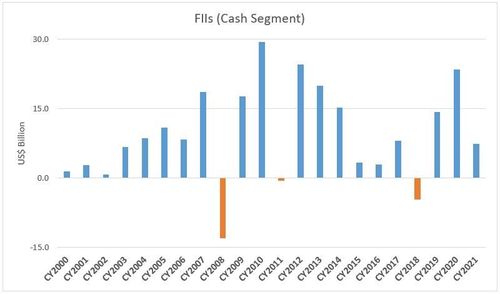

Over the years, FIIs have been showing diversified magnitude and changing trends. The FII flows witnessed a tepid trend from 2000 to 2003, which coincided with the Dotcom bubble.

During the Bull Run from 2004 to 2007, FIIs poured in US$ 46.4 billion into the Indian markets. However, in 2008, the whole world felt the heat of the global financial crisis that originated in the US. And FII investment took a dip.

From 2009 to 2015, we had an excellent period of foreign investor participation. In 2010 alone, FIIs injected US$ 29.3 billion in Indian equities. The reason was Quantitative Easing (QE) adopted by the developed economies. QE in simple terms means - money printing. These central banks printed money and flooded with cheap liquidity. This flood of cheap money found its way into many emerging markets, including India.

The period from 2016 till 2018 of weak FII participation coincided with the US central bank's goal to normalise the monetary policy

Fast Forward to Present

In the last three years till June 2025, FII flows in India have been highly volatile, with record inflows in 2023 and early 2024 followed by historic outflows in late 2024 and early 2025, mainly due to global risk aversion and high valuations. Despite this, FIIs still own 17% of BSE-500 companies, making them the second-largest investors after promoters, while strong domestic institutional investor (DII) buying has helped keep Indian markets resilient. India remains a preferred long-term destination for global investors, thanks to robust economic growth, policy reforms, and a large domestic market, even as short-term FII flows remain sensitive to global developments.

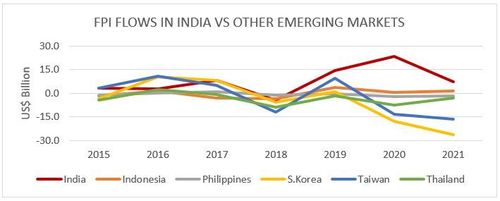

India – A Preferred Destination for Foreign Investors

FIIs - Not the Sole Movers Anymore

FII statistics have been proved pivotal in predicting the undercurrent of the market over the years. But in today's market, it is not only FIIs that influence markets. The share of retail, high net worth individuals (HNI), and domestic mutual funds have also increased since the last year.

Before Covid-19, the retail segment was not very dominant. The lockdown changed the tone of the market because of the proactive and aggressive retail segment participation. FY21 saw approximately 1.4 crore new demat accounts opened. Meanwhile, the monthly SIP run rate of Rs 8,000-9,000 crores also adds up to US$ 14-15 billion annually, which helped cushion against any major FII pullout.

In fact, DII flows from April 2021 to August 2021 stood at US$ 7.1 billion versus FII flows of US$ 2.4 billion. Note that, during the same period, Sensex and Nifty both gained nearly 15%!

FII vs DII - Highlighting Their Impact

| Aspect | FIIs (Foreign Institutional Investors) | DIIs (Domestic Institutional Investors) |

|---|---|---|

Definition | Institutions from outside India investing in Indian markets | Indian institutions investing in domestic markets |

Examples | Mutual funds, pension funds, hedge funds from abroad | Indian mutual funds, insurance companies, banks |

Impact on Market | Often cause significant volatility due to large inflows/outflows | Provide market stability with consistent investments |

Market Sentiment | Strongly influence sentiment; heavy buying/selling moves indices | Influence is steady, supports market during FII exits |

Investment Horizon | Generally short- to medium-term; opportunistic | Tend to have a longer-term perspective |

Regulatory Control | Subject to global and local regulations | Regulated primarily by Indian authorities |

Currency Impact | Large FII flows can affect the rupee’s value | Minimal direct impact on currency |

Overall Role | Drive market rallies and corrections | Act as a stabilising force, especially in volatile times |

What Should Act as Key Indicators to Assess Market Impact?

While FII and DII activity can be an indicator of market activity, one cannot base their investing decisions on whether FIIs or DIIs are buying or not. It is best to go for a bottom-up approach. Investors should place their bets only on companies that have strong fundamentals, robust management, and sustainable growth prospects. Valuations should also be considered, ensuring investments are made at reasonable prices to maximise long-term returns.

What It Means for Investors

For investors, the evolving dynamics of market participation underline the importance of diversification and a disciplined investment strategy. As both foreign and domestic institutions, as well as retail investors, influence market trends, relying solely on any one group’s activity can be misleading. Instead, investors should focus on building a well-researched portfolio that aligns with their risk tolerance and long-term goals. The increased participation of retail and domestic investors has added resilience to the Indian markets, reducing volatility from FII outflows.

Regular investing through SIPs and careful stock selection based on fundamentals and valuations can help investors navigate short-term market fluctuations. Staying informed, being patient, and avoiding herd mentality are crucial for long-term wealth creation in today’s dynamic market environment.

Conclusion

While FIIs, DIIs, and retail investors all play significant roles in shaping the Indian stock markets, no single group exclusively drives market direction today. The landscape has become more balanced, with domestic participation rising steadily. For investors, this means relying on sound research, focusing on company fundamentals, and maintaining a disciplined approach is more important than ever. By avoiding knee-jerk reactions to institutional flows and instead investing with a long-term perspective, investors can better navigate volatility and capitalise on India’s promising growth story.

Read More:

This article is for informational purposes only and does not constitute financial advice. It is not produced by the desk of the Kotak Securities Research Team, nor is it a report published by the Kotak Securities Research Team. The information presented is compiled from several secondary sources available on the internet and may change over time. Investors should conduct their own research and consult with financial professionals before making any investment decisions. Read the full disclaimer here.

Investments in securities market are subject to market risks, read all the related documents carefully before investing. Brokerage will not exceed SEBI prescribed limit. The securities are quoted as an example and not as a recommendation. SEBI Registration No-INZ000200137 Member Id NSE-08081; BSE-673; MSE-1024, MCX-56285, NCDEX-1262.