- Zero maintenance charges

- Zero fees for demat account opening

- Volume based brokerage

-

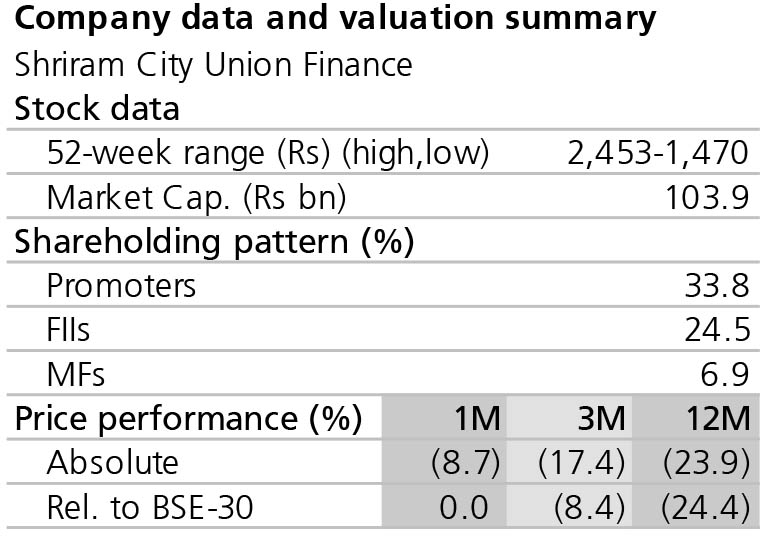

Stock Recommendation | Shriram City Union Finance - ADD - Target price : 1,875

Publish date: OCTOBER 29, 2018

Strong growth in 2Q; headwinds ahead. Shriram-City-Union-Finance reported weak 2QFY19 results with 22% yoy decline in net profit, which was 12% below our estimates. The miss was due to (1) higher-than-expected cost pressure and (2) slower-than-expected ramp-up of specialty tires plant leading to higher subsidiary losses. Competitive intensity in two-wheeler segment remains high, which does not augur well for the company. Medium-term growth outlook of the company hinges on ability to scale up presence in other segments. Reasonable valuations drive our ADD rating.

SCUF reported PAT (Ind-AS) of ₹2.5 bn, up 6% yoy. NII was up 17% yoy on the back of 18% yoy AUM growth, NIM was down 40 bps yoy 13.8% (up 60 bps qoq) led by compression in asset yields. Cost-to-income ratio was down 180 bps qoq and 64 bps yoy to 38.1%. Operating expenses saw modest growth at 16% yoy (employee expenses up 25% yoy) led by slowdown in infrastructure investment. Credit cost (calculated) increased to 3.4% from 2.8% yoy – this was due to 120 dpd norms followed for classification of stage 3 loans in 2QFY18 as compared to 90 dpd in 2QFY19. On a qoq basis, the ratio was up 40 bps.

SCUF reported PAT (Ind-AS) of ₹2.5 bn, up 6% yoy. NII was up 17% yoy on the back of 18% yoy AUM growth, NIM was down 40 bps yoy 13.8% (up 60 bps qoq) led by compression in asset yields. Cost-to-income ratio was down 180 bps qoq and 64 bps yoy to 38.1%. Operating expenses saw modest growth at 16% yoy (employee expenses up 25% yoy) led by slowdown in infrastructure investment. Credit cost (calculated) increased to 3.4% from 2.8% yoy – this was due to 120 dpd norms followed for classification of stage 3 loans in 2QFY18 as compared to 90 dpd in 2QFY19. On a qoq basis, the ratio was up 40 bps.While SCUF reported strong business growth in 1HFY19, we expect business momentum in 2H to be a bit weak; we are reducing our loan growth estimate to 15% from 23% for FY2019E. A couple of reasons—(1) festive demand to date appears to be weak and 2W sales will likely decline in 3QFY19, (2) SMEs will likely face challenges in case drying up of liquidity for NBFCs affects their cash flows. Many smaller NBFCs including fintech companies operate in the SME loan ecosystem though may not directly overlap with SCUF; SCUF has already started reducing its portfolio in the high-ticket SME loan segment that may be more vulnerable and (3) challenges in the debt markets may prompt SCUF to stay focused on liquidity over growth; higher cost of funding will also discourage growth in low-yields segments. Market sources suggest that funding costs for AA+ rated companies have increased by 75-100 bps over the last one month.

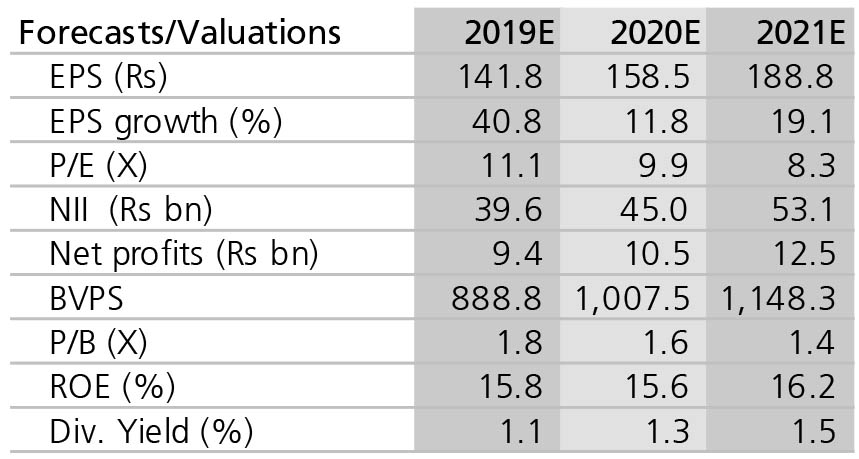

We are revising our estimates by -8% to +2%. While we factor in lower growth on the back of recent liquidity challenges, we expect NIM to remain strong due to (1) lower competition in the market leading to higher pricing power and (2) cherry picking of higher-yield loans. Post the revision in estimates, we expect the company to deliver 15-17% medium-term RoE and 15- 16% earnings CAGR during FY2019-21E. We are revising down our TP to ₹1,875 (1.7X book FY2020E) from ₹2,120 to reflect lower medium-term growth. Challenges in debt markets keep the business under pressure, driving our ADD rating despite high upside to our TP. We prefer Shriram Transport Finance over SCUF in the current environment.

AUM growth strong at 18% yoy in 2QFY19

▶ Strong growth in AUM at 18% yoy. SCUF reported strong growth in AUM at 18% yoy to ₹298 bn in 2QFY19 driven by sharp rise in AUM on business loans (MSME), twowheelers and personal loans (on a low base).

▶ MSME disbursements were modest at 13% yoy in 2QFY19 compared to 21.5% yoy in 1QFY19 even as loan growth was up 23% yoy. Disbursements have been in the range of 25-29% in the past two quarters but slowed down in 2QFY19 indicating some sign of weakness. Repayment rate in business loans increased to 58% from 47% qoq due to closure of one account worth ₹4 bn from South India.

▶ Two-wheeler loans witnessed steep disbursements growth of 20% yoy leading to a 27% yoy growth in AUM. While growth remain strong in the sector, rise in upfront payment and hike in fuel prices have dampened demand. Management guided that 3QFY19 will likely see a lower demand on yoy basis though the festive season might lead to an upward push.

▶ Personal loans continued to grow at a fast pace (up 36% yoy on a low base) to AUM of ₹25 bn. The share of personal loans to overall AUM has increased 42 bps qoq and 108 bps yoy to 8.4% of overall AUM. Management expects to increase the share of personal loans to >10% by FY2020E. Disbursements were high at 33%yoy in 2QFY19; slightly lower than previous quarter. The company is increasingly focusing on crossselling loans to existing customers with sound repayment records and this is expected to drive growth going ahead (leads to cost benefits). Almost 80% of all personal loans sourced in the past 2 years are via the cross-selling model of business origination.

▶ Gold loans continued to drag loan growth (down 10%) owing to problems related to cash disbursements and shift in customer base towards personal loans as a substitute for gold loans. Disbursements in this pace have slightly picked pace on a sequential basis; albeit down 17% yoy. The company is currently operating from 5 states in this space and expects to drop share of gold loan to overall loan going ahead.

▶ We expect growth to moderate in the near term. We expect loan growth to moderate to 15% in FY2019E from 18% in 1HFY19 as the company goes slow in the current environment. It has raised lending rates by 25-200 bps on various products; high rise in large ticket business loans to encourage exits from its portfolio. Gold loan will see marginal revival in growth in the medium term (10% AUM CAGR over FY2019-21E) on the back of higher prices.

Rise in rates across specific product classes led to NIM expansion

▶ Margin expansion in 2QFY19. Reported NIM compressed 31 bps yoy to 13.8% on the back of 31 bps drop in yields while borrowing cost was flat yoy at 6.7%. The likely drop in yields was a result of change in AUM mix towards higher share of low yielding products. On a qoq basis, the company saw 66 bps NIM expansion on the back of rise in yields; a likely impact of rise in rates across select product classes in recent months. Rise in cost of funds was low at 20 bps on qoq basis. The company has high share of bank borrowings (55%). The share of market borrowings has increased to 30% in 2QFY19 from 19% in 2QFY18.

▶ We expect medium-term NIM compression. We expect SCUF’s NIM to compress over the medium term as banking competition increases and funding may not be as comfortable as in FY2018. Exit of smaller NBFCs, improvement in pricing power and cherry picking of high yield loans will likely aid NIM in the near term.

Asset quality broadly stable qoq

▶ Gross stage-3 loans up 17 bps qoq. Asset quality was stable qoq with Gross stage-3 showing marginal increase by 17 bps qoq (yoy numbers are not comparable as the company made a transition in recognition of stressed loans from 120 dpd to 90 dpd in 4QFY18 to 10%. The rise in GNPL was witnessed in auto loans while all other segments saw an improving asset quality trend. GNPL in the auto segment at 11.1% is higher than others. Credit cost (calculated) increased to 3.4% versus 3% qoq (2.8% yoy) as the company increased provisioning on stage-1 and 2 assets (ECL coverage on stage-1 and 2 assets were up 20 bps qoq to 2.5% in 2QFY19).

▶ Gradual reduction in credit costs. We expect total ECL for SCUF to decline to 5.8% of loans by FY2021E from 7.4% in FY2019E (7.5% in 2QFY19) to reflect the improving trends in asset quality. Gross stage-3 loans are expected to improve by 60 bps over FY2019-21E to 8% driven by improvement in collections. The company has increased focus on improving collections and is devoted towards taking initiatives to improve asset quality at a swift pace. We build in improvement in provision coverage on stage-1 and 2 loans to 2% by FY2021E from 2.5% in 2QFY19.

Marginal improvement in cost ratios

▶ Cost-income ratio dropped 60 bps qoq (down 120 bps yoy) in 2QFY19 to 38.1% largely led by slowdown in infrastructure investments. The company has been trying to improve productivity of existing branches, which has led to strict cost control. Operating expense growth at 16% yoy was led by sharp rise in employee expenses at 25% yoy while other expenses growth was low at 6% yoy.

▶ We expect ~17% CAGR in operating expenses over FY2019-2021E driven by 18% CAGR in employee expenses and 16% CAGR in other expenses. The company is investing in business expansion, digital initiatives and analytics giving rise to jump in employee expenses. Cost-to-average AUM ratio will drop 20 bps over FY2019-2021E to 5.1%.

Shriram Housing Finance – AUM growth on track; rise in NPLs arrested

▶ AUM growth at 20% yoy based on Ind-AS. AUM increased 20% yoy (5% qoq) in 2QFY19 compared to 12% yoy in 1QFY19. Disbursements were up 1.6X yoy in 2QFY19. The AUM mix is more inclined towards retail loans and hence is gradually reducing focus on the construction finance space. The share of retail loans real estate loans dropped 100 bps qoq to 10% of overall portfolio. While share of high yielding loans decreased qoq, rise in home loans was the most likely reason for improvement in NIM.

Definitions of ratings

BUY - We expect this stock to deliver more than 15% returns over the next 12 months. ADD - We expect this stock to deliver 5-15% returns over the next 12 months. REDUCE - We expect this stock to deliver -5-+5% returns over the next 12 months. SELL - We expect this stock to deliver Our target prices are also on a 12-month horizon basis.

Other definitionsCoverage view. The coverage view represents each analyst's overall fundamental outlook on the Sector. The coverage view will consist of one of the following designations: Attractive, Neutral, Cautious.

Other ratings/identifiersNR = Not Rated. The investment rating and target price, if any, have been suspended temporarily. Such suspension is in compliance with applicable regulation(s) and/or Kotak Securities policies in circumstances when Kotak Securities or its affiliates is acting in an advisory capacity in a merger or strategic transaction involving this company and in certain other circumstances. CS = Coverage Suspended. Kotak Securities has suspended coverage of this company. NC = Not Covered. Kotak Securities does not cover this company. RS = Rating Suspended. Kotak Securities Research has suspended the investment rating and price target, if any, for this stock, because there is not a sufficient fundamental basis for determining an investment rating or target. The previous investment rating and price target, if any, are no longer in effect for this stock and should not be relied upon. NA = Not Available or Not Applicable. The information is not available for display or is not applicable. NM = Not Meaningful. The information is not meaningful and is therefore excluded. Corporate Office

Kotak Securities Ltd.

27 BKC, Plot No. C-27, "G Block"

Bandra Kurla Complex, Bandra (E)

Mumbai 400 051, India

Tel: +91-22-43360000Overseas Affiliates

Kotak Mahindra (UK) Ltd

8th Floor, Portsoken House

155-157 Minories

London EC3N 1LS

Tel: +44-20-7977-6900Kotak Mahindra Inc

369 Lexington Avenue

28th Floor, New York

NY 10017, USA

Tel:+1 212 600 8856Copyright 2018 Kotak Institutional Equities (Kotak Securities Limited). All rights reserved.

1. Note that the research analysts contributing to this report may not be registered/qualified as research analysts with FINRA; and

2. Such research analysts may not be associated persons of Kotak Mahindra Inc and therefore, may not be subject to NASD Rule 2711 restrictions on communications with a subject company, public appearances and trading securities held by a research analyst account.

3. Any U.S. recipients of the research who wish to effect transactions in any security covered by the report should do so with or through Kotak Mahindra Inc and (ii) any transactions in the securities covered by the research by U.S. recipients must be effected only through Kotak Mahindra Inc at vinay.goenka@kotak.com.

This report is distributed in Singapore by Kotak Mahindra (UK) Limited (Singapore Branch) to institutional investors, accredited investors or expert investors only as defined under the Securities and Futures Act. Recipients of this analysis / report are to contact Kotak Mahindra (UK) Limited (Singapore Branch) (16 Raffles Quay, #35-02/03, Hong Leong Building, Singapore 048581) in respect of any matters arising from, or in connection with, this analysis / report. Kotak Mahindra (UK) Limited (Singapore Branch) is regulated by the Monetary Authority of Singapore.

Kotak Securities Limited established in 1994, is a subsidiary of Kotak Mahindra Bank Limited. Kotak Securities is one of India's largest brokerage and distribution house.

Kotak Securities Limited is a corporate trading and clearing member of Bombay Stock Exchange Limited (BSE), National Stock Exchange of India Limited (NSE), Metropolitan Stock Exchange of India Limited (MSE). Our businesses include stock broking, services rendered in connection with distribution of primary market issues and financial products like mutual funds and fixed deposits, depository services and Portfolio Management.

Kotak Securities Limited is also a depository participant with National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL). Kotak Securities Limited is also registered with Insurance Regulatory and Development Authority as Corporate Agent for Kotak Mahindra Old Mutual Life Insurance Limited and is also a Mutual Fund Advisor registered with Association of Mutual Funds in India (AMFI). We are registered as a Research Analyst under SEBI (Research Analyst) Regulations, 2014.

We hereby declare that our activities were neither suspended nor we have defaulted with any stock exchange authority with whom we are registered in last five years. However SEBI, Exchanges and Depositories have conducted the routine inspection and based on their observations have issued advise/warning/deficiency letters/ or levied minor penalty on KSL for certain operational deviations. We have not been debarred from doing business by any Stock Exchange / SEBI or any other authorities; nor has our certificate of registration been cancelled by SEBI at any point of time.

We offer our research services to clients as well as our prospects.

This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions.

This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It is for the general information of clients of Kotak Securities Ltd. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither Kotak Securities Limited, nor any person connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions -including those involving futures, options and other derivatives as well as non-investment grade securities - involve substantial risk and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals.

Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

Kotak Securities Limited has two independent equity research groups: Institutional Equities and Private Client Group. This report has been prepared by the Private Client Group. The views and opinions expressed in this document may or may not match or may be contrary with the views, estimates, rating, target price of the Institutional Equities Research Group of Kotak Securities Limited.

We and our affiliates/associates, officers, directors, and employees, Research Analyst(including relatives) worldwide may: (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the subject company/company (ies) discussed herein or act as advisor or lender / borrower to such company (ies) or have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of Research Report or at the time of public appearance. Kotak Securities Limited (KSL) may have proprietary long/short position in the above mentioned scrip(s) and therefore may be considered as interested. The views provided herein are general in nature and does not consider risk appetite or investment objective of particular investor; readers are requested to take independent professional advice before investing. This should not be construed as invitation or solicitation to do business with KSL. Kotak Securities Limited is also a Portfolio Manager. Portfolio Management Team (PMS) takes its investment decisions independent of the PCG research and accordingly PMS may have positions contrary to the PCG research recommendation. Kotak Securities Limited does not provide any promise or assurance of favourable view for a particular industry or sector or business group in any manner. The investor is requested to take into consideration all the risk factors including their financial condition, suitability to risk return profile and take professional advice before investing.

The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report.

No part of this material may be duplicated in any form and/or redistributed without Kotak Securities' prior written consent. Details of Associates are available on www.kotak.com

Research Analyst has served as an officer, director or employee of subject company(ies): No

We or our associates may have received compensation from the subject company(ies) in the past 12 months.

We or our associates have managed or co-managed public offering of securities for the subject company(ies) in the past 12 months: No

We or our associates may have received compensation for investment banking or merchant banking or brokerage services from the subject company(ies) in the past 12 months. We or our associates may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company(ies) in the past 12 months. We or our associates may have received compensation or other benefits from the subject company(ies) or third party in connection with the research report. Our associates may have financial interest in the subject company(ies).

Research Analyst or his/her relative's financial interest in the subject company(ies): No

Kotak Securities Limited has financial interest in the subject company(ies) at the end of the month immediately preceding the date of publication of Research Report: Yes

Our associates may have actual/beneficial ownership of 1% or more securities of the subject company(ies) at the end of the month immediately preceding the date of publication of Research Report.

Research Analyst or his/her relatives has actual/beneficial ownership of 1% or more securities of the subject company(ies) at the end of the month immediately preceding the date of publication of Research Report: No.

Kotak Securities Limited has actual/beneficial ownership of 1% or more securities of the subject company(ies) at the end of the month immediately preceding the date of publication of Research Report: No

Subject company(ies) may have been client during twelve months preceding the date of distribution of the research report.

"A graph of daily closing prices of securities is available at https://www.nseindia.com/ChartApp/install/charts/mainpage.jsp and http://economictimes.indiatimes.com/markets/stocks/stock-quotes. (Choose a company from the list on the browser and select the "three years" icon in the price chart)."

Kotak Securities Limited. Registered Office: 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra (E), Mumbai 400051. CIN: U99999MH1994PLC134051, Telephone No.: +22 43360000, Fax No.: +22 67132430. Website: www.kotak.com/www.kotaksecurities.com. Correspondence Address: Infinity IT Park, Bldg. No 21, Opp. Film City Road, A K Vaidya Marg, Malad (East), Mumbai 400097. Telephone No: 42856825. SEBI Registration No: NSE INB/INF/INE 230808130, BSE INB 010808153/INF 011133230, MSE INE 260808130/INB 260808135/INF 260808135, AMFI ARN 0164, PMS INP000000258 and Research Analyst INH000000586. NSDL/CDSL: IN-DP-NSDL-23-97. Our research should not be considered as an advertisement or advice, professional or otherwise. The investor is requested to take into consideration all the risk factors including their financial condition, suitability to risk return profile and the like and take professional advice before investing. Investments in securities market are subject to market risks, read all the related documents carefully before investing. Derivatives are a sophisticated investment device. The investor is requested to take into consideration all the risk factors before actually trading in derivative contracts. Compliance Officer Details: Mr. Manoj Agarwal. Call: 022 - 4285 8484, or Email: ks.compliance@kotak.com.

In case you require any clarification or have any concern, kindly write to us at below email ids:

● Level 1: For Trading related queries, contact our customer service at 'service.securities@kotak.com' and for demat account related queries contact us at ks.demat@kotak.com or call us on: Toll free numbers 18002099191 / 1800222299, Offline Customers - 18002099292

● Level 2: If you do not receive a satisfactory response at Level 1 within 3 working days, you may write to us at ks.escalation@kotak.com or call us on 022-42858445 and if you feel you are still unheard, write to our customer service HOD at ks.servicehead@kotak.com or call us on 022-42858208.

● Level 3: If you still have not received a satisfactory response at Level 2 within 3 working days, you may contact our Compliance Officer (Mr. Manoj Agarwal) at ks.compliance@kotak.com or call on 91- (022) 4285 8484.

● Level 4: If you have not received a satisfactory response at Level 3 within 7 working days, you may also approach CEO (Mr. Kamlesh Rao) at ceo.ks@kotak.com or call on 91- (022) 4285 8301.

First Cut notes published on this site are for information purposes only. They represent early notations and responses by analysts to recent events. Data in the notes may not have been verified by us and investors should not act upon any data or views in these notes. Most First Cut notes, but not necessarily all, will be followed by final research reports on the subject. There could be variance between the First cut note and the final research note on any subject, in which case the contents of the final research note would prevail. We accept no liability for the contents of the First Cut Notes. For further disclosure please view https://kie.kotak.com/kinsite/index.php

Also read

- Read our latest stock recommendations

- Check out market strategy research

- Live insights about stock markets

- HDFC Bank Q1 result: Key highlights

- How to attain financial freedom

Don't have an account? Click here to open an account