What are limit orders and market orders and how to place Limit Orders & Market Orders?

Market Orders:

An order that enables you to purchase or sell a stock at the best price available in the market is known as a market order. So if you are placing a buy market order, you have to purchase a certain amount of stock from the exchange at any price that is available at the time. Likewise, if you place a sell market order, you have to sell your stock at any price that the buyers are willing to offer.

One benefit of market orders is that your trade will get executed immediately as it reaches the exchange, if there is someone interested in taking the opposite side of your trade. At the same time, the instant order comes with the drawback of slippage, i.e., you could be paying relatively more money to buy or receiving less money to sell your stocks.

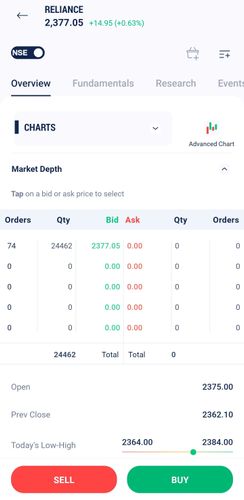

A market order generally will execute at or near the current bid (for a sell order) or ask (for a buy order) price. However, it is important for investors to remember that the last-traded price is not necessarily the price at which a market order will be executed. Depending on the order quantity or the liquidity of the scrip, the average price of your market order can deviate from the last traded price.

Limit Orders:

On the other hand, a limit order is when you purchase or sell a stock at or better than the price set by you. Let’s say for instance, you place a buy limit order at Rs. 100, you want to buy the stock at Rs. 100 or lower from the exchange. You don’t want to exceed this limit. In the same way, if you place a sell limit order at Rs. 200, your goal would be to sell the stock at Rs. 200 or higher.

What makes a limit order so desirable is that you can purchase or sell the order at the price that you want. That being said, there’s always a chance that your order might not get filled partially or completely, if a counter order is presented for part quantity or none at the price that you have set.

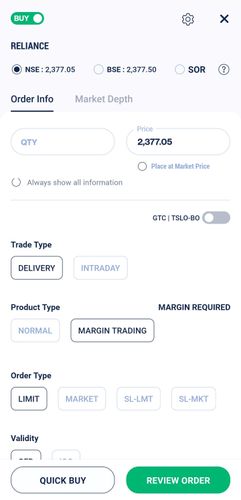

In order to place a Limit Order or a Market Order:

-

Select Limit or Market against the “Order Type” in the Order Page

-

A Limit or Market order can be placed for any type or order:

- Normal

- Margin Trading

- Super Multiple

- MIS

-

A Limit or Market order can be placed for any segment:

- Equity

- Derivatives

- Currency

- Commodities

- Select a stock

- Click on Limit / Market, as the case may be

- Enter Limit Price, if it is a limit order

What is a Buyback/Takeover/Delisting?

My order is getting rejected with the following error – ‘Order price is outside the trade execution range. Try placing the order again

My order is getting rejected with the following error – ‘The order was rejected to avoid self trade. Try placing the order again’.

Why was the stop loss executed even though the price did not breach the trigger?