The Indian Housing Dilemma: To Buy or Rent?

Kotak Insights | Date 07/03/2024

Should we buy or rent our home?

In India, owning a house is just a dream.

Today we'll dive into this age-old debate of Indian real estate. More than being right or wrong, it is a matter of choice and affordability.

Owning a home provides security, but also comes with high costs and debt.

Renting may be cheaper if the housing is expensive and you have limited funds.

In this blog, we explore both the options.

Owning a Dream Home

Picture Raj and Priya stepping into their own little fortress. It’s all about stability, investing in the future, and being the kings & queens of your castle without worrying about landlords or rent hikes.

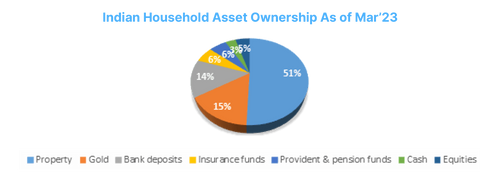

Interestingly, do you know where does India invest the most?

As per a Jefferies report, majority of the Indian household assets ownership include investment in properties with share of over 50%.

Source: Jefferies , TradingQ&A

Coming back to Raj & Priya, they go ahead, take huge home loans and make sure they are able to pay the equated monthly installments (EMIs).

Suppose they choose fixed interest rate. Note that, interest rates play a crucial role in this decision.

With a fixed rate, your monthly payments stay the same, giving you peace of mind and stability. But with a floating rate, they can fluctuate with the market, which can be risky but might save you some money in the long run.

Imagine Raj eyeing a sweet pad in bustling Mumbai. The buy vs. rent debate here is a real head-scratcher – property prices, rental rates, maintenance costs, and potential appreciation, oh my!

Let’s do a quick number crunching for him.

Buying Scenario:

Property Price

Down Payment

Rs 1 crore

Rs 20 lakh (20%)

Property Price

Loan Amount

Rs 1 crore

Rs 80 lakh

Property Price

Loan Term

Rs 1 crore

20 years

Property Price

Fixed Interest Rate

Rs 1 crore

7%

Property Price

EMI (Fixed)

Rs 1 crore

Rs 59,000 (approx.)

Property Price

Future Value Assumption (10 years)

Rs 1 crore

Rs 2 crore

| Property Price | Rs 1 crore |

|---|---|

| Down Payment | Rs 20 lakh (20%) |

| Loan Amount | Rs 80 lakh |

| Loan Term | 20 years |

| Fixed Interest Rate | 7% |

| EMI (Fixed) | Rs 59,000 (approx.) |

| Future Value Assumption (10 years) | Rs 2 crore |

Also, let’s not forget about the tax benefits!

When you buy a house, you can enjoy deductions on home loan interest under Section 24 of the Income Tax Act.

Plus, if you decide to rent out your property, you can also claim deductions on the interest paid on the loan taken for that property, as well as deductions for property taxes paid!

Adding a Twist: Buying to Rent Out

What if Raj decides to buy a property not to live in, but to rent out?

Now we’re talking passive income. Let’s say Raj buys a second property and rents it out for Rs 40,000 a month. He covers his EMI and even pockets a tidy profit. And let’s not overlook property appreciation.

What if Raj’s property increases in value over time? Suddenly, that humble abode is worth a pretty penny, giving Raj a nice little nest egg for the future.

Renting Option: No Debt, Tax Benefits, Freedom of Change

Why pay rent when you can own an asset? This is the top argument your parents, your relatives or your bank relationship manager give.

While it does make sense that you don’t get anything from the rent you are paying. But the primary reasons are the crazy cost of real estate in India.

So now, let’s flip the coin.

Meet Sameer and Neha. They’re all about the rental life. No strings attached, no commitments, just the freedom to move around and explore. Renting is simple, right? No big upfront costs, no mortgage headaches, just a straightforward monthly rent.

And while renting might not come with the same tax benefits as buying, there’s still a silver lining. Rent paid for residential accommodation can be claimed as a deduction under Section 80GG of the Income Tax Act, subject to certain conditions.

So, while you might not be building equity like Raj, you can still save some money come tax time.

Renting Scenario:

- Monthly Rent: Rs 30,000

The Verdict

So, let’s do the math. For Raj, buying means shelling out EMIs of roughly Rs 59,000 with a fixed interest rate, plus all the extra costs that come with homeownership.

On the flip side, Sameer and Neha keep it easy – just pay rent and let the landlord handle the rest.

Comparing the Options

So, where does that leave us?

Is it better to own like Raj, rent like Sameer and Neha, or buy to rent out like a boss? Well, it depends on your vibe, your lifestyle, and what makes financial and emotional sense for you.

Whether you choose to own, rent, or invest in rental properties, the ultimate goal is financial security and happiness.

So, crunch those numbers, weigh your options, and make the decision that’s right for you!

We will be back with another exciting story next week!

Until then…

Stay Tuned!

Disclaimer: The content of this blog is intended solely for educational purposes and should not be regarded as financial advice. It is not produced by the desk of the Kotak Securities Research Team, nor is it a report published by the Kotak Securities Research Team. The securities and assets mentioned serve purely as illustrations only and should not be taken as recommendations for investment. Please note that the information presented is compiled from several secondary sources available on the internet and may change over time. We strongly advise consulting with a qualified financial advisor prior to making any investment decisions. Read the full disclaimer here.