Rich Dad, Poor Dad - 6 Rules Decoded

- 4 min read•

- 9,680•

- Published 18 Dec 2025

“The middle class work for money; the rich have the money work for them” - Robert Kiyosaki

Throughout history, creating a life of prosperity has served as the ultimate goal for any child who came from a humble family. Everyone has the desire to make money, but only a select few actually understand how money operates. In addition to being a highly disciplined process, accumulating money calls for a mental transformation as well as an attitude that is oriented toward the creation of assets. Robert Kiyosaki's well acclaimed 1997 bestseller "Rich Dad Poor Dad'' addresses this very issue. People are guided through the process of creating money in Kiyosaki's book, which challenges readers to reevaluate their views on the topic. Despite the fact that Kiyosaki has filed for bankruptcy, the appeal of his book - which many people of all ages believe to be the bible in developing a money mindset - has not decreased.

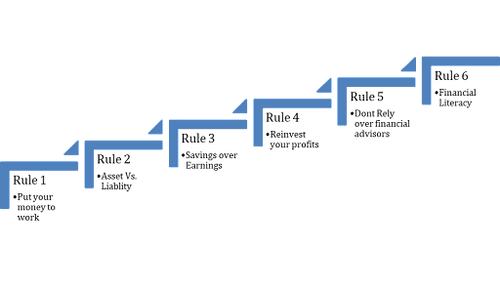

8 Money Rules from Rich Dad Poor Dad

Rule 1: The poor work for money. The rich put their money to work

Do you live to work or work to live? This is one of the basic concepts ‘Rich Dad Poor Dad’ sheds light on. People with limited financial resources follow the conventional route of getting a good education that qualifies them for safe and relevant jobs that'll help them earn more money. Thus, they avoid taking risks out of fear. On the other hand, rich people buy or invest in income-generating assets such as stocks, real estate, mutual funds, etc. They make money via passive income and don't work their entire life to earn it.

Rule 2: Know the difference between an asset and a liability

Simply put, an asset is something that puts money in your wallet. In contrast, a liability is something that takes money out of your wallet. Keeping this in mind, it’s clear why rich people focus on acquiring assets (such as securities and investments) and why those with fewer resources often take on liabilities (like commitments and obligations). This distinction plays a crucial role in shaping an individual’s future financial growth. Acquiring assets is one of the smartest ways to invest.

Rule 3: How much you save matters more than what you make

The most important practice that separates the rich - predominantly the self-made - from others is the consistent habit of saving enough. One of the biggest mistakes people commit is prioritising spending over saving. Savings get the leftovers.

For example, say your in-hand salary is ₹50,000. After allocating money for necessary expenses and a few ‘nice-to-have’ luxuries, you have ₹2,500 left. That means you’re only able to save 5% of your total income. In many cases, even that gets spent due to unavoidable expenses. However, the circumstance is different among those who aspire to become rich. The general rule of financial planning says that you should ideally save and invest 10-15% of your net income. However, the ones with more dedication end up saving way more, i.e. 30%, 40%, or even 50% at times!

Now, let’s go back to the same example. The only difference is the person successfully saves 50% of their income (₹25,000). Assuming an average annual return of 12%, they will accumulate a whopping ₹2.5 Cr in just 20 years! Remember, this doesn’t even consider their income and savings that’ll increase over the years.

Rule 4: Reinvest your profits

Robert Kiyosaki insists on reinvesting the profits created by your assets, in other assets. It’s one of the best ways of investment. Instead of thinking about earning more, focus on looking for more valuable assets. Say you rent out an apartment that you own. What do you do with the monthly rent that you receive? Is it just lying in your savings account? If yes, invest the same in stocks, mutual funds, or other avenues.

Rule 5: Don't rely exclusively on financial advisors

Kiyosaki says that every individual has valuable insights into their personal finances that only they can develop. Depending on financial advisors is undoubtedly beneficial, but not at the expense of losing control over your own money. "Learn how to invest because nobody will do it better than you," says Kiyosaki.

Rule 6: This is your greatest asset!

Financial education! Yes, financial literacy is more important than money itself. If you are always keen to learn more, nothing can stop you from creating financial security. Most importantly, analyse how the science of making money and investing works. "Intelligence solves problems and produces money, and money without financial intelligence is quickly lost," says Kiyosaki.

Rule 7: Learn to manage risk instead of avoiding it

The rich don’t fear risk - they manage it. Playing it safe rarely leads to success. Instead of running away from uncertainty, successful people learn how to calculate, understand, and control risk. They study investments, educate themselves about market volatility, and use methods like diversification to minimise losses.

Avoiding risk altogether keeps you stuck in mediocrity; the real trick is learning to make informed decisions, accepting that mistakes and setbacks are part of the process. If you want to grow financially, start treating risk as something to be understood and handled, not something to be dodged at all costs.

Rule 8: Work to learn, not just to earn

Chasing a paycheque won’t make you rich, but building skills will. Kiyosaki emphasises gaining broad experience and learning different aspects of money, business, and investing to prepare for long-term success. The most successful people deliberately take jobs that teach them sales, marketing, investing, or entrepreneurship, even if the pay isn’t great at first. Every new skill you pick up - be it communication, negotiation, or financial analysis - gives you an edge in the real world. Focus on learning, not just earning. Over time, those accumulated skills will open doors, create opportunities, and help you build capital in ways that a steady salary never will.

To Sum Up

The core message of “Rich Dad Poor Dad” is pretty simple: Change your mindset, and your financial destiny changes with it. Financial success isn’t just about making money - it’s about learning, investing, and taking calculated risks. Acquire assets, save aggressively, reinvest profits, and prioritise your own financial education. Stop fearing risk and use every job or experience as a learning opportunity. Ultimately, building real capital comes down to taking control, making smart decisions, and never stopping your pursuit of knowledge. The choice between “working for money” and “making money work for you” is entirely yours.