Updates to help you make informed trading decisions.

Buying or Selling from Portfolio? Here’s How Neo Finds You the Best Price

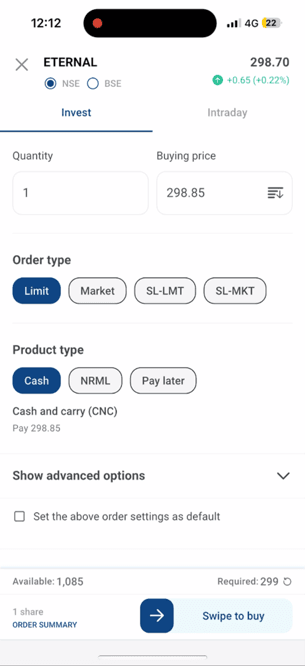

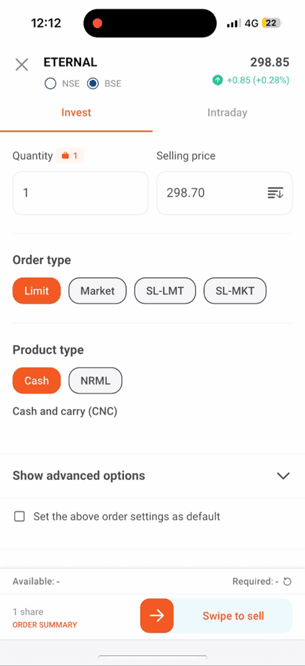

When you buy more or sell an existing stock directly from your portfolio on Kotak Neo, you may notice that the exchange (NSE or BSE) is already selected for you.

This isn’t random — it’s an intelligent feature designed to help you get best price execution on every trade.

What is Best Price Execution?

In India, stocks are traded on both National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

Since trades happen independently on each exchange, the Last Traded Price (LTP) of a stock can vary slightly between the two at any given moment.

Kotak Neo automatically identifies this difference and selects the exchange that gives you a better price — without requiring any manual effort from you.

How does it work?

When you initiate a trade from your portfolio, Kotak Neo checks live prices on both exchanges and applies the following logic:

- While selling:

The exchange with the higher LTP is selected so you can potentially get a better exit price. - While buying more:

The exchange with the lower LTP is selected so you can purchase shares at a better value.

This happens instantly when the order window opens.

A simple example

Let’s say you hold shares of a stock and decide to sell from your portfolio.

At that moment, live prices are:

- NSE price: ₹1571.30

- BSE price: ₹1572.50

Since BSE has a higher LTP, the order form will automatically default to BSE, helping you get a better selling price — without any extra steps.

Can the exchange be changed?

Yes, absolutely.

While Kotak Neo selects the best price by default, you always remain in control. You can manually switch between NSE and BSE from the order window before placing your order, if you prefer a specific exchange.

Why do prices differ between NSE and BSE?

The LTP on an exchange depends on the most recent trade executed on that exchange. Because buyers and sellers differ across NSE and BSE, prices move independently - which is why short-term price differences occur.

Kotak Neo simply uses this difference to your advantage.

Important to know

- This feature currently applies only to buy and sell orders initiated from the portfolio

- Best price selection is based on live LTP comparison at the time you open the order form

- You always retain full manual control over the exchange selection

In short

Best price execution on Kotak Neo ensures that when you trade from your portfolio, the app intelligently works in the background to help you buy lower or sell higher — automatically, transparently, and with full user control.