- Zero maintenance charges

- Zero fees for demat account opening

- Volume based brokerage

-

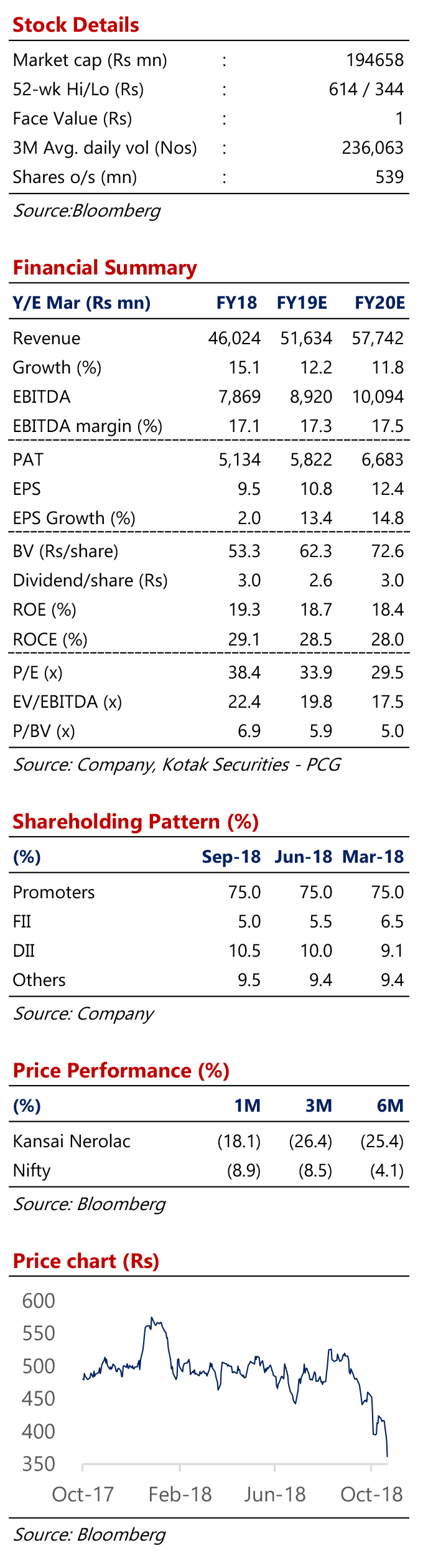

Stock Recommendation | KANSAI NEROLAC PAINTS LTD – BUY – Target Price : 485

Publish date: OCTOBER 24, 2018

Stable volume growth in the decorative segment, weakness in the industrial segment, continued raw material price inflation, small price hikes in Q2FY19, extended monsoon in key geographies and delayed onset of festive season in CY18 were the highlights of the results for KNPL during the quarter.

■ As per management commentary, KNPL experienced 9% volume growth YoY growth across segments led by decorative segment. Management commented that inflation (including Raw material cost), volatility in crude prices and INR movement was more pronounced this quarter which impacted the operating margins. Management is making efforts to increase product prices and reduce various costs to counter the situation.

■ Sales (excluding GST) was reported at Rs 12.94 bn (+11.1% YoY) with 9% overall volume growth. Raw material price inflation and weakness in the industrial segment (especially Auto) impacted the Gross margin and EBIDTA margin for the quarter.

■ In H1FY19, company had taken a price hike of just 2% to counter the steep increase in raw material (RM) prices including crude derivatives. Post further sharp increase in RM prices, company has taken another price hike of 2/3 % across segments on October 1st which should reflect in the performance of Q3FY19.

■ Management mentioned that the industrial segment including automotive segment is weak and it is difficult to pass on the RM hikes in this segment. While decorative paint segment is strong for the entire paint industry including KNPL.

■ Consequently, PAT was reported at Rs 1.22 bn vs. our expectation of Rs 1.42 bn

We estimate that branded paint demand will remain robust in a country like India where per capita consumption is very low and 30% paint market is still unorganised. Management of KNPL also indicated that the volume trends remain strong for the company in the decorative segment and expect the trend to continue in medium term. However, industrial segment is weak and expected to remain weak in rest of FY19. We also estimate the gross margin of the company to remain under pressure with continued RM inflation and the company's restricted ability to pass on cost inflation to its industrial paint clients (45% of revenue). In view of the impact on gross margins and weakness in the industrial segment, we cut our EPS forecast for FY19E and FY20E by 9% each and assign a lower PE multiple to the stock in a weak macro environment. On the flip side, the stock remains one of the favored companies in the consumer space with a strong brand, credible history, sound management and BS and a reasonable outlook. Maintain BUY with a lower TP of Rs 485 (from Rs 540) at 39x FY20E earnings (from 40x).

Paint Industry uses two key raw material including crude derivatives and Titanium Dioxide. The Paint industry is experiencing increase in prices of raw material since the last one year, with steep increase in Q2FY19. Almost ~60% of the raw material are crude derivatives and with crude at $80/barrel (+50% YoY), prices of crude derivatives have also increased. Even prices of pigments like Titanium Dioxide, Iron oxide and Zinc oxide have increased. Even INR volatility has contributed to cost inflation for the company. To counter this, the management of KNPL have not resorted to price increase in Q2FY19 due to competition and also due to sticky nature of prices for industrial customers.

In H1FY19, company had taken a price hike of just 2% and another price increase of 3% from 1st October to offset increase in RM prices. Company is also continuously engaging with industrial paint customers including Auto companies for price increases to compensate for the input cost inflation. However, industrial customers are rigid and difficult to convince for any type of price hikes. In most cases, there is a lag of 3 months from the time of increase in RM prices and increase in product prices for industrial customers.

Management indicated the sales performance of Q2FY19 could be attributed to:

■ 9% volume growth in the decorative segment

■ Weakness in automotive demand and weak private sector capex leading to weakness in the industrial segment

Industrial segment contributes ~45% to KNPL’s revenues with automotive segment contributing 75% of the industrial segment revenues. KNPL's strong dominance in automotive paints segment is supplemented by its parent Kansai's association with global OEMs that have a strong presence in India.

Automotive production was weak in H1FY19 with volume of 21.04 lakh units (against 19.71 lakh units in H1FY18 and 96.7% YoY) which compelled SIAM to reduce growth forecast for passenger car sales from 11% to 9%. Going forward, cost of ownership of passenger cars can increase by 10 to 15% over the next one year led by—(1) sharp increase in insurance costs as IRDA has made it mandatory to purchase five-year third-party insurance; (2) rising interest rates; (3) increasing crude prices; (4) depreciating INR and (5) rising raw material prices. This could slow down the growth for automobile companies in near term impacting demand for automotive

KNPL has maintained a low double digit or high single digit volume growth rate in the decorative segment for the last 12 quarters in the decorative segment outperforming the performance of market leader Asian Paints and peer Berger Paints driven by:

1) New product offerings - New product launches which are eco-friendly, lead free, low VOC etc.

2) Aggressive marketing by KNPL- KNPL is one of the largest spender on Advertisement, which is around 9% of the decorative segment revenue as against 6% of Asian Paints and Berger

3) Improving geographical reach – north India is the strongest market for KNPL, now the company is focussing on West and South (which are strongholds of Asian Paints)

4) Huge Dealer Base – Company current has 20000+ dealers which is growing at 10% CAGR. These dealers are serviced through 102 depots.

5) Aggressive sales pitch and higher dealer margins

6) Connecting directly with the customers through initiatives like tinting machines- 75% of the dealers of the company have tinting machines

7) Other factors like increasing disposable income, shortening painting cycle to 5 years (from 10 years over a decade) and increase in per-capita consumption to 3.3 kg (from 1.5 kg over a decade)

KNPL has four manufacturing facilities situated at Lote in Maharashtra, Bawal at Haryana, Jainpur in UP and Hosur in Tamil Nadu with an Installed capacity of ~431,000 tonnes with utilization rate of ~75%. We estimate the company to spend another Rs 3.6 bn over FY18 to 21E to add another 106,000 tonnes. Healthy addition of capacities is a lead indicator that the demand for paints is going to remain healthy over the next few years

Management of KNPL mentioned that the company has taken a price hike of 2/3% in July 2018 and a similar price hike in October 2018. This should partly offset input cost pressures (INR depreciation + crude rise). We expect the GST rate cut (28% to 18%) to alleviate impact on consumer demand from such increases. However, we estimate the gross margin of the company to remain under pressure with continued RM inflation and weakness in the industrial segment. Consequently, we cut our EPS forecast for FY19E and FY20E by 9% each and assign a lower PE multiple to the stock in a weak macro environment. On the flip side, the stock remains one of the favored companies in the consumer space with a strong brand, credible history, sound management and BS and a reasonable outlook. Maintain BUY with a lower TP of Rs 485 (from Rs 540) at 39x FY20E earnings (from 40x).

Kansai Nerolac Paints Ltd. (KNPL), a subsidiary of Kansai Paint, Japan, is one of India’s leading paint companies and the largest player in the industrial segment. KNPL had its beginning as Gahagan Paints and Varnishes Co. Ltd. in the year 1920. In over 93 years of its existence the Company has built a strong brand and gained a reputation for high quality, innovation and differentiated product offerings. The Company has 4 manufacturing facilities at Lote in Maharashtra, Bawal in Haryana, Jainpur in UP and in Hosur in Tamil Nadu with a total capacity of 4.31 lakh metric tonnes per annum. The company is the market leader in the automotive coating segment in India with a dominant market share. Over the years, it has maintained its leadership position in the Industrial Coatings segment with a wide range of products in the Automotive, Powder, General Industrial and High performance Coatings space.

BUY - We expect the stock to deliver more than 12% returns over the next 12 months ACCUMULATE - We expect the stock to deliver 5% - 12% returns over the next 12 months REDUCE - We expect the stock to deliver 0% - 5% returns over the next 12 months SELL - We expect the stock to deliver negative returns over the next 12 months NR - Not Rated. Kotak Securities is not assigning any rating or price target to the stock. The report has been prepared for information purposes only. SUBSCRIBE - We advise investor to subscribe to the IPO. RS - Rating Suspended. Kotak Securities has suspended the investment rating and price target for this stock, either because there is not a Sufficient fundamental basis for determining, or there are legal, regulatory or policy constraints around publishing, an investment rating or target. The previous investment rating and price target, if any, are no longer in effect for this stock and should not be relied upon. NA - Not Available or Not Applicable. The information is not available for display or is not applicable NM - Not Meaningful. The information is not meaningful and is therefore excluded. NOTE - Our target prices are with a 12-month perspective. Returns stated in the rating scale are our internal benchmark. Kotak Securities Limited established in 1994, is a subsidiary of Kotak Mahindra Bank Limited. Kotak Securities is one of India's largest brokerage and distribution house.

Kotak Securities Limited is a corporate trading and clearing member of Bombay Stock Exchange Limited (BSE), National Stock Exchange of India Limited (NSE), Metropolitan Stock Exchange of India Limited (MSE). Our businesses include stock broking, services rendered in connection with distribution of primary market issues and financial products like mutual funds and fixed deposits, depository services and Portfolio Management.

Kotak Securities Limited is also a depository participant with National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL). Kotak Securities Limited is also registered with Insurance Regulatory and Development Authority as Corporate Agent for Kotak Mahindra Old Mutual Life Insurance Limited and is also a Mutual Fund Advisor registered with Association of Mutual Funds in India (AMFI). We are registered as a Research Analyst under SEBI (Research Analyst) Regulations, 2014.

We hereby declare that our activities were neither suspended nor we have defaulted with any stock exchange authority with whom we are registered in last five years. However SEBI, Exchanges and Depositories have conducted the routine inspection and based on their observations have issued advise/warning/deficiency letters/ or levied minor penalty on KSL for certain operational deviations. We have not been debarred from doing business by any Stock Exchange / SEBI or any other authorities; nor has our certificate of registration been cancelled by SEBI at any point of time.

We offer our research services to clients as well as our prospects.

This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions.

This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It is for the general information of clients of Kotak Securities Ltd. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither Kotak Securities Limited, nor any person connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigations and take their own professional advice. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions -including those involving futures, options and other derivatives as well as non-investment grade securities - involve substantial risk and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals.

Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

Kotak Securities Limited has two independent equity research groups: Institutional Equities and Private Client Group. This report has been prepared by the Private Client Group. The views and opinions expressed in this document may or may not match or may be contrary with the views, estimates, rating, target price of the Institutional Equities Research Group of Kotak Securities Limited.

We and our affiliates/associates, officers, directors, and employees, Research Analyst(including relatives) worldwide may: (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the subject company/company (ies) discussed herein or act as advisor or lender / borrower to such company (ies) or have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of Research Report or at the time of public appearance. Kotak Securities Limited (KSL) may have proprietary long/short position in the above mentioned scrip(s) and therefore may be considered as interested. The views provided herein are general in nature and does not consider risk appetite or investment objective of particular investor; readers are requested to take independent professional advice before investing. This should not be construed as invitation or solicitation to do business with KSL. Kotak Securities Limited is also a Portfolio Manager. Portfolio Management Team (PMS) takes its investment decisions independent of the PCG research and accordingly PMS may have positions contrary to the PCG research recommendation. Kotak Securities Limited does not provide any promise or assurance of favourable view for a particular industry or sector or business group in any manner. The investor is requested to take into consideration all the risk factors including their financial condition, suitability to risk return profile and take professional advice before investing.

The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report.

No part of this material may be duplicated in any form and/or redistributed without Kotak Securities' prior written consent. Details of Associates are available on www.kotak.com

Research Analyst has served as an officer, director or employee of subject company(ies): No

We or our associates may have received compensation from the subject company(ies) in the past 12 months.

We or our associates have managed or co-managed public offering of securities for the subject company(ies) in the past 12 months: No

We or our associates may have received compensation for investment banking or merchant banking or brokerage services from the subject company(ies) in the past 12 months. We or our associates may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company(ies) in the past 12 months. We or our associates may have received compensation or other benefits from the subject company(ies) or third party in connection with the research report. Our associates may have financial interest in the subject company(ies).

Research Analyst or his/her relative's financial interest in the subject company(ies): No

Kotak Securities Limited has financial interest in the subject company(ies) at the end of the month immediately preceding the date of publication of Research Report: Yes

Our associates may have actual/beneficial ownership of 1% or more securities of the subject company(ies) at the end of the month immediately preceding the date of publication of Research Report.

Research Analyst or his/her relatives has actual/beneficial ownership of 1% or more securities of the subject company(ies) at the end of the month immediately preceding the date of publication of Research Report: No.

Kotak Securities Limited has actual/beneficial ownership of 1% or more securities of the subject company(ies) at the end of the month immediately preceding the date of publication of Research Report: No

Subject company(ies) may have been client during twelve months preceding the date of distribution of the research report.

"A graph of daily closing prices of securities is available at https://www.nseindia.com/ChartApp/install/charts/mainpage.jsp and http://economictimes.indiatimes.com/markets/stocks/stock-quotes. (Choose a company from the list on the browser and select the "three years" icon in the price chart)."

Kotak Securities Limited. Registered Office: 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra (E), Mumbai 400051. CIN: U99999MH1994PLC134051, Telephone No.: +22 43360000, Fax No.: +22 67132430. Website: www.kotak.com/www.kotaksecurities.com. Correspondence Address: Infinity IT Park, Bldg. No 21, Opp. Film City Road, A K Vaidya Marg, Malad (East), Mumbai 400097. Telephone No: 42856825. SEBI Registration No: NSE INB/INF/INE 230808130, BSE INB 010808153/INF 011133230, MSE INE 260808130/INB 260808135/INF 260808135, AMFI ARN 0164, PMS INP000000258 and Research Analyst INH000000586. NSDL/CDSL: IN-DP-NSDL-23-97. Our research should not be considered as an advertisement or advice, professional or otherwise. The investor is requested to take into consideration all the risk factors including their financial condition, suitability to risk return profile and the like and take professional advice before investing. Investments in securities market are subject to market risks, read all the related documents carefully before investing. Derivatives are a sophisticated investment device. The investor is requested to take into consideration all the risk factors before actually trading in derivative contracts. Compliance Officer Details: Mr. Manoj Agarwal. Call: 022 - 4285 8484, or Email: ks.compliance@kotak.com.

In case you require any clarification or have any concern, kindly write to us at below email ids:

● Level 1: For Trading related queries, contact our customer service at 'service.securities@kotak.com' and for demat account related queries contact us at ks.demat@kotak.com or call us on: Toll free numbers 18002099191 / 1800222299, Offline Customers - 18002099292

● Level 2: If you do not receive a satisfactory response at Level 1 within 3 working days, you may write to us at ks.escalation@kotak.com or call us on 022-42858445 and if you feel you are still unheard, write to our customer service HOD at ks.servicehead@kotak.com or call us on 022-42858208.

● Level 3: If you still have not received a satisfactory response at Level 2 within 3 working days, you may contact our Compliance Officer (Mr. Manoj Agarwal) at ks.compliance@kotak.com or call on 91- (022) 4285 8484.

● Level 4: If you have not received a satisfactory response at Level 3 within 7 working days, you may also approach CEO (Mr. Kamlesh Rao) at ceo.ks@kotak.com or call on 91- (022) 4285 8301.

Also read

- Read our latest stock recommendations

- Check out market strategy research

- Live insights about stock markets

- HDFC Bank Q1 result: Key highlights

- How to attain financial freedom

Don't have an account? Click here to open an account